Solana has surged by 40% since plummeting to a 12-month low of $95.23 on April 7, igniting renewed bullish sentiment in the derivatives market.

As of today, this price recovery has driven SOL’s long/short ratio to a 30-day high, signaling a significant uptick in demand for long positions among futures traders.

SOL Eyes Fresh Rally as Long/Short Ratio Surges

According to Coinglass, SOL’s long/short ratio currently sits at a 30-day high of 1.06, reflecting today’s surge in demand for long positions.

The long/short ratio measures the proportion of long positions (bets on price increases) to short positions (bets on price declines) in the market.

A ratio below 1 indicates more traders are betting on the asset’s price falling. Conversely, as with SOL, a ratio above 1 suggests a bullish sentiment, with the majority expecting further price gains.

The growing appetite for longs suggests SOL traders are increasingly confident in further upside potential. This is notable because following the sharp rebound from its 12-month low, SOL appears to have entered a consolidation phase, a typical cooling-off period that often precedes the next leg of a rally.

Hence, if the demand for long positions persists and buying pressure strengthens, SOL could break above this narrow range and initiate the next cycle of its rally.

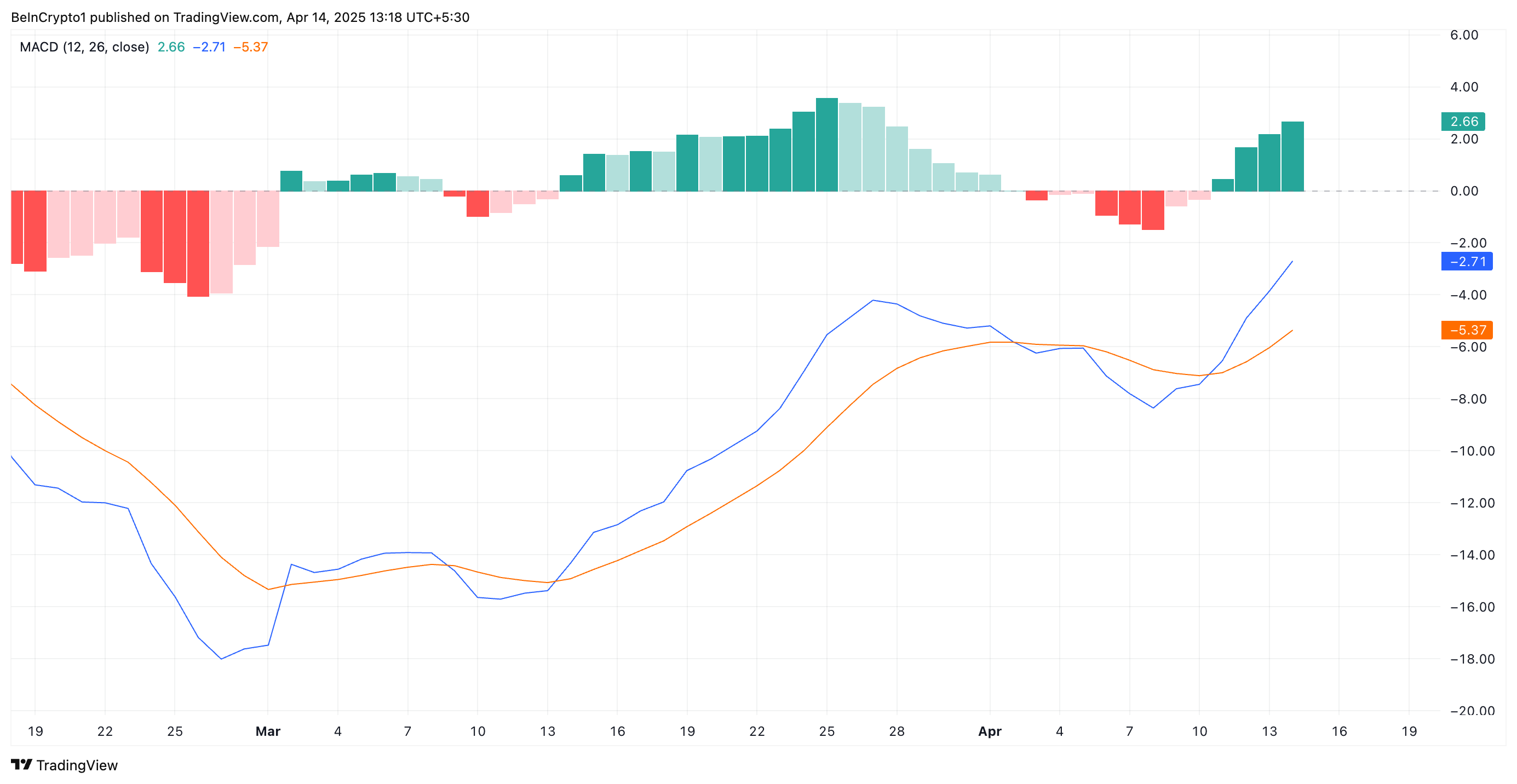

On the technical side of things, the setup of the coin’s Moving Average Convergence Divergence (MACD) confirms this bullish outlook. At press time, SOL’s MACD line (blue) rests atop its signal line (orange).

This trend indicates growing bulling momentum in the SOL spot markets. The crossover suggests that buying pressure is increasing and offers confirmation that the recent upward price movement could continue in the short term.

Solana Attempts to Stabilize above $130, with $147 in Sight

SOL currently trades at $131.66, attempting to stabilize above its new support floor formed at $130.17. If the demand for longs persists and bullish momentum remains strong, SOL could break out of its sideways movements and rally toward $147.59.

On the other hand, if bullish pressure weakens and profit-taking resumes, SOL could slip below $130.17 and fall to $95.54.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/solana-futures-traders-sol-recovery/

2025-04-14 13:00:00