Polygon (MATIC) stands as one of the top performers in today’s crypto market, ranking third among the top-100 cryptocurrencies by market cap as of August 21. With a gain of 9% within the last 24 hours, the MATIC price recent surge is outpaced only by the Justin Sun associated crypto assets, TRON (+12%) and BitTorrent (+22%).

Over the past week, MATIC has experienced a notable rally, accumulating over a 23% increase in its value. This upswing has positioned MATIC at a crucial juncture from a technical analysis standpoint. Crypto analyst World of Charts (@WorldOfCharts1) has pointed out via an analysis on X that Polygon has broken out of a more than six-month long downtrend. The analyst predicts that MATIC could potentially surge towards the $1 mark.

Polygon (MATIC) Poised For 143% Rally?

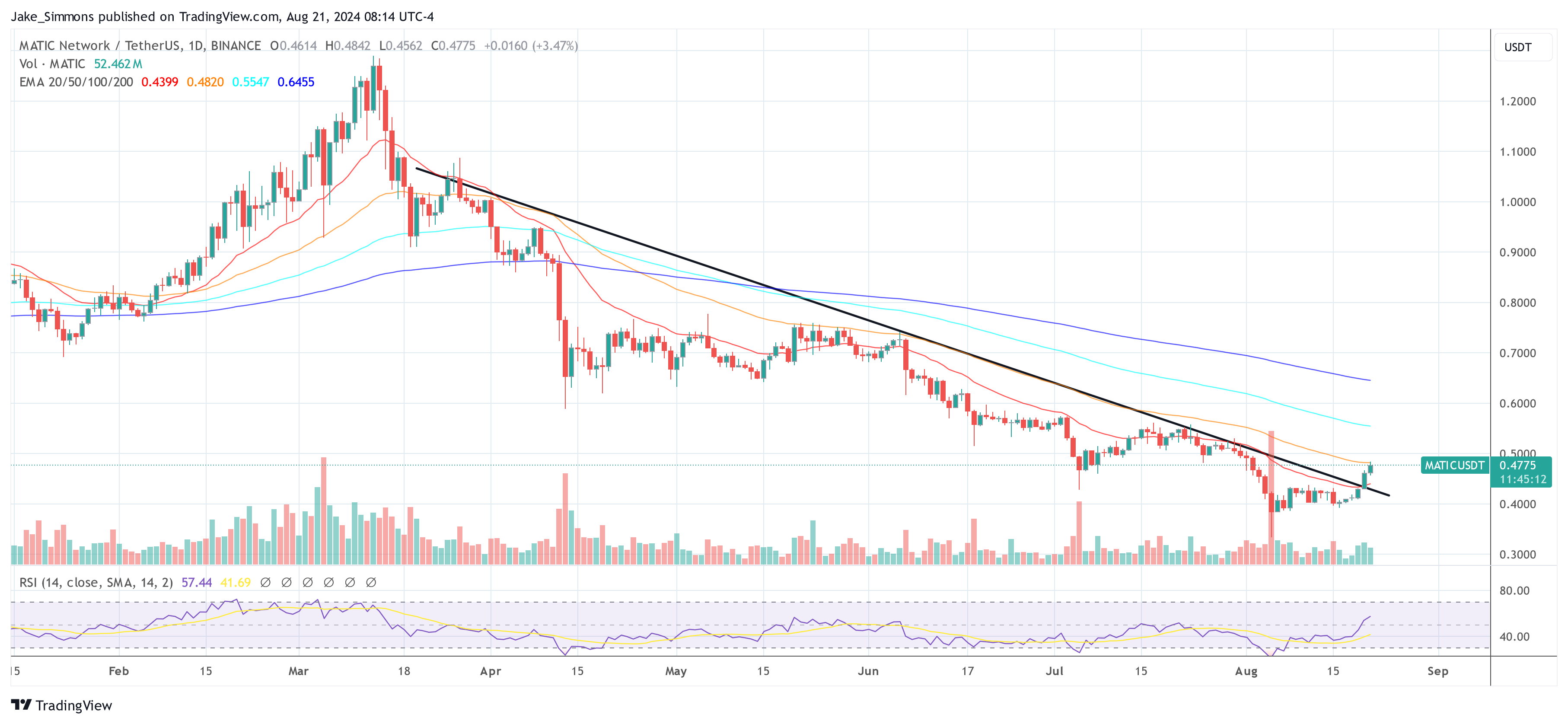

The Polygon price has been caught in a descending channel since mid-March, identified by two parallel downward-sloping trend lines. This channel represents a consolidation pattern typically observed as the price makes lower highs and lower lows. Historically, a descending channel is bearish in the context of a downtrend but can indicate a reversal if a breakout occurs.

Related Reading

Yesterday, on August 20, the Polygon price broke out from this descending channel, which can be considered a major bullish signal, suggesting a potential end to the previous downtrend. The breakout move by MATIC is crucial because it not only represents a shift in market sentiment but also sets a new trajectory for potential price targets.

The breakout point is situated at approximately $0.44. Following the breakout, the price is projected to rise by more than 143%, according to the analyst. A price rally of this magnitude would push the MATIC price above $1.10. “Matic testing crucial area breakout can lead massive recovery towards 1$ in coming days,” World of Charts remarked via X.

Critically, the current price level, post-breakout, needs to serve as a new support level. If MATIC maintains above the descending trend line and ideally performs a successful retest, the bullish outlook could be confirmed. Should the price drop below the trend line again, it might be considered a false breakout, potentially leading to a reassessment of the bullish scenario.

Related Reading

Furthermore, investors might want to monitor the trading volume and market sentiment. Both will probably play critical roles in sustaining the current upward momentum. An increase in trading volume typically accompanies genuine breakouts, providing further confirmation.

A catalyst for another Polygon Rally is just around the corner. As announced in mid-July, Polygon will complete the migration from MATIC to POL on September 4.

POL is an eagerly awaited upgrade, primarily due to its role in enhancing the functionality of Polygon’s native token. Upon its implementation, POL will serve immediate practical purposes within the existing Polygon Proof-of-Stake (PoS) network. It will become the principal gas and staking token of Polygon PoS, playing a crucial role in the security framework of the Polygon network.

At press time, MATIC traded at $0.4775.

Featured image created with DALL.E, chart from TradingView.com

Source link

Jake Simmons

https://www.newsbtc.com/altcoin/polygon-matic-breakout-price-to-1-in-days/

2024-08-21 23:30:22