Like Bitcoin and other top altcoins, Solana continues to sell off at press time, rewinding losses of the first part of the year. At press time, SOL, the native currency of the smart contracts platform, is trading at around $130, retesting a critical support level.

As it is, the third-most valuable crypto asset is down nearly 40% from 2024 highs of around $210. Technically, sellers are in control, and unless there is a sharp shift in trend favoring buyers, the short-term will continue to be bearish.

Is SOL Preparing For $100? Triple Bottom Forms

Though some analysts are upbeat, expecting a rebound toward the $200 zone in the coming days and weeks, others are bearish. Taking to X, one analyst said SOL, in line with the current state of price action, thinks the coin will slip to as low as $100.

This outlook, it should be noted, follows the recent drop from a key resistance, previously supported, level at around $140. With the coin changing hands at $130, the analyst is convinced there will be more losses in a bear trend continuation pattern. From his outlook, SOL will trickle lower “if nothing changes” in the market.

The forecast, looking at the candlestick formation in the daily chart, isn’t surprising. As mentioned earlier, SOL is down by nearly 40%% from March highs.

With prices consolidating and moving inside a wide range of between $210 on the upper end and $130 on the lower end, this prediction aligns with recent price movement. Presently, SOL is now retesting multi-month support as a triple bottom form.

For the printout of the uptrend from October 2023 to March 2024, SOL must find support around spot rates. Subsequent gains above $140 and $160 could spark demand, lifting the coin toward $190 and, finally, $210 or 2024 highs.

Solana Dumps, Bitcoin Sell-Off And Pump.fun Liquidation Impact Sentiment

Even so, the leg up will depend on a multitude of factors. A recovery in Bitcoin prices would almost likely lift altcoins, of which SOL is highly ranked. Besides this, the resurgence of meme coin activity on Solana will be a big price movement.

Related Reading

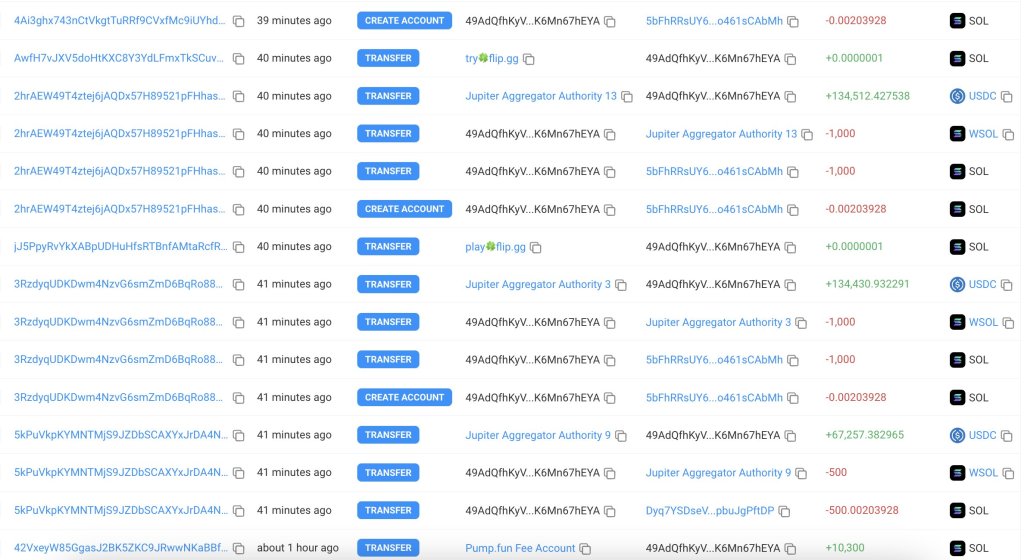

Lookonchain data shows that Pump.fun, a meme coin launchpad on Solana, has been liquidating SOL. Being a large holder, their action is net-negative, impacting sentiment and helps sow doubt on the strength of buyers.

As a SOL whale, the more they sell, the more retailers dump, following in their path. By September 3, the meme coin launchpad had sold over 264,000 SOL worth more than $1.3 million.

Feature image from Shutterstock, chart from TradingView

Source link

Dalmas Ngetich

https://www.newsbtc.com/news/solana/solana-to-100-inevitable-after-this-break-sol-forms-a-triple-bottom/

2024-09-06 19:00:46