Sonic’s S has emerged as the market’s top performer in the past 24 hours, surging by 6% as bullish momentum builds.

The altcoin’s price has rallied steadily over the past few days and is now poised to break above a key moving average. What does this mean for S holders?

Sonic (S) Flashes Bullish Signals as Buying Pressure Increases

Currently, S is approaching its 20-day Exponential Moving Average (EMA) and appears ready to cross above it—a move that often signals the continuation of an uptrend.

The 20-day EMA tracks an asset’s average price over the past 20 trading days, weighing more recent prices to determine short-term trends. A rally toward this key moving average indicates a positive shift in market momentum. It suggests growing bullish strength in the S market and hints at the likelihood of an extended uptrend.

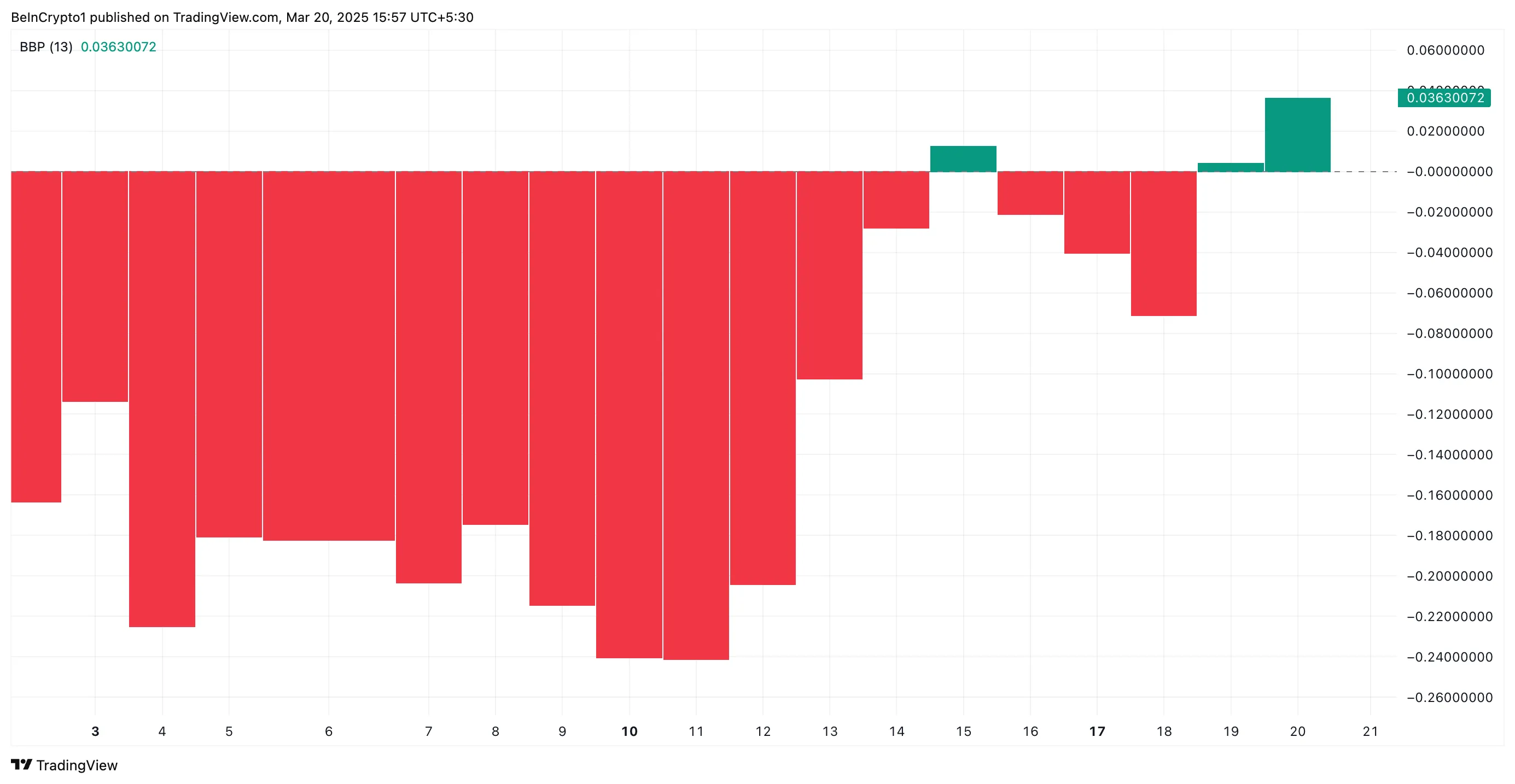

Additionally, S’ Elder-Ray Index posts a positive value, reinforcing the strength of buying pressure and growing investor demand. As of this writing, the metric is at 0.036.

The indicator measures the balance between bullish and bearish pressure in the market. When the index is positive, it means buyers are stronger than sellers, indicating growing demand and potential for further price increases.

S Tests Dynamic Resistance at $0.55—A Move Past $0.63 in Sight?

S’ 20-day EMA currently forms a dynamic resistance above its price at $0.55. A successful breach of this level would intensify the token’s upward trend.

If the $0.55 price zone flips into a support floor, it could propel S’ value past $0.57 and toward $0.63.

On the other hand, if the bears regain market dominance, this bullish projection will be invalidated. In this scenario, S could resume its downtrend, shed recent gains, and drop to $0.49.

If the bulls cannot defend this support, S’s price could plunge to $0.40.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/sonic-rally-outperforms-market/

2025-03-20 15:00:00