Shiba Inu (SHIB) price has struggled to break past $0.00001961 since mid-June, with repeated attempts at this resistance level falling short, including another failed attempt in the last seven days.

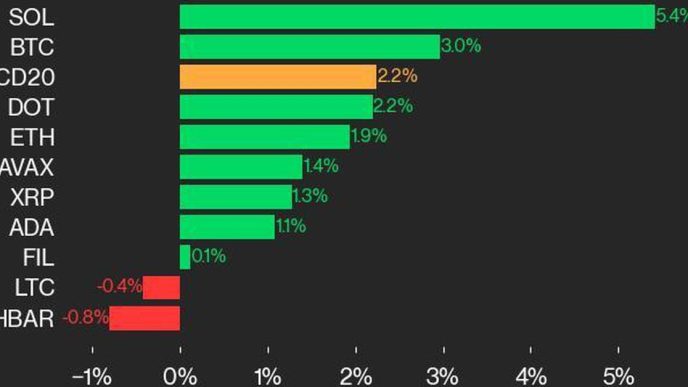

As Bitcoin edges closer to forming a new all-time high, SHIB’s decoupling from BTC’s influence is becoming more apparent. The meme coin’s divergence from Bitcoin’s trend poses challenges for its near-term price outlook.

Shiba Inu Investors Are Positive

Shiba Inu’s correlation with Bitcoin, currently at 0.51, has significantly dropped, a sign of weakening alignment between the two assets. A declining correlation with Bitcoin may limit SHIB’s capacity to benefit from BTC’s potential gains, which could negatively impact its price trajectory. With Bitcoin nearing a historical high, the decoupling suggests SHIB may not share in the broader market’s upward momentum, reducing the likelihood of a rally.

While BTC’s bullish outlook typically influences altcoins, Shiba Inu’s reduced dependence on Bitcoin’s price cues introduces uncertainty. Should this divergence continue, SHIB’s price could struggle to find significant support or upward traction.

Read more: How To Buy Shiba Inu (SHIB) and Everything You Need To Know

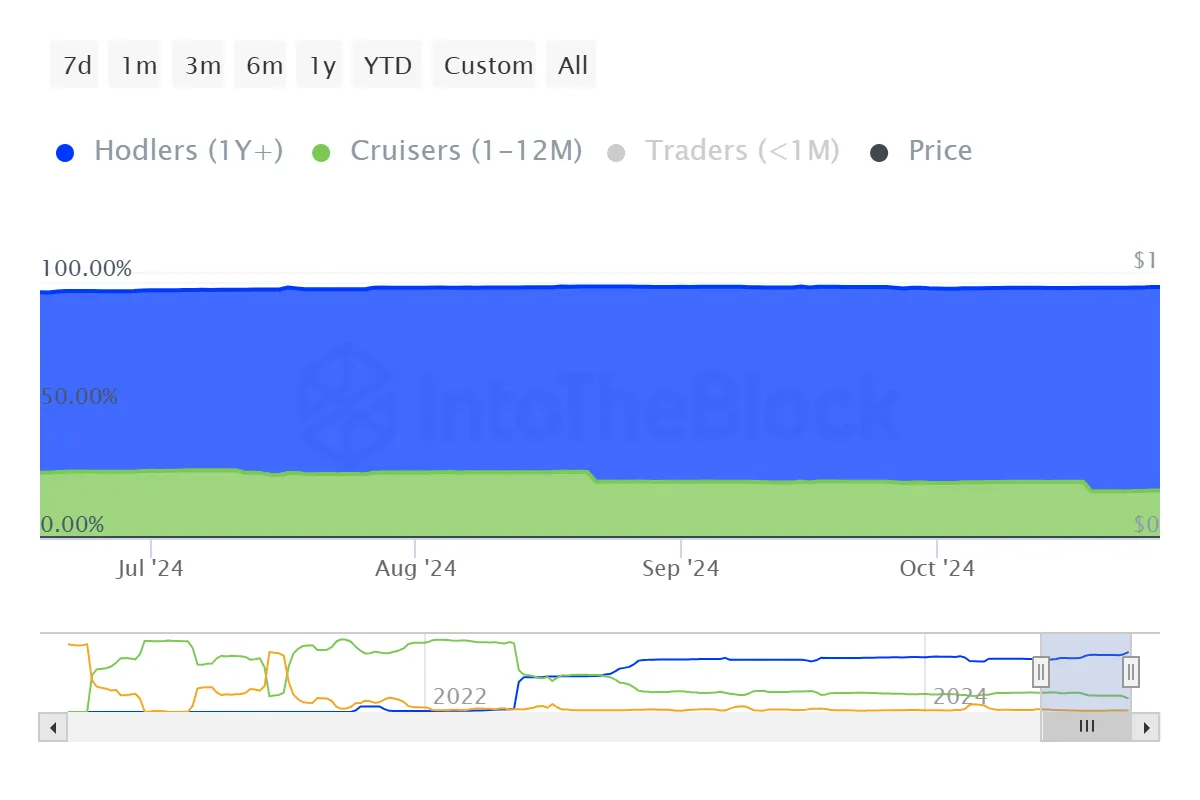

Despite current price challenges, Shiba Inu’s investor base shows positive signs, with a notable shift from short-term holders (STHs) to long-term holders (LTHs). Approximately 4% of SHIB holders have transitioned into the LTH category, having held the asset for over a year. This shift indicates a growing level of commitment, suggesting investors retain confidence in SHIB’s potential despite recent price fluctuations.

This transition from STHs to LTHs demonstrates an underlying conviction that could stabilize Shiba Inu’s price in the face of market volatility. As more investors commit to holding SHIB for extended periods, the asset may see reduced sell pressure, potentially buffering it from sharper declines. This shift supports a more sustainable growth outlook, even if short-term gains remain limited.

SHIB Price Prediction: Failure Ahead

Shiba Inu’s price dropped by 11% this week yet remains above the local support level of $0.00001676. The meme coin’s inability to breach the resistance levels at $0.00001961 and $0.00002093 has stunted potential gains. Without surpassing these barriers, SHIB may continue to struggle with upward momentum, limiting short-term gains.

Given mixed cues from the aforementioned factors, SHIB may stay in a consolidation phase under $0.00001961. With investor sentiment showing both confidence and caution, the meme coin’s price action could remain range-bound in the near term. This period of consolidation may give the asset time to stabilize before attempting further upward movement.

Read more: Shiba Inu (SHIB) Price Prediction 2024/2025/2030

If Shiba Inu drops below the $0.00001676 support level, it could test the next support at $0.00001462. A breach here might invalidate any bullish-neutral outlook, pushing SHIB’s price further down to $0.00001271, which would mark a more significant pullback for the meme coin.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/shiba-inu-price-drop-extends/

2024-10-28 12:30:00