A group of Republican lawmakers, headed by Rep. Patrick McHenry and Sen. Cynthia Lummis, have raised concerns over the Securities and Exchange Commission’s (SEC) approach to regulating crypto custody.

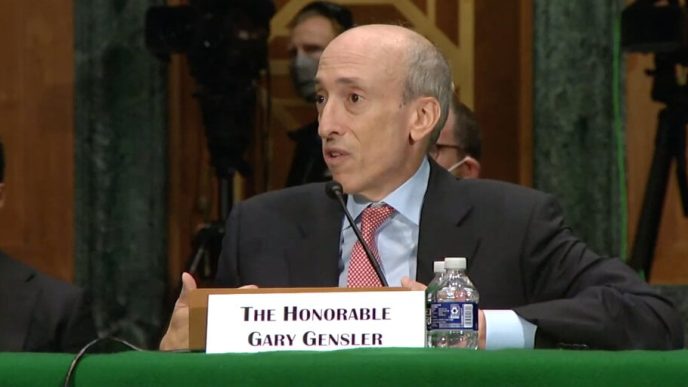

In a letter addressed to SEC Chair Gary Gensler, the lawmakers demanded the agency “rescind” its Staff Accounting Bulletin No. 121 (SAB 121).

Critique of SAB 121

The letter, shared by Fox reporter Eleanor Terrett via an X post, highlights several issues with SAB 121. The Republicans claim that the SEC issued the guidance without consulting key regulators or following the formal rulemaking process, causing confusion and exposing consumers to greater risks.

The rule requires digital assets custodians to recognize a liability and hold a corresponding offset on their balance sheets, valued at the fair market price of their crypto. This method deviates from traditional accounting practices and could put consumers at greater risk by inaccurately reflecting custodians’ legal and economic obligations.

Rescinding SAB 121 is the only appropriate action and well within the SEC’s authority. There is ample precedent for revisiting a staff accounting bulletin.

The letter also cites a decision by the Government Accountability Office (GAO), which ruled that SAB 121 qualifies as a “rule” under the Congressional Review Act, meaning it should have been subject to the formal notice and comment process under the Administrative Procedure Act (APA). Instead, the regulatory body bypassed this process by framing it as staff guidance.

Closed-Door Deals

The GOP legislators also drew attention to confidential consultations between SEC staff and select financial institutions, where exemptions from reporting requirements were granted on a case-by-case basis.

Terrett addressed this in a separate post questioning the SEC commissioners for allowing accounting staff to “pick winners and losers in the crypto custody space” while bypassing the APA and official rulemaking process.

One of the beneficiaries of this treatment is BNY Mellon, which has been identified as the first bank to receive an exemption from the rule. During a public hearing in Wyoming, Chris Land, general counsel to Sen. Lummis, revealed that the SEC had allowed the financial institution to bypass some of the bulletin’s more burdensome requirements.

In 2022, the bank started accepting crypto deposits following approval from relevant authorities. However, as it has been for players in the crypto custodial space, complying with the accounting requirements contained in SAB 121 proved onerous, even as BNY sought to make greater inroads into the crypto market.

“BNY is looking to get more involved in the crypto custody business,” Land said. “They had some problems with SAB 121, and the SEC has apparently given them some kind of variance to move forward.”

The lawmakers seem to have an issue with this act of cherry-picking who gets to avoid reporting the balance sheet requirements. They say it fails to provide any transparency or assurance that SAB 121 is being applied in the same way to different institutions.

They also warned that the SEC’s approach undermines investor protections, as inconsistent application of rules across institutions prevents “enhanced” disclosures.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!

Source link

Wayne Jones

https://cryptopotato.com/republicans-request-sec-to-rescind-disastrous-sab-121-decry-crypto-regulatory-confusion/

2024-09-24 20:21:31