Dogecoin (DOGE) has experienced a steady decline in value over the past month, dropping more than 20% in 30 days. This downward trend has pushed its price below both its 50-day simple moving average (SMA) and 20-day exponential moving average (EMA).

This signals growing selling pressure and indicates that DOGE could face further downward movement.

Dogecoin Faces Resistance, but There Is a Catch

On August 23, DOGE attempted to break above its 50-day SMA at $0.11 but encountered strong bearish resistance. This pressure pushed the price downward, leading to a drop below its 20-day EMA by Monday.

The 20-day EMA is a short-term indicator that quickly responds to price changes, reflecting the average closing price over the past 20 days. In contrast, the 50-day SMA is a longer-term indicator, showing the average closing price over the past 50 days.

When an asset’s price drops below these levels, sellers take control, indicating a short-to-medium-term downtrend. In such scenarios, these moving averages often act as resistance, making it difficult for the price to climb above them in the near term.

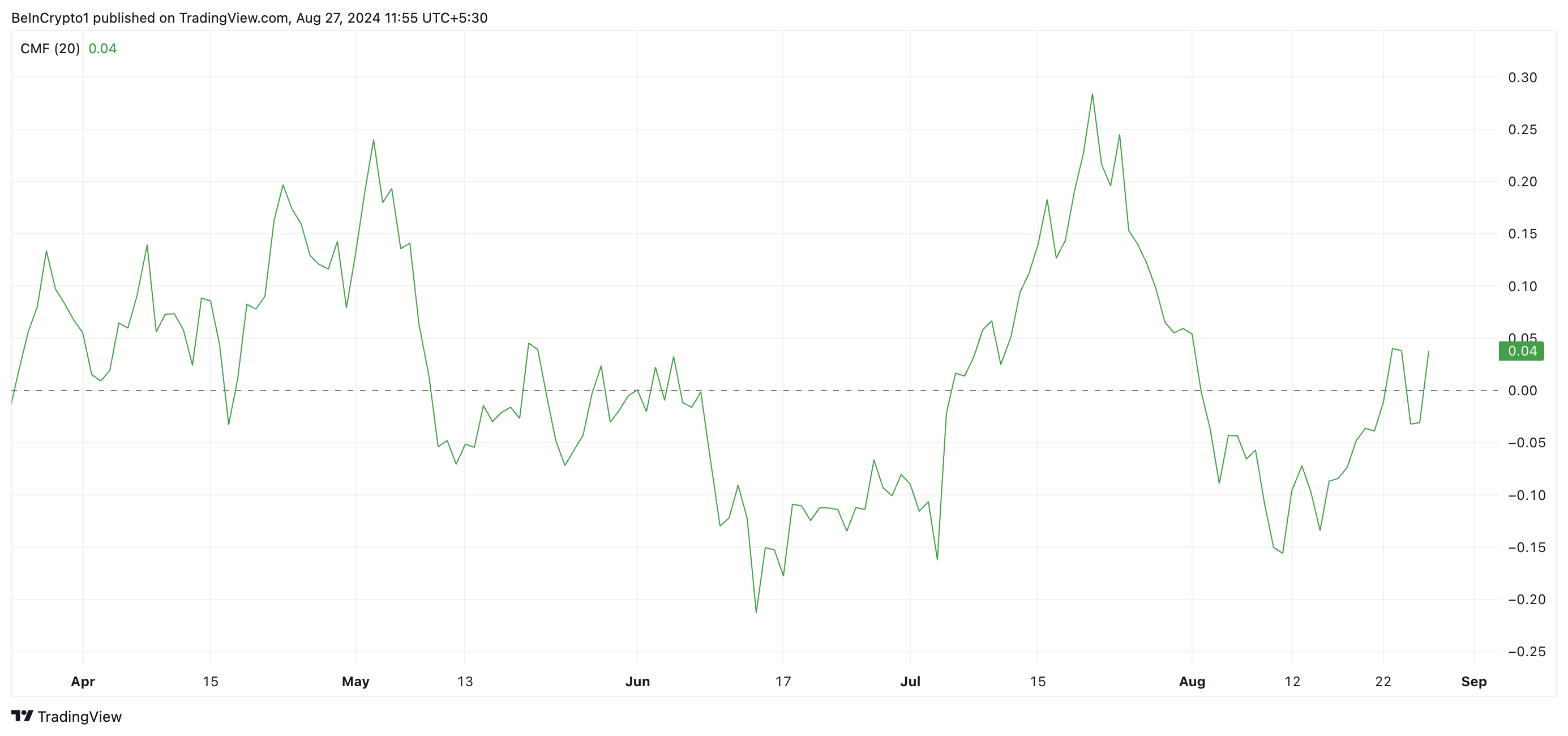

However, DOGE’s Chaikin Money Flow (CMF) readings hint that the downtrend could be nearing its end. The momentum indicator has started an uptrend, crossing above the zero line. At press time, DOGE’s CMF stands at 0.04.

Read more: Dogecoin (DOGE) Price Prediction 2024/2025/2030

A bullish divergence occurs when an asset’s price declines while its CMF rises. This suggests that the selling pressure behind the price drop is weakening, making a rebound likely.

DOGE Price Prediction: Hopefuls Await Rebound

In addition to DOGE’s Chaikin Money Flow (CMF), its Moving Average Convergence Divergence (MACD) setup also suggests a potential rebound. Currently, the MACD line (blue) is above the signal line (orange) and is approaching a crossover above the center line.

The MACD tracks an asset’s price trend, direction, and momentum shifts. When the MACD line is above the signal line, it indicates a bullish trend, driven by strong buying momentum. A move above the zero line confirms this bullish trend and often prompts traders to go long.

Read more: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

If the bullish momentum continues to build and demand for DOGE increases, it could break through the resistance at the 50-day SMA and 20-day EMA, pushing the meme coin’s price to $0.13. However, if the downtrend continues, DOGE’s price could drop further below these key levels, potentially falling to $0.08.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/doge-falls-below-key-averages/

2024-08-27 10:00:00