Pi Network has experienced a significant decline, with the price pulling away from its all-time high (ATH) of $3.00. Despite the broader market downturn, investor sentiment remains optimistic, allowing PI to resist extreme losses.

Now trading near $1.60, the altcoin is positioning for a potential reversal, aiming to regain lost ground.

Pi Network Is Aiming For Recovery

The Moving Average Convergence Divergence (MACD) indicator suggests a potential bullish crossover for Pi Coin. If the MACD line crosses above the signal line, it would indicate growing bullish momentum. A shift in the histogram bars from red to green would further confirm the possibility of a trend reversal.

Investor support plays a key role in sustaining this momentum. If buying pressure increases, Pi Network’s price could solidify its uptrend, mitigating the risk of further downside.

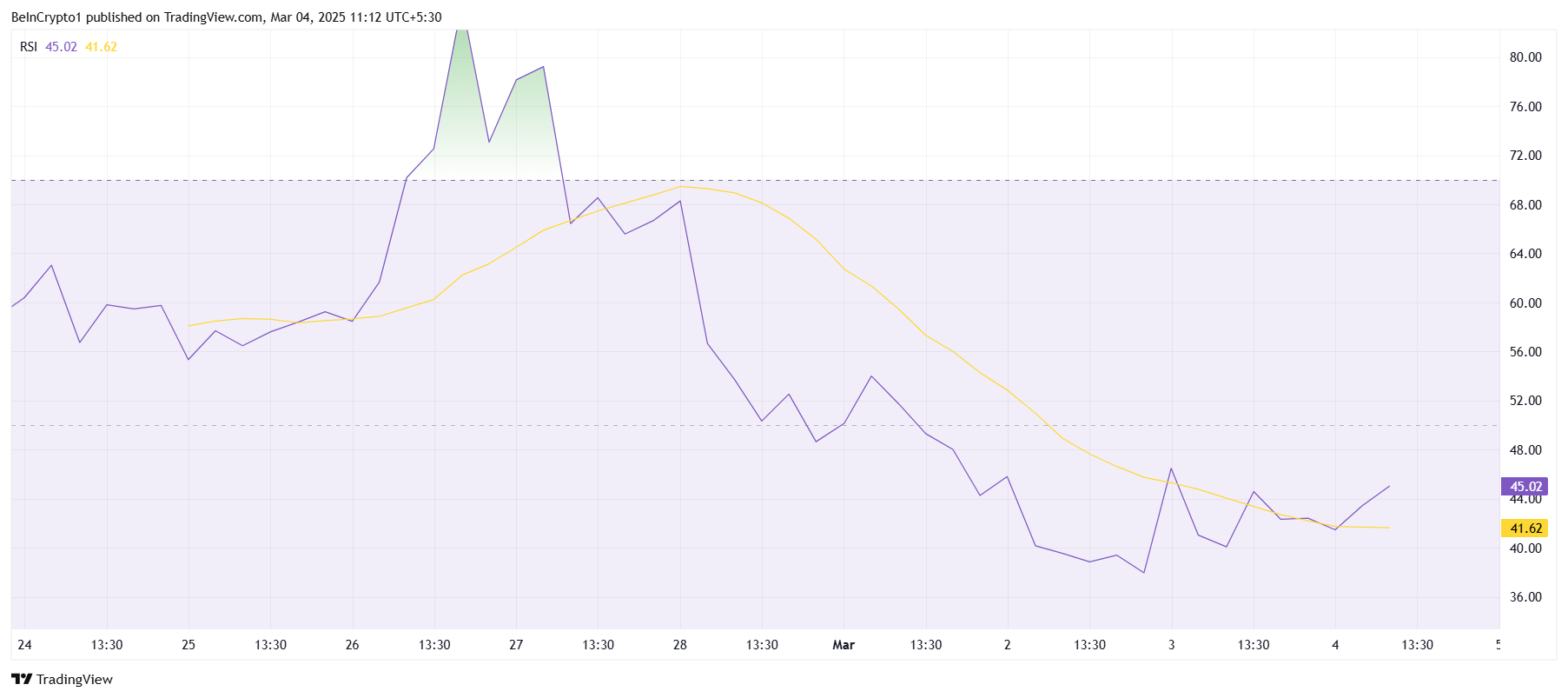

Despite signs of recovery, the Relative Strength Index (RSI) remains below the neutral 50.0 mark, indicating a lingering bearish sentiment. Until RSI crosses into bullish territory, Pi Network price upward movement may remain slow and uncertain. The broader market environment continues to pose challenges for altcoins.

A strong push from investors could accelerate momentum, but the macro outlook remains cautious. If RSI remains suppressed, PI’s recovery may be gradual rather than immediate.

PI Price Could See Gains

Pi Coin is holding above $1.59, attempting to bounce back toward the $2.00 resistance. Breaking past this level is crucial for reversing recent losses. If PI manages to establish support above $2.00, it could signal renewed investor confidence.

With support from technical indicators and buying momentum, securing $2.00 as support could open the path toward its ATH of $3.00. A successful breakout may lead to price discovery, allowing PI to set new highs. However, this depends on broader market sentiment remaining stable.

On the downside, if bearish pressure dominates, Pi Coin could lose its $1.59 support. A drop below this level could send PI toward $1.43 or even $1.19, invalidating the bullish thesis. This would indicate a prolonged correction, delaying any potential recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/pi-network-price-prepares-for-reversal/

2025-03-04 09:30:00