Solana’s price has seen an interesting mix of resistance and support in recent weeks, especially with the ongoing efforts to break above the $186 barrier.

Despite several failed attempts to breach this level, institutions remain optimistic about Solana’s potential, as shown by increased interest from prominent investors.

Solana Inflows From Institutions Grow

According to a recent report from CoinShares, Solana has emerged as one of the top choices among institutional investors for the week ending November 2. Solana’s inflows reached $5.7 million, just over half of Ethereum’s $9.5 million inflows but far above any other altcoin. These numbers indicate sustained interest from institutions, reinforcing Solana’s appeal as a leading blockchain network.

Institutional support for Solana has continued despite the broader crypto market’s ups and downs, demonstrating a long-term commitment from significant investors. This confidence from institutional players could provide SOL with the boost it needs to move beyond recent price hurdles.

Read more: Solana vs. Ethereum: An Ultimate Comparison

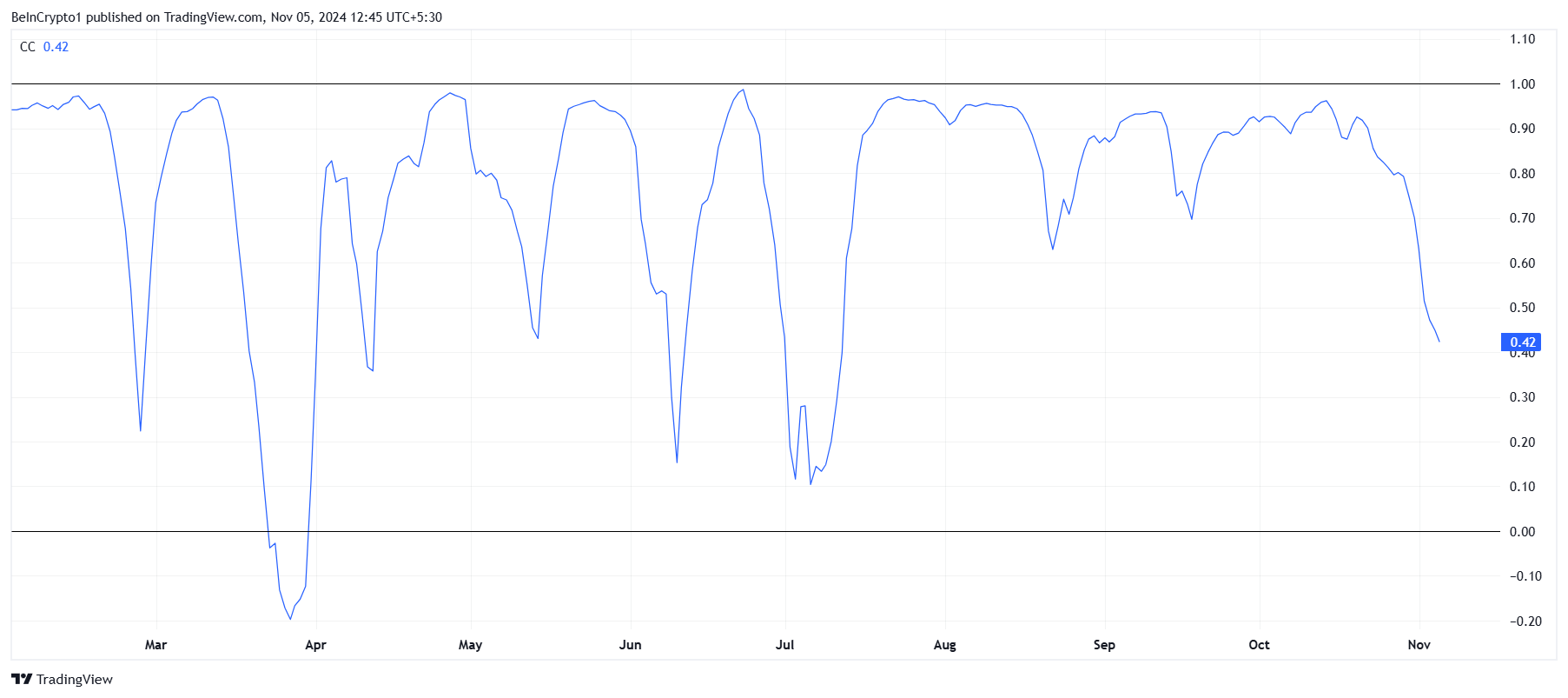

Solana’s overall momentum shows unique patterns compared to other major cryptocurrencies, particularly in its correlation with Bitcoin. Unlike most altcoins that rise and fall in tandem with Bitcoin, Solana has shown historical strength when decoupled from Bitcoin’s price action.

This shift is advantageous for Solana, as periods of lower Bitcoin correlation have coincided with positive price action for SOL. With Bitcoin currently declining, this decoupling could work in Solana’s favor, giving it a greater chance to achieve a meaningful recovery without being heavily influenced by broader market downturns.

SOL Price Prediction: Reclaiming Support

Solana has been down 12% over the past week, trading at $160 and hovering just below the key $161 resistance level. Converting this resistance into a support level is essential for SOL to attempt a recovery toward $186. Successfully establishing $161 as support could provide Solana with the foundation needed for continued gains.

The factors influencing Solana’s price movement appear favorable, suggesting a potential breach of $161 and its conversion into support. If bullish momentum persists, Solana could push beyond $161, aiming for the $175 level and possibly even higher. Consistent buying interest from institutions could further bolster this rally.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

However, failure to secure $161 as support could result in a pullback to $155. If Solana loses this support, it would invalidate the bullish outlook, with the price likely falling further to around $140. This decline would introduce greater caution among investors, delaying hopes for a rapid recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/solana-price-benefits-us-election/

2024-11-05 08:02:46