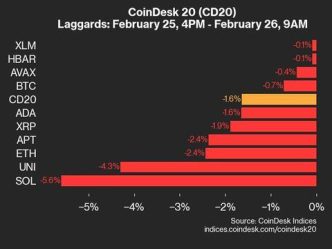

Solana (SOL) has recently experienced a sharp downtrend, erasing months of recovery in just four weeks. This rapid decline caught many investors by surprise, triggering widespread fear among SOL holders.

The price of Solana dropped to a 5-month low, raising concerns about the altcoin’s near-term future.

Solana Needs Support

The current sentiment in the Solana market is overwhelmingly bearish, as indicated by the rising NUPL (Net Unrealized Profit and Loss) metric. This shows a significant increase in unrealized losses among investors, which is contributing to widespread fear. As investors become fearful of further price declines, many are opting to step away from the network, reducing their participation in Solana’s ecosystem.

This fear-driven behavior is likely to exacerbate the issue of declining liquidity, which has already been evident over the past few weeks. As fewer participants engage with the network, the Solana price could struggle to recover.

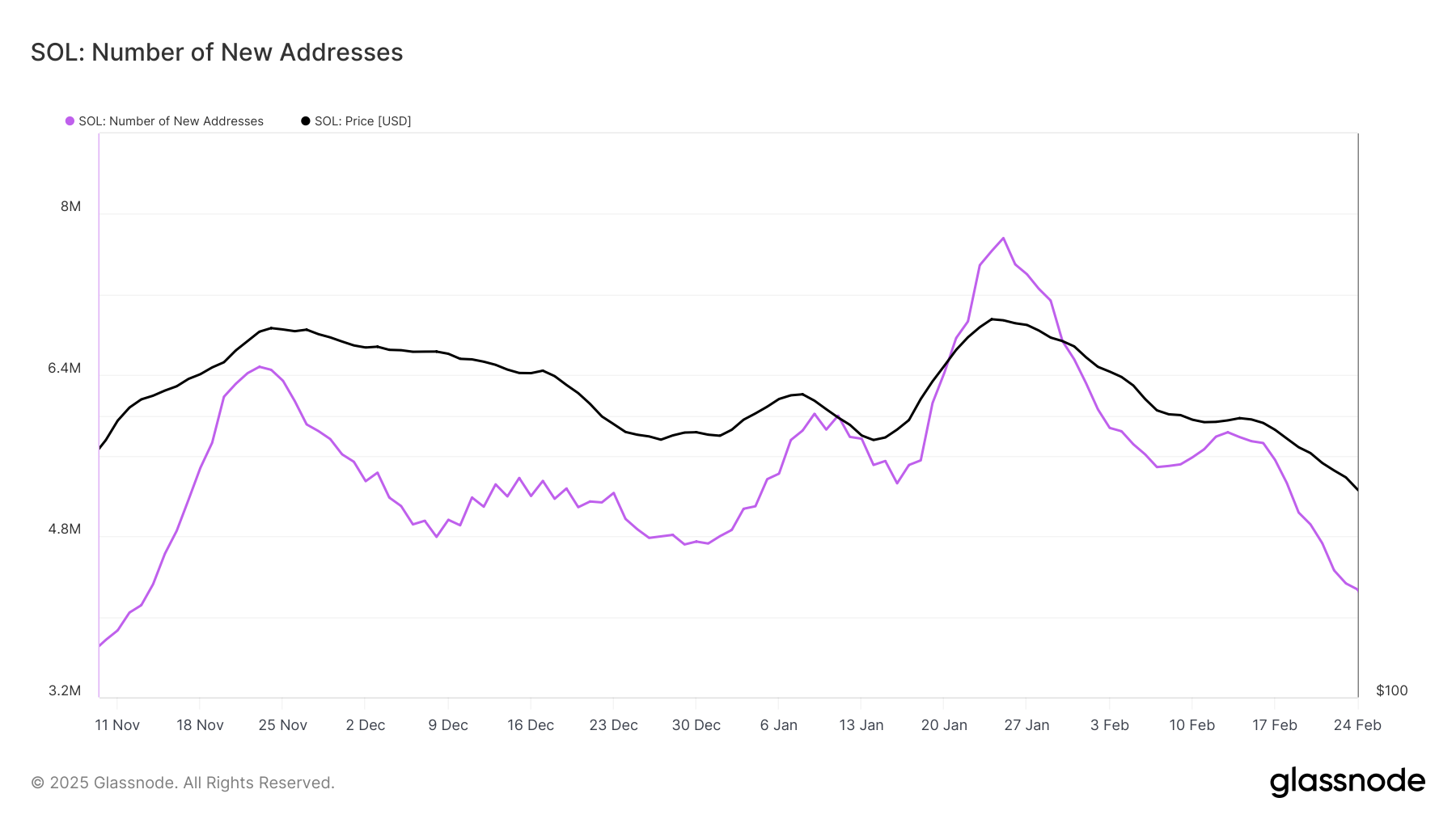

Solana’s broader macro momentum is also showing signs of weakening. New addresses on the network have dropped to a three-month low, signaling a lack of new investment in SOL. The decreased interest from potential buyers suggests that Solana is losing traction in the market, as new investors are reluctant to commit to the cryptocurrency amid ongoing price volatility.

This drop in new addresses is a concerning trend, as it typically indicates a lack of interest and investor confidence in the project. Without fresh inflows, Solana’s price could face further downward pressure, making it difficult for the cryptocurrency to regain its previous momentum.

SOL Price Could Consolidate

Solana is currently trading at $140, holding above the crucial support level of $138. However, the recent decline from $168 to its 5-month low has made a swift recovery look increasingly questionable. This price drop has caught investors off guard, and while it has yet to break below $138, the outlook remains bearish.

Solana may continue to consolidate between $138 and $161 as it has in the past, but the bearish sentiment suggests that SOL could slip further. If this consolidation continues, the price might eventually fall to $131, pushing SOL into a more vulnerable position. This would mark an extended period of losses for investors.

For Solana to invalidate the bearish outlook, the price would need to breach the $168 barrier and flip it into support. A move above this level would signify a recovery and restore some confidence. This would help SOL recover from the recent downturn and potentially regain its bullish trajectory.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/solana-price-crashes-as-fear-grips-investors/

2025-02-26 14:00:00