Solana price action has seen a significant drawdown over the past three days, falling from $221 to $201.

Despite this decline, investor sentiment remains bullish, although their optimism has not yet translated into tangible actions to support a recovery.

Solana Needs More Support

The number of active addresses on the Solana network has been steadily increasing since the beginning of the year. Over nine days, addresses conducting transactions on the network grew by 1.5 million. This rise indicates that investors are optimistic about Solana’s potential for a bounce-back and are positioning themselves to capitalize on lower prices.

While the rising number of active addresses highlights a growing interest, it also emphasizes a gap between optimism and action. Many investors are still waiting for more favorable conditions before significantly increasing their participation in the network, leaving Solana in a precarious position.

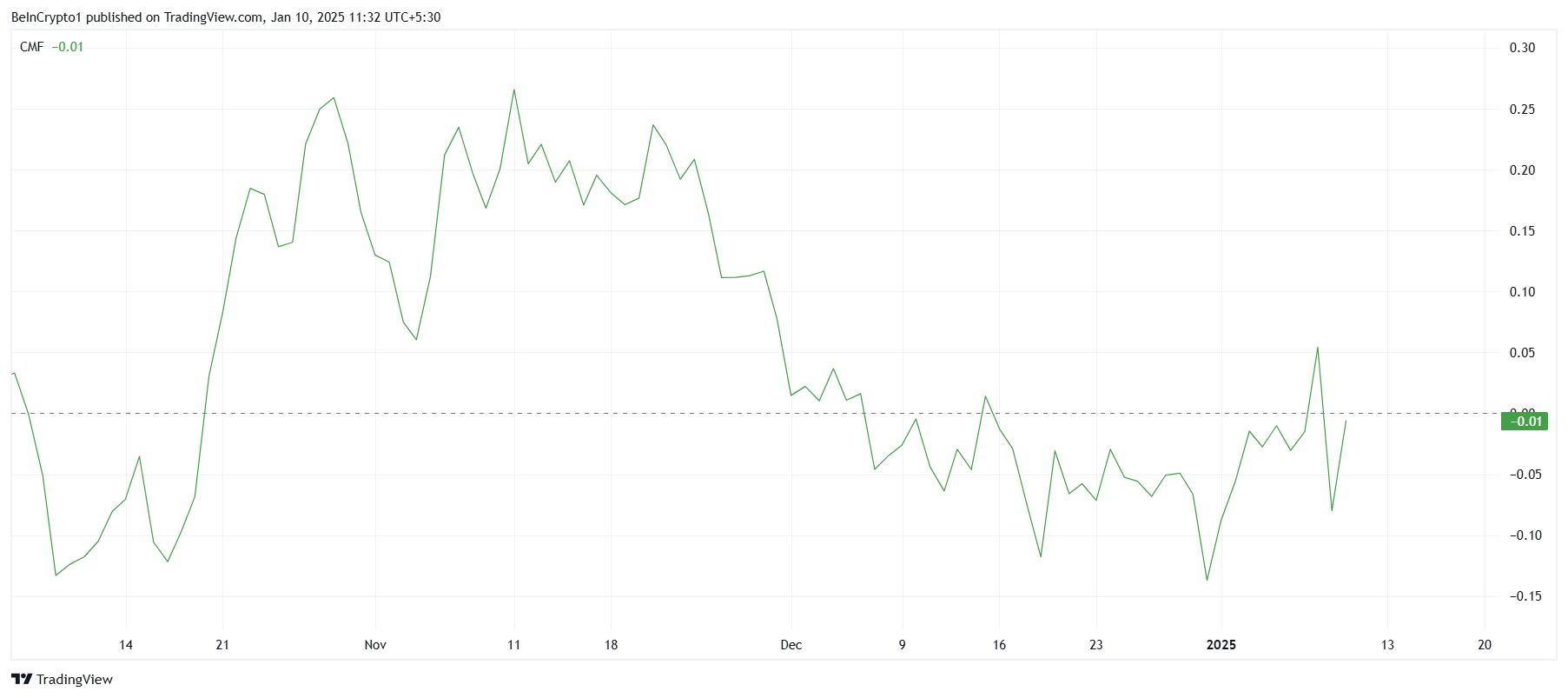

The Chaikin Money Flow (CMF) indicator shows that inflows into Solana are not yet strong enough to drive substantial recovery. While investors remain optimistic, the lack of materialized inflows has limited Solana’s ability to benefit from heightened interest and rising active addresses.

The weak inflows underline the need for investors to make a more concerted effort to support Solana’s price action. Until these inflows strengthen, the altcoin’s bullish potential will remain unrealized, leaving it vulnerable to broader market influences and continued volatility.

SOL Price Prediction: Breaching Resistance

At the time of writing, Solana’s price stands at $188 after reclaiming the critical support level of $186. The altcoin is now targeting the $201 resistance level, aiming to convert it into support to set the stage for a potential recovery.

If inflows into Solana gain momentum, bullish activity could push the altcoin past the $201 resistance. Breaching this level would enable further recovery, likely attracting more investors and reinforcing the positive sentiment.

However, a failure to sustain the current support could lead to a deeper decline, with Solana potentially falling to $175. Such a move would invalidate the bullish recovery thesis and may exacerbate negative sentiment among investors.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/solanas-price-decline-deepens-this-week/

2025-01-10 08:00:00