Solana’s decentralized finance (DeFi) ecosystem has hit an important milestone, showing its growing role in the blockchain space.

The blockchain’s total value locked (TVL) surpassed $10 billion for the first time in three years.

Solana’s Surging TVL and DEX Activity

Data from DeFiLlama shows that Solana’s TVL rose by $1.5 billion since January 14, reaching an all-time high of $10.172 billion. This surge highlights the platform’s growing adoption in DeFi applications and its ability to attract substantial liquidity.

Solana has also outperformed competitors in decentralized exchange (DEX) trading activity. Over the last 24 hours, figures reveal that Solana’s daily DEX volume soared to $10.47 billion, almost three times that of Ethereum’s $3.28 billion.

Over the past week, Solana sustained its dominance, achieving $33.7 billion in trading volume compared to Ethereum’s $15.39 billion.

A significant contributor to this growth is the launch of a memecoin named “TRUMP” on the Solana blockchain. The token, linked to US President-elect Donald Trump, experienced a meteoric rise, surging nearly 500% in price and reaching a market capitalization exceeding $15 billion.

“TRUMP pairs account for 18.5% ($1.92B) of Solana’s total Trading Volume today,” crypto analyst Tom Wan said.

Similarly, blockchain analyst Sharples pointed out that the meme coin frenzy fueled activity in borrowing markets, with a $20 million spike in USDC loans and 460 million new USDC tokens minted since the token’s debut.

Meanwhile, the excitement surrounding Solana isn’t limited to memecoins. Market speculation about potential Solana-based spot ETFs and its rumored inclusion in US strategic reserves has bolstered investor sentiment. These developments have spurred whale transactions and amplified Solana’s appeal to institutional investors.

Notably, the bullish outlook has positively influenced Solana’s native token, SOL, which saw a 10% price jump in the past day, trading around $242, according to BeInCrypto data.

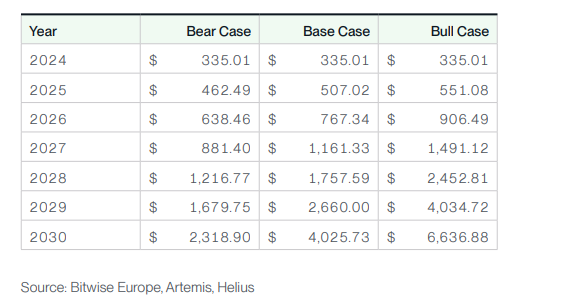

A recent Bitwise Asset Management report forecasts SOL reaching $2,318.90 to $6,636.88 by 2030, driven by increasing daily active addresses and robust blockchain adoption.

Solana’s growth has solidified its position as a formidable competitor to Ethereum in the DeFi landscape. The network’s scalability and efficient infrastructure make it a prime choice for speculative trading and innovative applications. Analysts anticipate that as Solana’s ecosystem matures, it will unlock even more opportunities for growth and innovation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Oluwapelumi Adejumo

https://beincrypto.com/solanas-defi-tvl-surpasses-10-billion/

2025-01-18 17:15:00