Like many altcoins in the market, Solana’s (SOL) price jumped in the last 24 hours. This is a positive development for the token, which has increased 13% in the last seven days.

However, on-chain indicators suggest that this rally could be short-lived.

A Huge Warning for Solana Bulls

At press time, SOL’s price sits at $158, marking its highest point since August 11. Despite this surge, Solana’s social dominance has dropped.

Social dominance measures how much attention a cryptocurrency receives compared to others. A high percentage suggests increased discussions about Solana, which can be key to sustaining its upward momentum.

However, SOL’s social dominance declined from 4.50% on August 19 to 2.58%. This drop hints that the market’s enthusiasm for the token may be fading.

If social dominance continues to fall, SOL’s rally could lose steam. In the worst case, its price might slide much lower than the gains it has had in recent days.

As seen above, whenever social dominance drops during an uptrend, the rally typically halts. If history repeats itself, SOL could be headed for a decline.

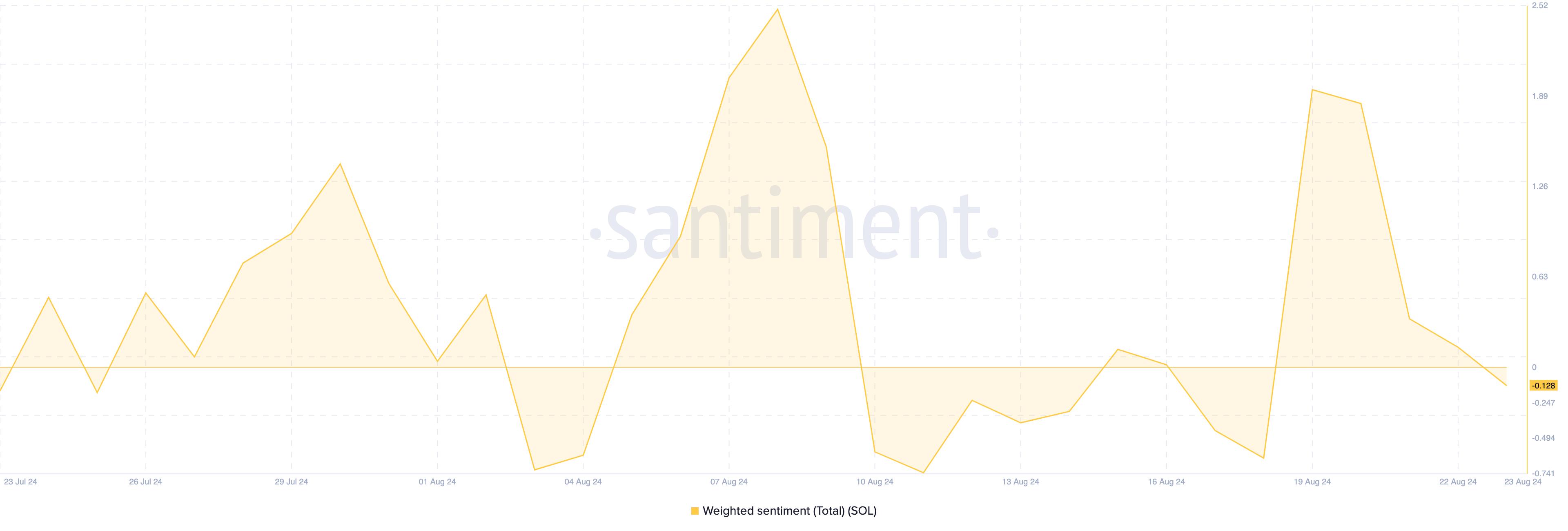

In addition to social dominance, Solana’s Weighted Sentiment has also turned negative. According to Santiment, this metric tracks the overall sentiment toward a cryptocurrency across social media platforms.

When sentiment is positive, social media comments lean bullish. On the flip side, negative sentiment reflects a pessimistic outlook, which is now the case with SOL.

Read more: Solana vs. Ethereum: An Ultimate Comparison

This shift in sentiment suggests that despite the recent price gains, market participants may be losing confidence in sustained growth.

SOL Price Prediction: Mixed Signals on Different Charts

According to the daily chart, SOL’s price could face resistance at the upper points of interest around $163.93.

Should the token’s uptrend be rejected at this point, it could face a drawdown, possibly falling to $150.84. In this region, bulls appear to have formed a strong support system that could prevent another downturn.

Meanwhile, on the 4-hour chart, SOL price formed a bullish Adam and Eve pattern. This pattern is in the form of a V-shaped bottom (Adam) followed by a U-shaped consolidation period, signaling the start of a new uptrend.

As shown below, SOL’s price has broken above the neckline of the technical pattern. If this uptrend continues, the bearish bias analyzed on the daily chart could be invalidated.

Read more: 13 Best Solana (SOL) Wallets To Consider in August 2024

Specifically, a continued upswing could see the token increase by 10% to $172.83. In a highly bullish scenario, the Solana native token might hit $187.33.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/solana-market-dominance-dwindles/

2024-08-24 19:00:00