Cardano (ADA) has seen a steady price decline since early December, reaching a monthly low of $0.86. This downturn has left ADA investors anticipating a bleak start to the new year.

However, market signals suggest a potential buying opportunity for those willing to take a long-term view.

Cardano Investors Have an Opportunity

Cardano’s MVRV (Market Value to Realized Value) ratio indicates a possible buy opportunity. The metric currently falls within the range of -13% to -26%, an area historically considered an accumulation zone for ADA. When the MVRV ratio hits this range, the altcoin often rebounds, offering substantial recovery potential to investors.

Accumulating Cardano at these levels could yield positive returns, particularly as the altcoin has shown resilience in similar scenarios in the past. While current sentiment remains cautious, the MVRV zone suggests ADA is undervalued, making it an attractive option for strategic investors.

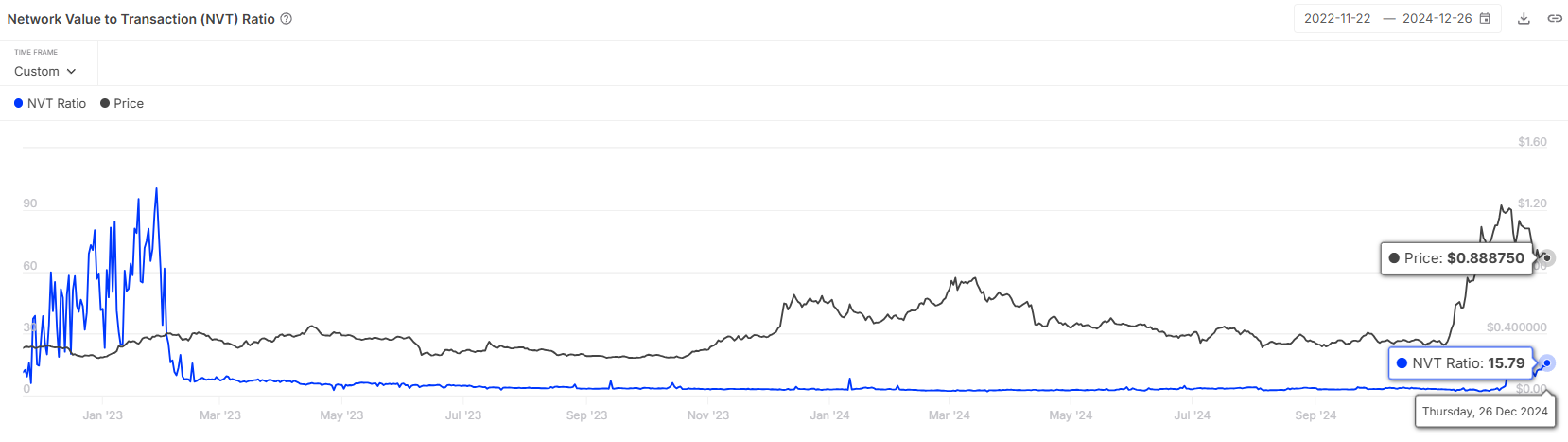

Cardano’s macro momentum, however, presents challenges. The Network Value to Transactions (NVT) ratio is at a 22-month high, signaling a bearish trend. A high NVT ratio indicates that the network valuation is significantly outpacing its transactional activity, reflecting weak on-chain demand and reduced investor interest.

This disparity suggests that while Cardano’s market value remains elevated, its real-world utility and adoption are lagging. Investors should consider this imbalance when evaluating the altcoin’s potential for short-term recovery or long-term growth.

ADA Price Prediction: Finding Support

Cardano’s price is currently at $0.86, a monthly low that reflects its recent decline through the $0.87 support level. This price point, coupled with the mixed signals from market and macro indicators, leaves ADA in a precarious position.

In the near term, ADA could consolidate between $0.87 and $1.00, provided no major bullish or bearish cues emerge. This range could serve as a stabilizing zone for the altcoin while investors await stronger signals from the broader crypto market.

However, failure to reclaim $0.87 as support could drive Cardano to its next support level of $0.77. Such a drop would reinforce bearish sentiment and delay any recovery, highlighting the importance of this critical price point for ADA’s near-term trajectory.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/cardano-price-hits-monthly-low/

2024-12-27 07:00:00