Solana has struggled to maintain its recovery momentum, with the crypto token’s price failing to break past $150 despite multiple attempts. The altcoin’s price action reflects a lack of sustained bullishness, making further gains difficult.

However, strong investor support is keeping SOL from experiencing a sudden or sharp decline. This balance has left the cryptocurrency in a neutral position.

Solana Is Overvalued

The NVT Ratio, a key metric that measures Solana’s valuation relative to transaction activity, is at a four-month high. This suggests that while the network’s value is rising, transaction activity has not kept pace.

Historically, such discrepancies indicate an overvaluation, which often leads to price corrections. If transaction volumes fail to catch up, SOL could struggle to maintain its current price. Unless transaction activity increases, the overvaluation could result in a period of stagnation or mild corrections.

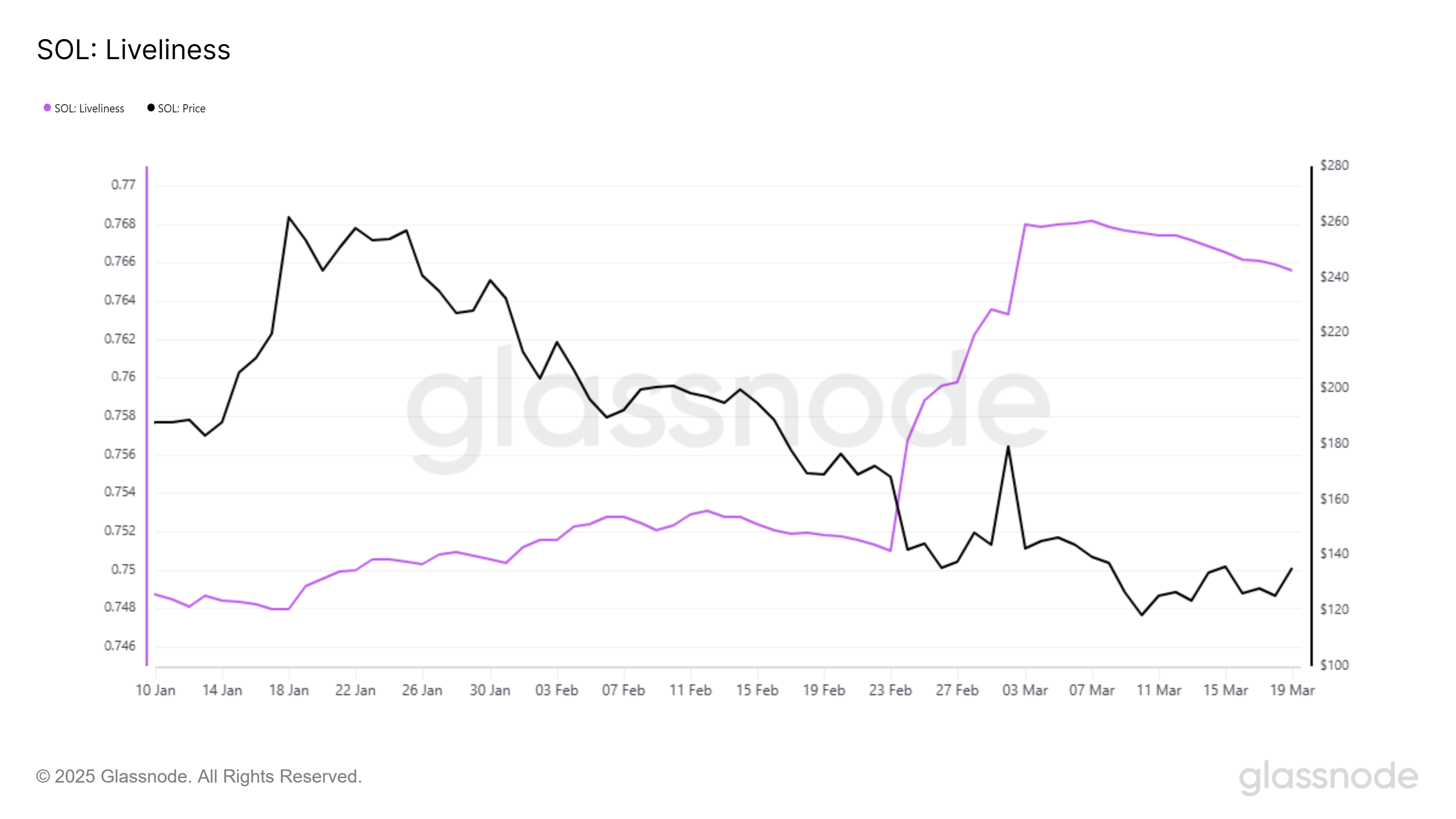

Liveliness, an indicator measuring long-term holders’ behavior, is showing a notable decline. This means that investors who previously sold their holdings are now shifting toward accumulation. When long-term holders accumulate, it signals confidence in the asset, reducing the likelihood of large sell-offs that could trigger price drops.

Earlier this month, Solana saw a sharp spike in liveliness, indicating significant liquidations. However, the current downtrend in this metric suggests a shift back to accumulation. This could act as a buffer against major price corrections.

SOL Price Fall Prevented

Solana’s price is up 6% in the last 24 hours, trading at $133 at the time of writing. The altcoin has remained stuck below $135 for several days, struggling to flip $148 into a support level for over a month. The lack of momentum has prevented SOL from making a decisive move upward.

The current market conditions present mixed signals. While overvaluation raises the risk of correction, the accumulation by long-term holders provides support.

As a result, Solana is likely to remain under $150, failing to breach $148. However, it is also unlikely to drop below the key supports of $125 and $118, even in a bearish scenario.

If Solana either successfully tests $148 as support or drops to $109, the neutral outlook would be invalidated. In that case, depending on broader market conditions and investor sentiment, the cryptocurrency could continue in the respective direction.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/solana-crypto-price-overvaluation-price-stagnation/

2025-03-20 18:00:00