The meme coin hype that marked the crypto market in the first few weeks of 2025 has significantly faded, and Shiba Inu (SHIB) is bearing the brunt of this shift.

After experiencing a surge in buying pressure at the start of the year, demand for SHIB has sharply declined, with new addresses dropping to their lowest levels so far this year.

Shiba Inu Traders Reduce Activity

BeInCrypto’s assessment of SHIB’s on-chain performance reveals a drop in the number of new addresses trading the meme coin daily. According to Santiment, this has dropped by 62% since January 19.

For context, only 1,814 new addresses were created on Sunday, marking the lowest daily count since the start of the year. This downturn follows the market-wide retreat from meme coin speculation, leaving SHIB struggling to maintain the hype-driven interest it initially enjoyed.

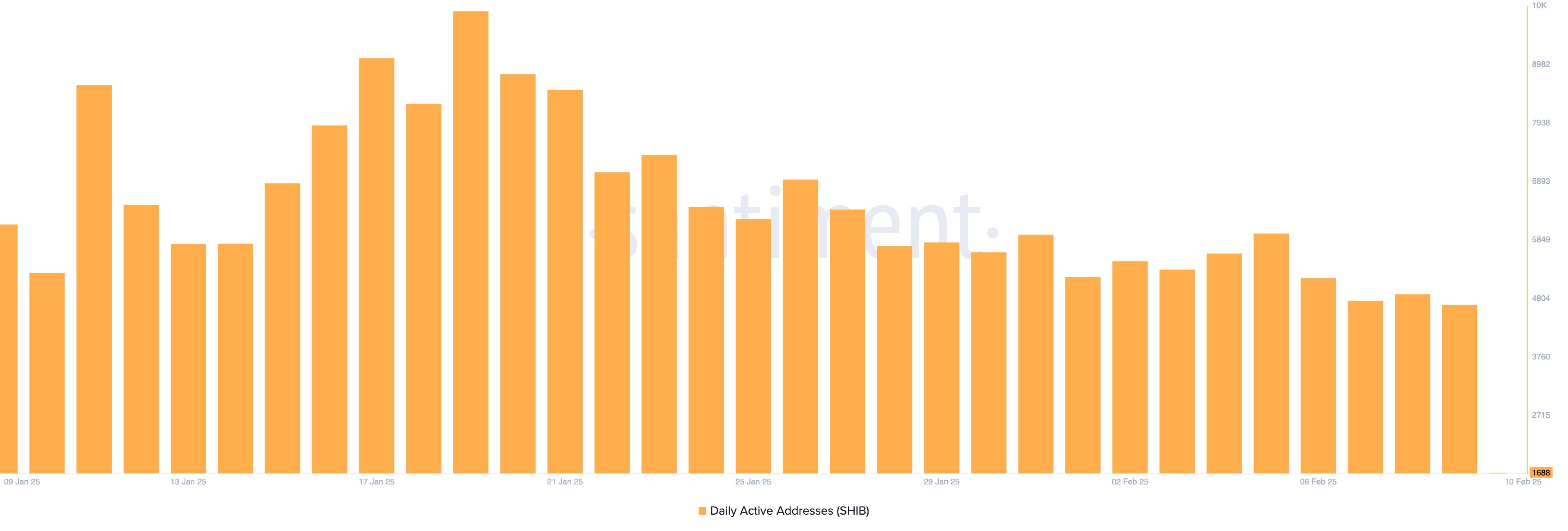

Also, the number of daily active addresses trading SHIB has plummeted. As the TRUMP and MELANIA-fueled market rally lost traction, the number of active addresses trading SHIB trended downward.

For context, on February 9, 4,690 active wallet addresses engaged in at least one SHIB transaction. This marked a 53% drop from the year-to-date high of 9,928 active addresses recorded on January 19.

A drop in an asset’s daily active addresses and new demand signals reduced interest and participation in the asset. This leads to lower trading volumes and a surge in bearish sentiment among investors.

Therefore, this decline in SHIB’s network activity indicates a weakening market for the asset, making it more susceptible to price drops and volatility.

SHIB Price Prediction: Coin Stuck Below Key Trend Line

On the daily chart, SHIB’s price remains under the descending trend line, which it has traded below since December 9. This is a bearish pattern formed when an asset’s price creates lower highs over time, signaling a downtrend in the market.

This pattern suggests that selling pressure dominates the SHIB market, and the meme coin value will likely continue to decline. In this scenario, the coin’s price could fall to $0.000014.

Conversely, if the leading meme coin sees a spike in new demand, it may drive its value above the descending trend line to trade at $0.000018.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/shiba-inu-network-activity-falls/

2025-02-10 15:30:00