Stellar (XLM) has recently managed to pull itself out of a month-long downtrend, which had created a bearish sentiment among investors.

This recovery has brought optimism back to the market, giving the altcoin a chance to continue its upward momentum and aim for higher price levels.

Stellar Investors Are on the Fence

Over the past few weeks, Stellar’s funding rate has remained consistently positive. This indicates that traders have maintained a bullish outlook on the asset despite its previous decline. The optimism shown by these market participants suggests an expectation of recovery, which aligns with XLM’s recent price performance.

The persistence of a positive funding rate, even during periods of price correction, highlights the confidence investors have in Stellar’s potential for a rebound. This bullish sentiment has contributed to the asset’s recovery, providing the foundation for a sustained uptrend in the near term.

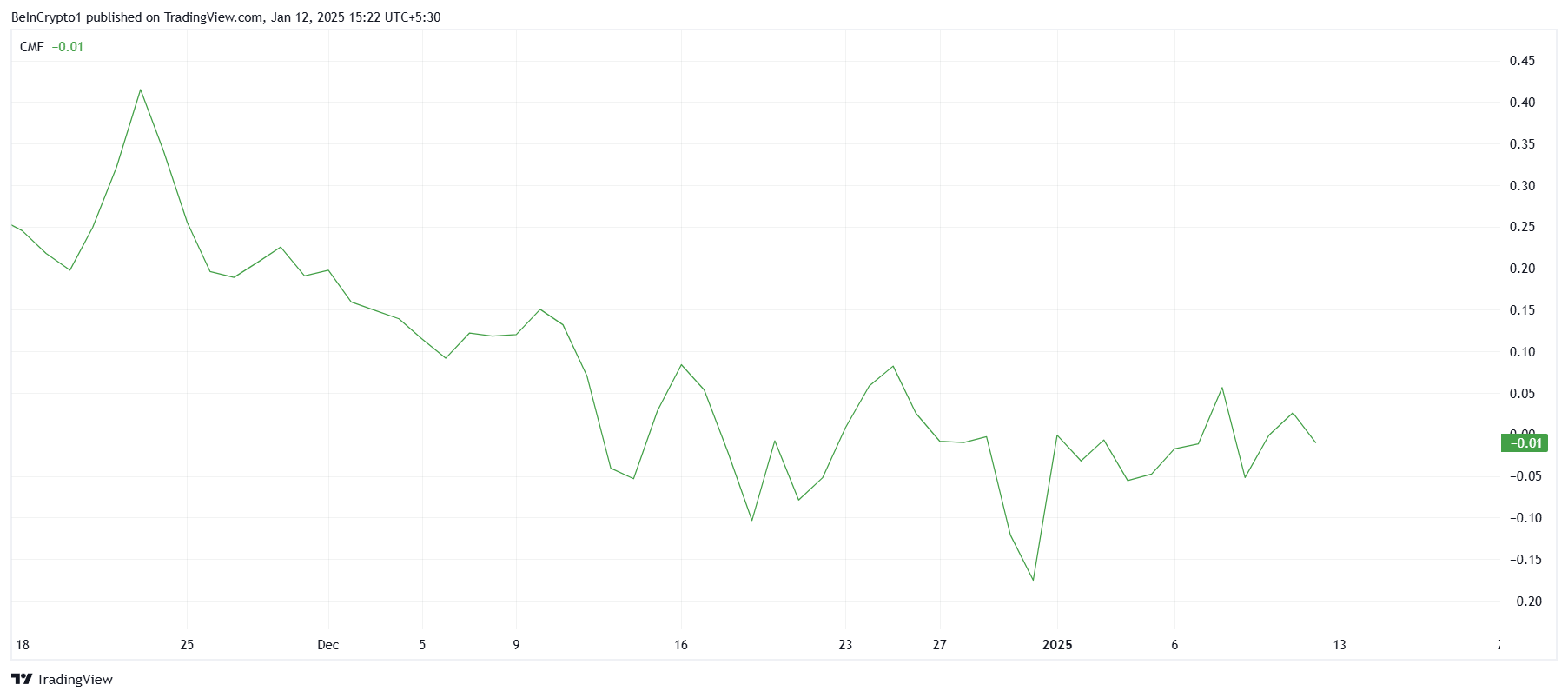

From a macro perspective, Stellar’s Chaikin Money Flow (CMF) indicator hovers around the zero line, reflecting weak inflows. This demonstrates ongoing uncertainty among investors, which could hinder the asset’s recovery if not addressed. Without a significant increase in inflows, Stellar’s price may remain vulnerable to corrections.

Investor uncertainty continues to influence Stellar’s market performance. Stronger inflows are necessary to stabilize the asset and support a move higher. Until this occurs, the cryptocurrency may face challenges in maintaining its current recovery trajectory.

XLM Price Prediction: Continuing The Recovery

Stellar has seen a 30% recovery since the beginning of the year, with its price currently standing at $0.429. The altcoin has successfully secured $0.416 as a support level, reinforcing its position and signaling the potential for further upward movement.

To fully recover from December’s losses, Stellar would need to reach $0.583. Achieving this level will require strong support from the market and renewed investor confidence. Such a recovery would validate the bullish outlook and solidify XLM’s long-term growth prospects.

However, if broader market conditions turn bearish, Stellar’s price could fall below the critical support level of $0.416. This decline could push the asset down to $0.355, invalidating the bullish outlook and delaying any further recovery efforts. Such a scenario highlights the importance of sustained investor confidence and market support for Stellar’s continued upward momentum.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/stellar-rise-is-the-result-of-traders-perseverance/

2025-01-12 21:15:00