Robinhood is rolling out futures trading for Bitcoin and Ethereum in addition to traditional commodities like oil and gold. It teased this launch on social media, but the Chigaco Mercantile Exchange (CME) detailed its partnership with Robinhood.

The CME Group recently claimed that it has no interest in futures trading for Solana or XRP, so the partnership is unlikely to offer other cryptoassets soon.

Futures Trading on Robinhood

Robinhood, a popular trading app, is expanding into futures trading. The firm has significantly diversified its offerings in the last few months. Most recently, it joined Polymarket in offering elections betting and re-listed former assets in November.

In January, its CEO expressed interest in RWA tokenization, and it can now add futures trading to the list.

Robinhood first teased these futures trading services in a social media post, and the firm’s official website detailed a few more specifics. Shortly thereafter, the CME circulated its own press release, which revealed that these offerings came through a partnership.

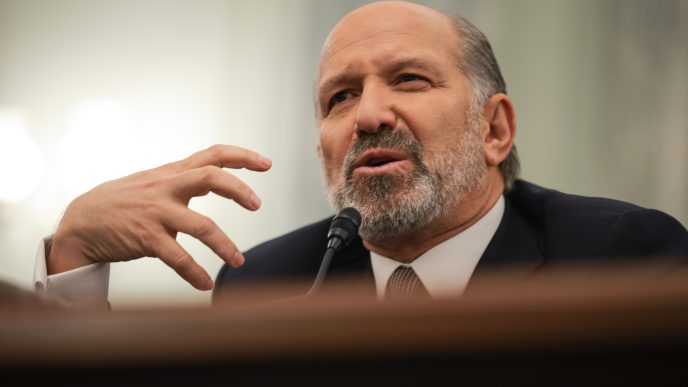

“We are extremely pleased to offer some of our most popular futures contracts to the broad network of retail traders on Robinhood. Demand for futures has skyrocketed as a new generation of self-directed traders is seeking diversified investment opportunities,” said Julie Winkler, Chief Commercial Officer at CME Group.

So far, Robinhood isn’t offering futures trading for any cryptoassets other than Bitcoin or Ethereum. A week ago, statements from the CME clarified that the exchange has yet to make any decisions on offering futures contracts for Solana or XRP.

The company has offered Bitcoin futures for years, but it’s maintaining a conservative approach towards most altcoins.

Nonetheless, this is a significant development for Robinhood. The trading platform reported huge revenue gains in 2024, boasting a 114% increase in trading volume from the previous year.

By offering these futures trades, Robinhood can deepen its commitment to the growing crypto market while hedging its bets with more traditional commodities.

“Brand new revenue stream that the business has never had and should only deepen the relationships users have with the platform. I have never traded a futures contract before so my first time will be on Robinhood. Futures also requires you have margin so we could see an increase in margin balances as people enable futures,” wrote Amit, a popular tech and stock trading influencer on X (formerly Twitter).

Additionally, the firm was quite clear that these commodities futures would still benefit from the Web3 trading ethos. Low fees, round-the-clock trades, and other convenient features are typical in cryptocurrency exchanges but less so in TradFi.

Robinhood is seeking to cover its bases and ensure that this launch appeals to a broad consumer base.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Landon Manning

https://beincrypto.com/robinhood-futures-trading-cme-partnership/

2025-01-29 17:28:49