Shiba Inu (SHIB) has been consolidating over the past two weeks, struggling to break out and recover from recent losses.

Despite this stagnation, the changing momentum suggests the meme coin could soon regain upward traction. Indicators point toward an impending shift, fueling optimism among investors.

Shiba Inu Investors Have An Opportunity

Shiba Inu’s Market Value to Realized Value (MVRV) ratio has dipped into the opportunity zone, which lies between -9% and -21%. Historically, this zone signals potential price reversals, as it often prompts investors to hold their positions rather than sell. This behavior supports accumulation at lower price levels, reducing selling pressure.

Every time the MVRV ratio has entered this zone, SHIB has shown a tendency to bounce back. Current market conditions align with this pattern, encouraging investors to anticipate a recovery. This trend highlights the growing confidence that SHIB could soon break free from its consolidation phase.

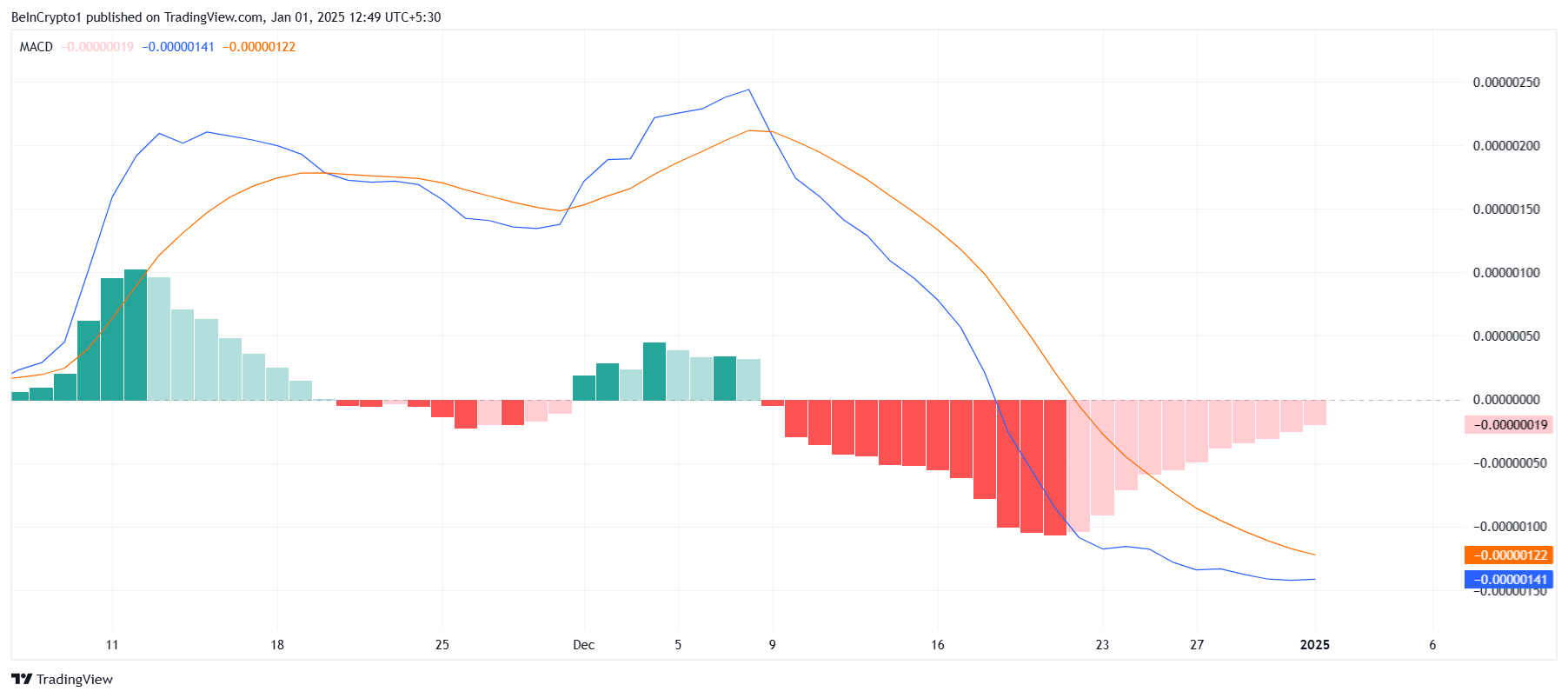

The Moving Average Convergence Divergence (MACD) indicator for SHIB suggests that bearish momentum is fading. The MACD is nearing a bullish crossover, indicating a potential shift from negative to positive momentum. This technical signal has historically aligned with upward price movements, signaling a possible recovery for the cryptocurrency.

As the bearish pressure subsides, SHIB is poised to attract renewed buying interest. A confirmed bullish crossover on the MACD would strengthen the case for a sustained rally. This shift in momentum could enable Shiba Inu to regain lost ground and target higher resistance levels.

SHIB Price Prediction: Breaking Out Is The Target

Shiba Inu’s price has been trading between $0.00002341 and $0.00002093 over the past two weeks, currently hovering at $0.00002118. Considering the improving indicators, a drop below this range appears unlikely. Accumulation and reduced selling pressure are expected to support the current levels.

For SHIB to recover, it must flip $0.00002341 into support and break past $0.00002606, a key resistance level. Historically, the meme coin has consolidated under this level, making it a critical target. Achieving this milestone would signal the beginning of a new rally.

However, if bearish momentum persists, SHIB’s price could drop to $0.00001961. This scenario would invalidate the bullish outlook and raise caution among investors. Maintaining key support levels is vital to sustaining market optimism.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/shiba-inu-price-eyes-breakout/

2025-01-01 09:30:00