Solana (SOL) hit another record: Today, it has over 75 million monthly active addresses. The surge speaks to growing popularity of the network, especially in areas like developer and user activity within the decentralized applications (dApps), DeFi, and NFT sectors.

Related Reading

With such an increase in Solana’s activities, the platform stretches even further away from others as it remains one of the most scalable and efficient blockchains available.

Despite this positive momentum, recent market activity has seen significant volatility for SOL. On September 18, Solana experienced $121,000 in short liquidations and nearly $3.20 million in long liquidations, with Binance seeing the majority of the long positions liquidated. This heavy liquidation of long positions signals that traders might be cautious about the near-term price movements of Solana.

Source: Artemis

Price Forecast Shows Potential

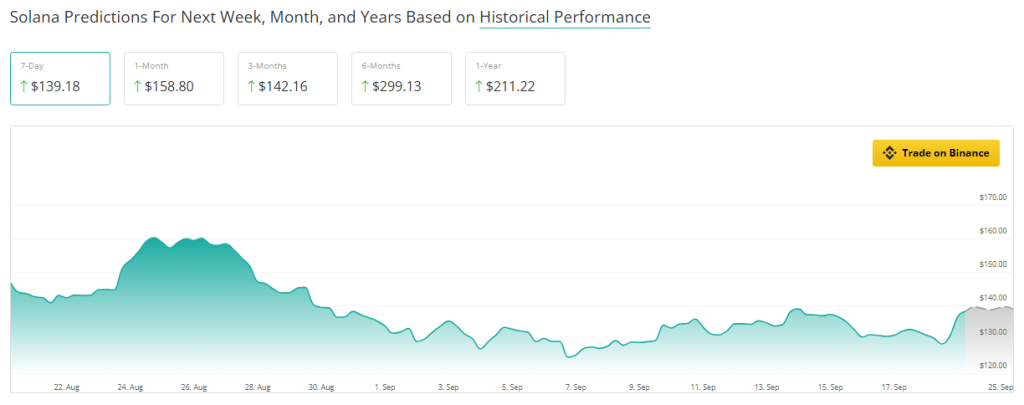

While short-term volatility is a concern, Solana’s price forecast points to a brighter future. Currently, SOL is trading 14.59% below its estimated value for next month, indicating short-term bearish pressure. However, the price is predicted to grow by 2.59% over the next three months, with even stronger growth expected further down the road.

In six months, Solana’s price could surge by 115%, with a 52% increase projected over the next year. This indicates that though the short-term future is not so promising, Solana is a big investment prospect in the long-run.

At the time of writing, SOL is trading at $141.21 up 10.1% and 4.1% in the daily and weekly timeframes, data from Coingecko shows.

Surge In User Activity

One of the key factors why Solana has strong potential is that it has an increasingly growing user base. Active addresses on the network increased exponentially, from mid-2023, and stood at 75.2 million in absolute terms so far.

That reflects that Solana is scaling well and can process large volumes of transactions while the fees are low; more developers and users flocked to the platform, and Solana’s ecosystem continues to grow.

This user growth isn’t just a short-term phenomenon. The launch of new features and updates in the coming months could further accelerate adoption, particularly in the DeFi and NFT spaces where scalability is a key factor.

Related Reading

A Network For The Future?

The growth in active addresses as well as the bright price forecast should put Solana on stable ground. Although liquidations and sideways movement in near-term might raise some concerns among the investors, the long run looks promising.

For now, investors may need to be cautious about short-term volatility, but Solana’s long-term prospects remain solid. Those looking to invest for the future may find Solana’s current price a good entry point before the predicted growth takes hold.

Featured image from Protos, chart from TradingView

Source link

Christian Encila

https://www.newsbtc.com/news/solana-active-addresses-hit-75-million-as-sol-nears-140-mark/

2024-09-19 20:30:34