Solana is gearing up for a potential price surge against Bitcoin as the SOL/BTC pair inches closer to a bullish breakout. After a prolonged period of consolidation within a symmetrical triangle since March, SOL/BTC is making another attempt to rally past the upper resistance line.

A successful attempt will cause Solana to exchange hands at a multi-month high. This analysis explores the possibility of this happening.

Solana Seeks To Outshine Bitcoin

The SOL/BTC pair represents the exchange rate between Solana and Bitcoin. It currently stands at 0.0024, which indicates a 14% rally over the past 12 days.

When the SOL/BTC pair rallies, SOL’s value increases relative to BTC. This means that SOL holdings are becoming more valuable in terms of BTC.

A look at the SOL/BTC pair on a one-day chart reveals that it now trends toward the upper line of the symmetrical triangle it has traded within since March. When an asset trades within this pattern, its price fluctuates between two converging trend lines, forming resistance and support levels.

Read more: Solana vs. Ethereum: An Ultimate Comparison

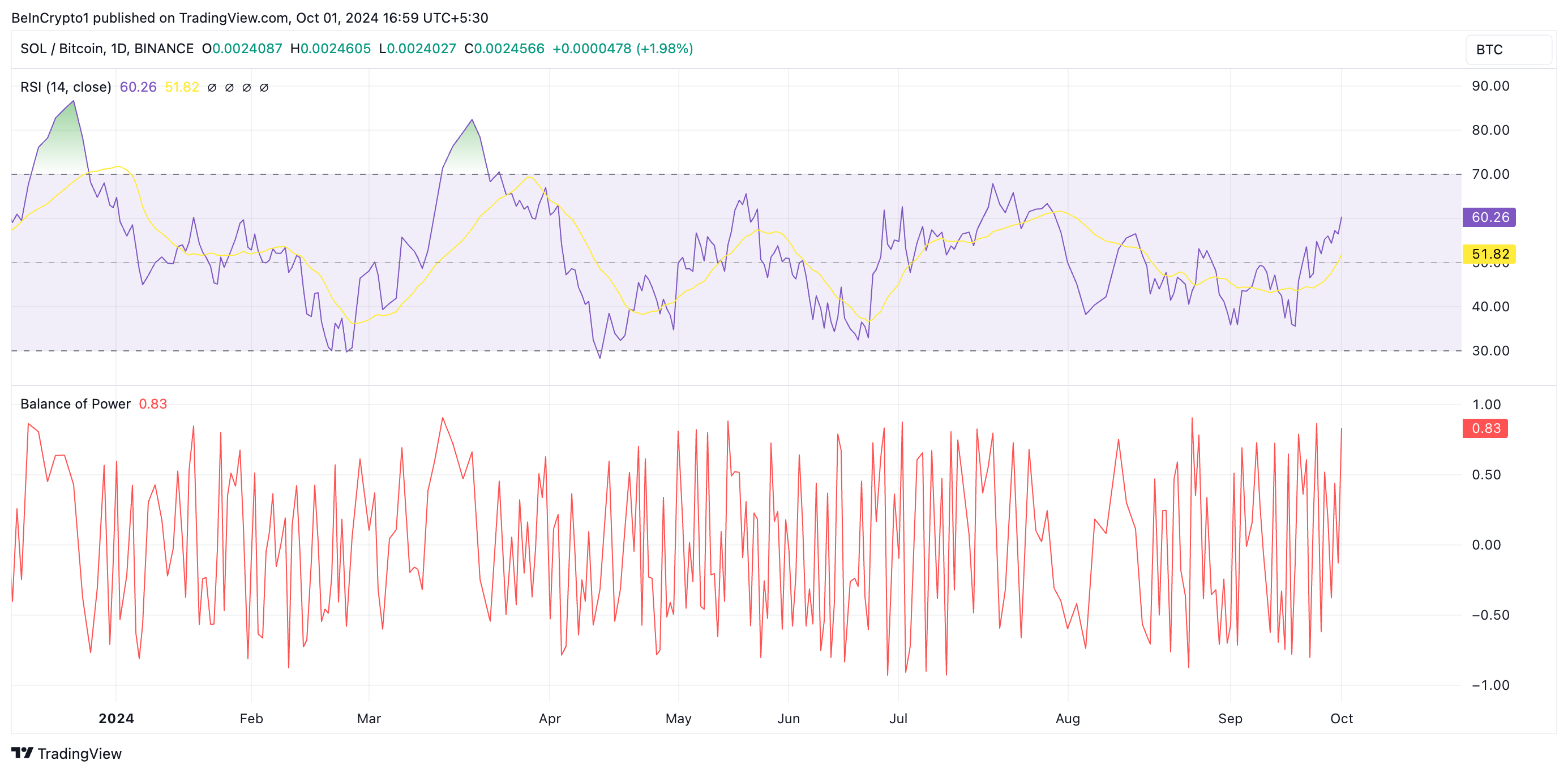

A breakout above this upper resistance would indicate that the bulls have overpowered bearish forces, confirming the potential for further price gains. The positive readings from the pair’s Balance of Power (BoP) suggest that this breakout may be likely in the near term.

The SOL/BTC BoP, which measures the relationship between buying and selling pressures in the market, is 0.8 at press time. When this indicator is positive (above zero), buying pressure is stronger than selling pressure within the market. It indicates there are more buyers than sellers, driving the price upward.

The pair’s Relative Strength Index (RSI) supports this bullish thesis. As of this writing, the RSI, which tracks oversold and overbought conditions in the market, is in an uptrend at 60.26. This signals that SOL accumulation is high among market participants, dwarfing all profit-taking efforts.

Solana Price Prediction: A Multi-Month High Is Imminent

The SOL/BTC pair could be driven to new highs if demand for Solana continues to outpace Bitcoin’s. Readings from the pair’s Fibonacci Retracement tool suggest that a successful break above the upper resistance line will push it to 0.0031, a level last seen on March 18.

Should this occur, SOL may trade above $200 for the first time in seven months.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

However, if Bitcoin gains strength against Solana, causing the pair to decline, the attempt to break resistance could fail, and the pair may continue to trend within the descending triangle. In such a scenario, it might drop to support at 0.0021, bringing Solana’s price down to $133.58 if buying pressure weakens significantly.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/solana-price-targets-multi-month-highs/

2024-10-01 22:30:00