As the cryptocurrency market continues to evolve, certain projects are demonstrating impressive growth and momentum. Starknet (STRK) and Mpeppe (MPEPE) are two tokens that have recently experienced a bullish trend, while Ethereum (ETH), despite being a foundational blockchain, has been facing challenges in regaining its momentum. Let’s delve into what’s driving Starknet (STRK) and Mpeppe (MPEPE)’s success and explore why Ethereum (ETH) is struggling to pick back up.

Starknet: Revolutionizing Ethereum (ETH) Scaling with ZK-Rollups

Starknet (STRK), a Layer-2 scaling solution for Ethereum (ETH), has been at the forefront of innovation by addressing Ethereum (ETH)’s scalability issues. Utilizing Zero-Knowledge (ZK) Rollups, Starknet (STRK) enables multiple transactions to be accumulated into off-chain proofs and submitted to Ethereum (ETH) as a single batch, significantly reducing transaction costs and increasing the speed of operations. This has made Starknet (STRK) a popular choice for developers and users who are looking for faster and more cost-effective ways to interact with the Ethereum (ETH) network.

A significant development for Starknet (STRK) is the launch of StarkGuardians, an NFT collection designed to enhance both security and liquidity in the NFT space. StarkGuardians is not just another NFT project but one with a unique utility. It allows users to lend and borrow NFTs through a new protocol launched on the Sepolia testnet. This protocol lets users borrow NFTs in return for cryptocurrencies or vice versa, making NFTs more accessible and liquid without being sold. The NFT lending and borrowing mechanism is a groundbreaking move in making digital assets more functional in decentralized finance (DeFi).

Additionally, the StarkGuardians collection, featuring 323 cyber female characters, has been designed with a focus on security and protection of NFT projects. As Starknet (STRK) continues to innovate, the integration of NFTs and financial services creates new opportunities for users to leverage their assets in ways that were previously inaccessible.

The introduction of gasless voting on the platform, facilitated by Snapshot X, allows users to participate in on-chain governance without paying gas fees. This has been a major step forward in increasing user engagement and participation in decentralized governance.

Mpeppe: Disrupting the Casino Industry with Blockchain

Mpeppe (MPEPE) is gaining traction as a decentralized casino platform, offering players an innovative and transparent way to gamble. The platform allows users to earn rewards in a decentralized and provably fair manner. The recent surge in Mpeppe (MPEPE)’s popularity has been driven by its presale success, where it raised over $12 million. The low entry point at $0.0021 per token has attracted a wide range of investors, including those looking for a high-growth project that taps into the burgeoning world of decentralized gaming.

One of Mpeppe (MPEPE)’s key strengths is its ability to merge traditional online casinos with blockchain technology, bringing transparency and fairness into play. The platform uses smart contracts to ensure that all transactions and game results are verifiable and cannot be tampered with, which gives players the confidence to engage with the platform.

With whales beginning to notice Mpeppe (MPEPE)’s potential, the project is quickly becoming a favored choice among investors seeking exposure to both gaming and blockchain. The project’s success is seen as a bellwether for future decentralized gaming platforms, as more users gravitate toward blockchain-powered entertainment solutions.

Ethereum (ETH)’s Struggles

Despite Ethereum (ETH) being one of the most important blockchains in the world, it has faced challenges in maintaining its upward momentum. Ethereum (ETH) ’s transition to Ethereum (ETH) 2.0, while highly anticipated, has come with some growing pains. While the shift to Proof-of-Stake (PoS) was meant to improve scalability and energy efficiency, it has not been enough to address the high gas fees and network congestion that users continue to experience.

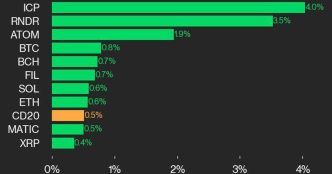

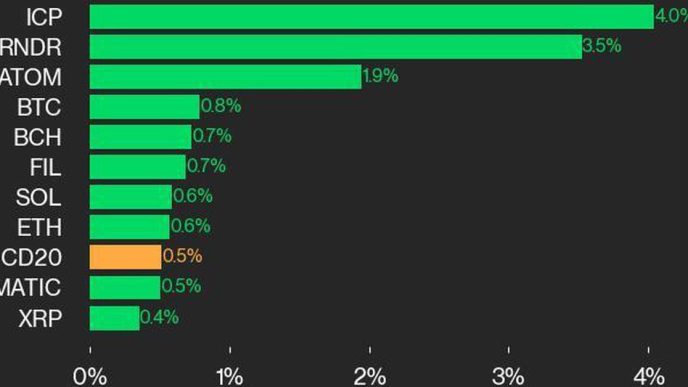

Recently, Ethereum (ETH) whales, who have historically influenced the altcoin’s price, have reduced their buying activity. Since July, on-chain data has shown that large holders have been selling or redistributing their holdings, leading to price stagnation. Ethereum (ETH) is currently facing resistance at the $2,400 level, and unless whale activity picks up again, the asset may struggle to break out of its current range.

Additionally, Ethereum (ETH)’s dominance in the DeFi space is being challenged by more scalable Layer-2 solutions like Starknet (STRK). While Ethereum (ETH) remains the backbone of decentralized applications, the introduction of more efficient systems is diverting attention and investment away from the main chain. Developers are increasingly turning to Layer-2s for better transaction speeds and lower fees, making Ethereum (ETH)’s core network less attractive for certain use cases.

The Future Outlook: Starknet and Mpeppe Lead the Way

Both Starknet (STRK) and Mpeppe (MPEPE) have positioned themselves as leaders in their respective sectors. Starknet (STRK)’s technological innovations, such as gasless voting, parallel execution, and NFT lending protocols, are reshaping how users interact with the blockchain. With StarkGuardians leading the charge in the NFT space and its innovative governance mechanisms, Starknet (STRK) is set to become a critical player in the Ethereum (ETH) ecosystem.

On the other hand, Mpeppe (MPEPE)’s approach to disrupting the online casino space through decentralized solutions is tapping into a massive global market. With its low entry cost and transparent gaming model, Mpeppe (MPEPE) is quickly building a dedicated user base and gaining the attention of large investors.

While Ethereum (ETH) may be struggling in the short term, the long-term prospects of Layer-2 solutions like Starknet (STRK) are promising. As these projects continue to develop and attract users, the overall Ethereum (ETH)ecosystem will likely benefit from their advancements. For investors, the combination of Ethereum (ETH)’s foundational strength, Starknet (STRK)’s technological prowess, and Mpeppe (MPEPE)’s gaming innovation presents a diversified portfolio of opportunities.

Conclusion

Starknet (STRK) and Mpeppe (MPEPE) are two standout projects that are continuing their bullish trend while Ethereum (ETH) works to regain its footing. Starknet (STRK)’s cutting-edge solutions in the NFT and Layer-2 space, coupled with Mpeppe (MPEPE)’s innovative approach to decentralized casinos, offer investors unique opportunities for growth. As the cryptocurrency market continues to evolve, it will be exciting to see how these projects develop and continue to lead the way in their respective fields.

For more information on the Mpeppe (MPEPPE) Presale:

Visit Mpeppe (MPEPPE)

Join and become a community member:

https://x.com/mpeppecommunity?s=11&t=hQv3guBuxfglZI-0YOTGuQ

Source link

NewsBTC

https://www.newsbtc.com/altcoin/starknet-and-mpeppe-bullish-trend-continues-whilst-ethereum-eth-struggles-to-pick-back-up/

2024-09-10 13:00:22