Worldcoin’s (WLD) price has faced significant price pressure recently, failing to bounce off the $2.00 support level. The altcoin is currently trading at $1.65, with consolidation appearing to be the next likely move.

Investors are now assessing whether Worldcoin is a good addition to their portfolio this October, as market sentiment around the token remains cautious.

Worldcoin May Not Be the Best Choice

The MVRV (Market Value to Realized Value) Long/Short Difference indicator for Worldcoin is currently signaling a bearish outlook. Highly positive values typically suggest that long-term holders are in profit, a sign of stability. On the other hand, deeply negative values indicate that short-term holders are profiting, which tends to increase selling pressure.

Currently, the indicator is at -24%, showing that short-term holders are seeing profits. These investors’ profits are a bearish sign, as short-term investors are often prone to selling quickly, increasing the likelihood of a price decline.

This shift in market sentiment, driven by short-term profit-taking, suggests that Worldcoin may struggle to regain upward momentum in the near term. The bearish signals are prompting many investors to remain cautious about adding WLD to their portfolios.

Read More: How to Buy Worldcoin (WLD) and Everything You Need to Know

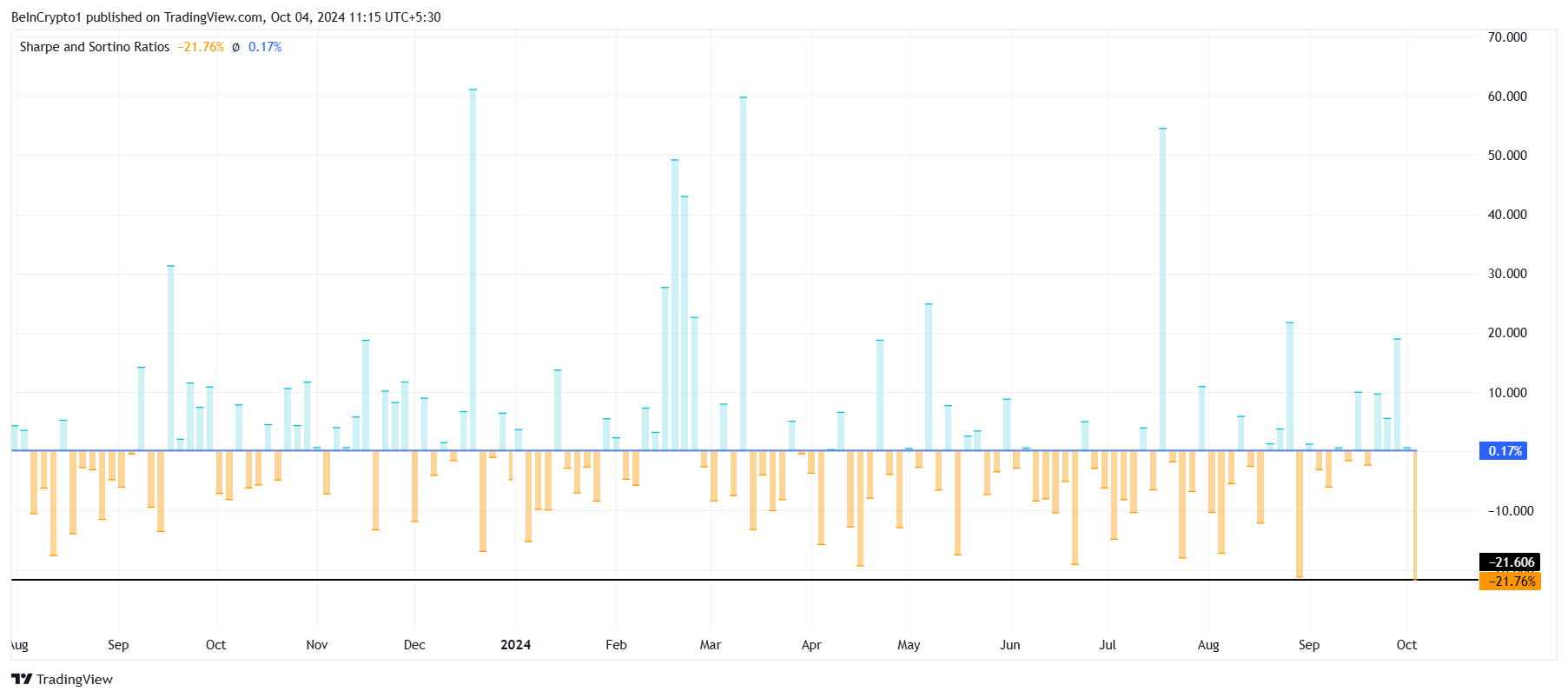

Furthermore, the broader macro momentum for Worldcoin isn’t faring much better. WLD’s Sharpe Ratio, an indicator that measures the risk-adjusted returns of an asset, is at its lowest point since the altcoin’s inception. This indicates that the risk associated with investing in WLD currently outweighs the potential rewards, making it a less attractive option for investors.

The low Sharpe Ratio suggests that Worldcoin may not be the best bet at the moment. This is because the current risk environment could lead to further losses. Investors are advised to be wary of entering the market under these conditions, as WLD may continue its downtrend unless significant bullish catalysts emerge.

WLD Price Prediction: Barriers Ahead

Worldcoin’s price has declined by 24% in recent days, now trading at $1.65. Given the current market sentiment and macro indicators, it is likely that WLD will remain under the $2.00 barrier for the foreseeable future.

The altcoin is also facing resistance at $1.74, which may not present a significant hurdle, but failure to breach it could lead to further declines. A drop towards $1.34, the lower limit of the consolidation range between $2.00 and $1.34, is possible if bearish conditions persist. This possibility excludes Worldcoin from the “must-have altcoins for your portfolio in October” list.

Read More: Worldcoin (WLD) Price Prediction 2024/2025/2030

However, a change in market trends and a successful breach of $1.74 could enable Worldcoin to rise beyond $2.00. If this occurs, it will invalidate the current bearish-neutral outlook, potentially pushing WLD’s price toward $2.50.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/worldcoin-wld-is-not-a-good-bet/

2024-10-04 06:48:06