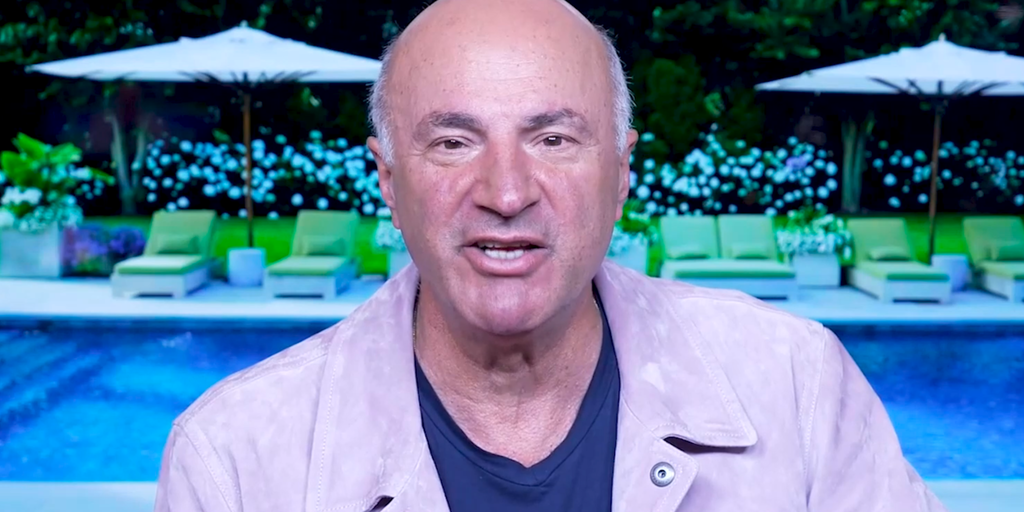

The speculative nature of Bitcoin won’t catapult digital assets into the mainstream, according to Kevin O’Leary. Rather, the ascension of crypto tech will be driven by the disruptive potential of stablecoins tied to real-world currencies, the Canadian investor and “Shark Tank” star believes.

“We should expand our thinking in this narrative we’re having right now about digital payment systems,” he said in a recent interview with Decrypt. “The largest market on earth is FX, it’s currency. And I think there’s huge friction and fees and costs.”

As an example, O’Leary discussed the process behind buying a luxury watch overseas, and the burden that buyers face when converting U.S. dollars into foreign cash. The cumbersome process could be flattened significantly, he said, through stablecoins.

“If I want to buy a pièce unique, I have to do it in Swiss francs,” he said. “It is an absolute pain in the ass to transfer the U.S. dollars into Swiss francs, and it’s [time-consuming] and expensive, and there’s no added value there.”

While Bitcoin and Ethereum have a place in O’Leary’s portfolio, the investor also owns a slice of Circle, which issues the stablecoin USDC. With a market cap of $34 billion, the stablecoin is crypto’s second-largest behind the $116 billion footprint of Tether.

“I’m a big believer in picks and shovels,” O’Leary said, using a gold rush term to refer to the infrastructure that powers projects. He described Circle’s business as “agnostic to the price of Bitcoin”—much like the crypto exchange WonderFi, which he’s also backed.

U.S. Securities and Exchange Commission Chair Gary Gensler has said that stablecoins serve primarily as settlement tools in decentralized finance. As tokens pegged to the price of a sovereign currency, such as the U.S. dollar, Gensler once called them “poker chips.”

Payments giant Visa found in May that an overwhelming number of stablecoin transactions stem from “inorganic activity,” such as those initiated by smart contracts as opposed to humans. Still, remittances are an area where stablecoins have notable use.

The 2022 collapse of Terra’s UST and LUNA sent shivers down regulators’ spines, as the algorithmic stablecoin and sister token unraveled, sparking $40 billion in losses. Since then, the tone has shifted on Capitol Hill as lawmakers push for stablecoin regulation to give them a more secure place in the market.

“The narrative around stablecoins as digital payment systems has vastly changed over the last 24 months,” O’Leary said. “It was a vilified asset, and now all of a sudden people are starting to see the merit of being able to transfer at a very low cost.”

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

André Beganski

https://decrypt.co/244701/shark-tank-kevin-oleary-blueprint-crypto-mass-adoption

2024-08-14 22:37:37