Solana is testing a crucial supply level around $160 following a strong 15% surge since last Friday. The crypto market is experiencing heightened volatility as optimism grows, increasing token prices.

In recent weeks, Solana and other major cryptocurrencies have been on a rollercoaster ride, and the coming weeks promise continued uncertainty as volatility shows no signs of slowing down.

Related Reading

Key metrics from DefiLlama reveal that Solana’s total value locked (TVL) has reached a new yearly high, now at around $6 billion, its highest level since September 2022. This TVL increase signals confidence in Solana’s ecosystem and decentralized finance (DeFi) offerings.

Investors and traders are closely watching the market, with Solana’s performance likely to serve as a key indicator for broader market sentiment. As Solana tests this crucial resistance level, the next few days will determine whether the token continues its upward momentum or faces another round of volatility.

Solana Testing Crucial Resistance

Solana is flirting with a 5% surge, poised to challenge local highs and potentially confirm a long-term uptrend. As the broader crypto market experiences a shift, investors and traders are eagerly searching for signals that Solana is ready to break into new highs.

Key data from DefiLlama shows that Solana’s total value locked (TVL) has reached a new yearly high of $6 billion. TVL measures the total value of assets deposited into a blockchain project and is a key indicator of user confidence and engagement.

A rising TVL suggests that more users are locking their funds into Solana’s decentralized applications, a sign of growing trust in its ecosystem.

This increase in TVL further supports the bullish outlook that many investors hold for Solana. The platform’s expanding DeFi offerings and solid infrastructure make it a strong contender in the altcoin space. As Solana continues to push toward new highs, such fundamental data reinforces optimism about its future price action.

Related Reading

A confirmed surge above key resistance levels could begin a sustained upward trend for Solana, positioning it as one of the top performers in the market. Investors are watching closely to see if the current price movement can translate into a longer-term rally.

Key Levels To Watch

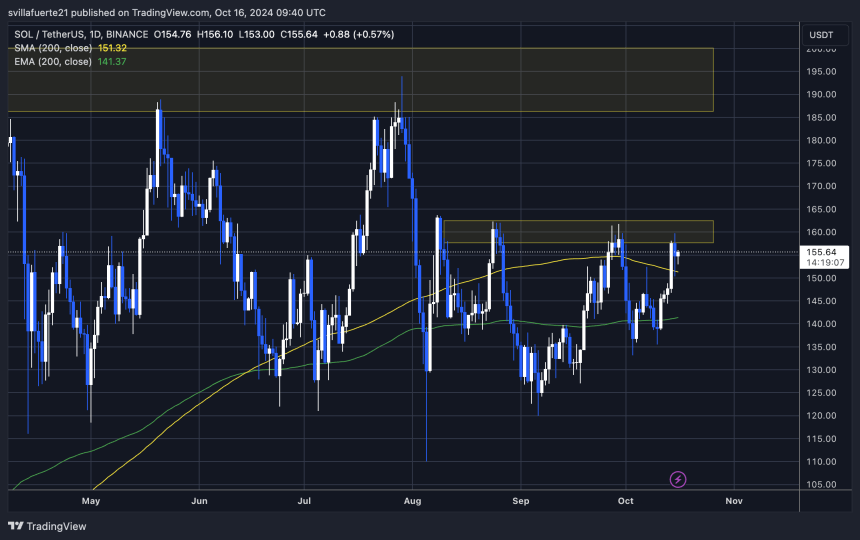

Solana is currently trading at $155 after a volatile session yesterday. The price successfully retested and now holds above the 200-day moving average (MA) at $151, signaling strong support for the asset. This level has been a key indicator for traders, and maintaining it is crucial for sustaining the current bullish momentum.

For bulls to keep the momentum going, SOL must stay above this 200-day MA and break through the $160 level. Such a move would likely confirm a bullish trend and propel Solana to test its yearly highs around $210. This would mark a significant upward move, reflecting optimism in the market and increasing confidence among traders and investors.

However, the bullish momentum could weaken if the price fails to close above $160 and holds above the 200-day MA. In this case, a retracement is likely, with the price potentially dropping to lower demand levels around $140.

Related Reading

This correction would serve as a consolidation phase before any further upward moves. Traders are closely watching these key levels as they will dictate Solana’s next major move in the market.

Featured image from Dall-E, chart from TradingView

Source link

Sebastian Villafuerte

https://www.newsbtc.com/news/solana/solana-targets-160-resistance-as-tvl-hits-new-yearly-highs/

2024-10-17 02:00:20