A closely followed crypto analyst is warning that on-chain metrics suggest investors are losing interest in Bitcoin (BTC) amid the extended correction.

In a new strategy session, crypto trader Ali Martinez tells his 70,000 followers on the social media platform X that the warm supply realized price metric is signaling bearishness for Bitcoin.

Bitcoin’s warm supply realized price metric tracks the average buying price of all the coins that have not moved for a week to six months.

Says Martinez,

“Bitcoin above the warm supply realized price is a positive sign, while dropping below it may indicate the start of a longer bear market. Right now, this level is $66,000. If BTC stays under it, bulls should proceed with caution!”

The analyst also says that Bitcoin’s short-term holder realized price metric, the average acquisition price of all the BTC acquired in the past 155 days, is acting as a stiff resistance level for BTC.

“The short-term holder realized price helps gauge the behavior of recent Bitcoin buyers. It acts as resistance in downtrends because these holders are more likely to sell if the price falls below their entry point. Since June 22nd, BTC has struggled to break above this level, now at $63,250. Until BTC reclaims this area as support, there’s a risk of continued selling pressure. Caution is advised.”

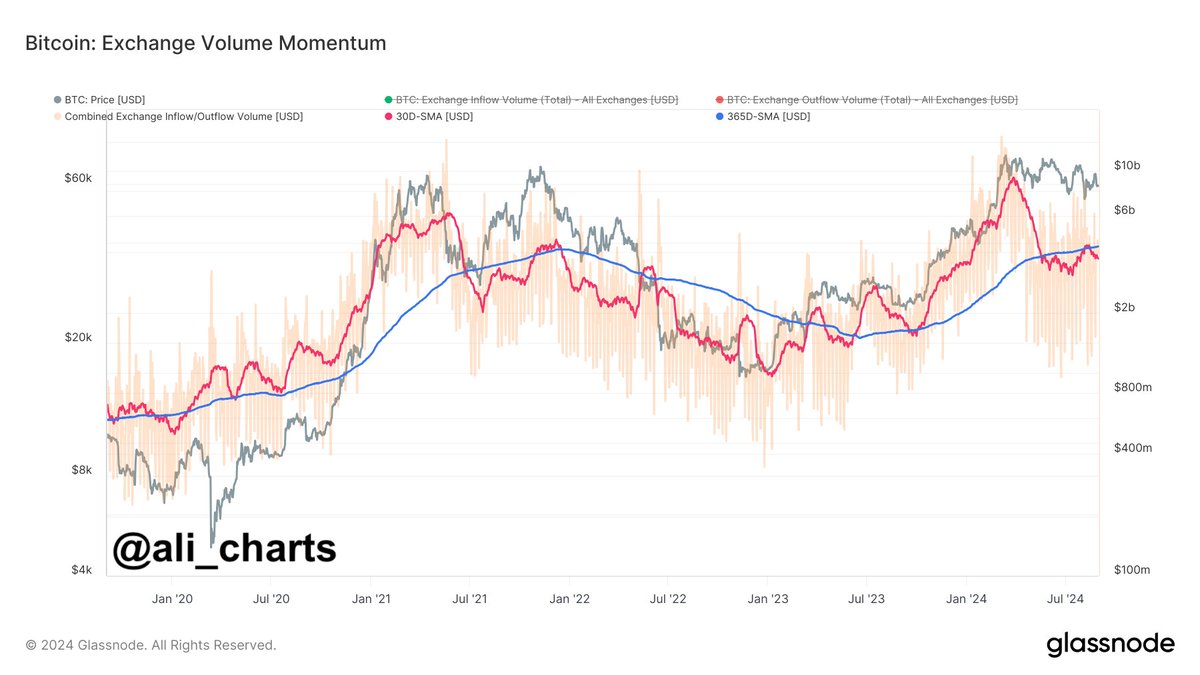

Lastly, the analyst says that the exchange volume momentum indicator is showing a drop-off in Bitcoin investment activity.

The metric tracks a crypto asset’s monthly average of combined inflows and outflows against the yearly average.

Says Martinez,

“The exchange volume momentum indicator shows a sustained drop in exchange-related on-chain activity, which usually points to lower investor interest in Bitcoin and decreased network usage.”

Bitcoin is trading for $59,697 at time of writing, up 3.29% in the past 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Daily Hodl Staff

https://dailyhodl.com/2024/09/03/proceed-with-caution-analyst-warns-multiple-on-chain-metrics-signaling-lower-investor-interest-in-bitcoin/

2024-09-03 20:00:50