Solana’s (SOL) price has faced a tough time maintaining its upward momentum, particularly after repeated failed attempts to secure $161 as a support level over the past two months.

Another failed breach of this level recently triggered a 13% decline in SOL’s price, pushing it down to $139. As the cryptocurrency battles ongoing downward pressure, traders are left wondering if further declines are on the horizon.

Solana Traders Have a Trick up Their Sleeve

At the moment, the macro momentum for Solana is pointing toward a bearish outlook, as reflected in key technical indicators. The Relative Strength Index (RSI) has fallen below the neutral line of 50.0, signaling increasing bearish momentum. RSI’s position in the bearish zone suggests that selling pressure has intensified, with little indication of a reversal in the near term.

Following Solana’s failed breach of the $161 resistance level, the buildup of bearish sentiment has gained strength. With the RSI showing no signs of recovery, it appears that SOL is set to face more downward pressure in the short term, potentially leading to further price declines.

Read more: Solana vs. Ethereum: An Ultimate Comparison

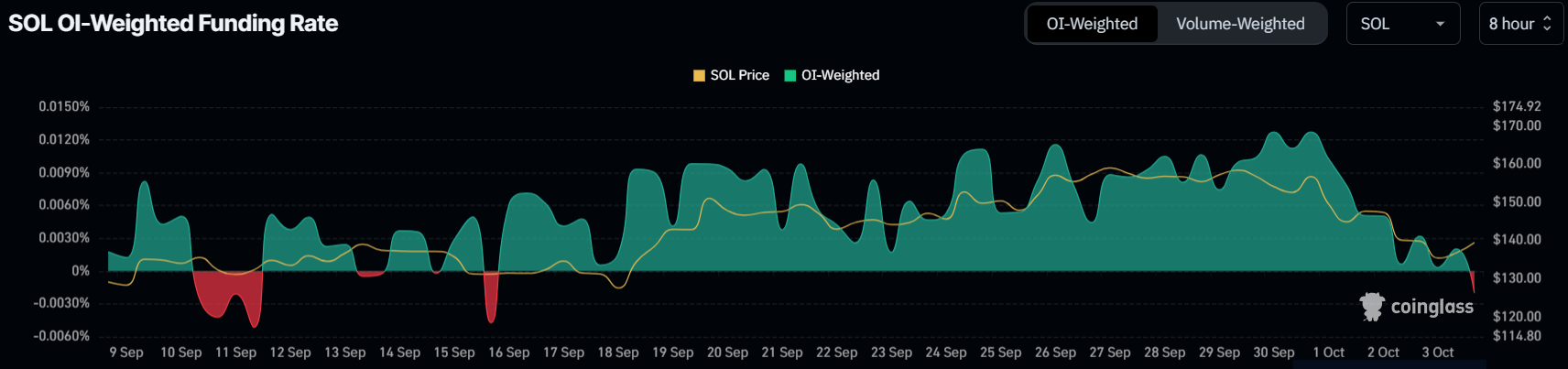

Market sentiment around Solana has also shifted to the downside. Traders are positioning themselves to capitalize on a potential further decline by placing short contracts in the Futures market. These short contracts have now surpassed long contracts as traders look to profit from SOL’s falling price.

This sentiment shift is further evidenced by Solana’s funding rate, which has turned negative for the first time in over two weeks. The negative funding rate indicates that the market is now predominantly bearish, with traders anticipating more losses in the near future.

SOL Price Prediction: Finding Support

Solana’s price is currently trading at $139, just below the local support level of $140. Considering the ongoing bearish momentum and negative market sentiment, a further drop to $124 is more likely. This level acted as a support for SOL last month, with the cryptocurrency bouncing back from it previously.

However, if Solana fails to hold the $124 support level, a drop to $120 could be next, forming the lower limit of the consolidation range under $161. This would represent a further decline for the cryptocurrency, leaving it vulnerable to additional losses.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

On the other hand, if Solana manages to flip $140 into a support level, it could have a chance to rise back toward the $160 range. Breaching the local resistance at $155 would invalidate the current bearish outlook, giving SOL a renewed opportunity to recover and potentially push higher in the weeks ahead.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/solana-sol-price-dip-turns-traders-bearish/

2024-10-04 15:00:00