Solana (SOL) has faced significant price challenges in recent weeks, with a notable drawdown that has left it struggling to recover.

This decline has triggered concerns in the market, further compounded by a key bearish signal. There is a rising concern among investors that these factors could lead to even more bearishness in the short term.

Solana Faces Strong Bearishness

Solana’s price has slipped below the realized price for the first time in almost 3 years. The realized price is a key metric that represents the average price at which an asset was last moved. When the spot price falls below this, it signals that the holders of Solana are collectively experiencing net unrealized losses.

This situation is often considered a bearish signal, as it suggests that investors are sitting on losses, which may prompt some to sell in an attempt to avoid further declines. As a result, the potential for panic selling increases when the price trades below the realized price.

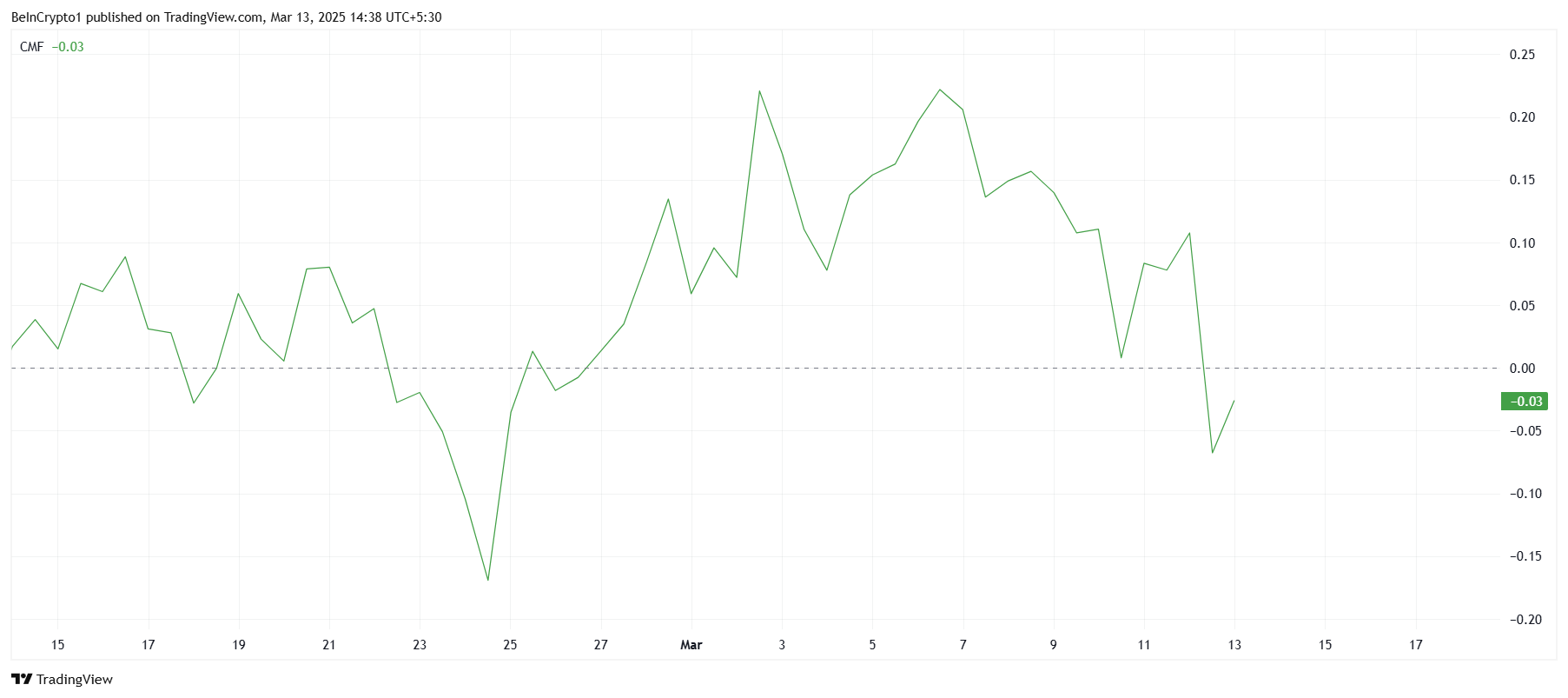

On a broader scale, Solana is also experiencing weak macro momentum, highlighted by the technical indicators. The Chaikin Money Flow (CMF), which measures the volume-weighted flow of money into and out of an asset, has noted a sharp downtick. The CMF is currently below the zero line, indicating that outflows are dominating inflows.

As the CMF remains negative, it suggests that Solana’s price recovery could be hindered. The lack of buying interest and the dominance of selling activity are likely to limit any significant upward movement.

SOL Price Is Vulnerable To A Decline

Solana’s price has been down nearly 30% over the last ten days, and it is currently trading at $125, just under the critical $126 resistance level. Despite recently bouncing off the support at $118, the overall sentiment and market conditions suggest that recovery may be short-lived. The price remains under pressure, with further declines possible if key levels fail to hold.

If Solana fails to secure $126 as support, the altcoin could drop back to $118 or even lower, possibly reaching $109. This scenario would reinforce the bearish outlook and prolong the struggle for recovery. Without a strong rally, Solana could face more losses in the short term.

However, if Solana manages to breach and flip $126 into support, it could trigger a bounce toward $133, followed by potential resistance at $143. A successful breach of $143 would invalidate the current bearish thesis and signal a more strong recovery. If this occurs, Solana could regain some of the losses it has recently suffered, offering hope for investors.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/solana-slips-below-realized-price/

2025-03-13 12:30:00