DogWifHat (WIF) is emerging as one of the top meme coins in the market, currently testing a critical liquidity level that could propel the price to new highs.

As the broader crypto market navigates a period of volatility and uncertainty, traders eagerly search for confirmation of a potential rally. WIF, which has gained significant traction in recent months, is now at a crucial point where the next move could define its short-term future.

Related Reading

Prominent analyst and investor Ali Martinez has shared insightful data suggesting a bullish outlook for DogWifHat. Metrics point toward a rise in price action, which could lead to a breakout, with WIF potentially surging to the $4 mark if momentum continues to build.

However, the coming days will be key in determining whether a bull trend can be confirmed as market participants await signs of sustained upward movement. All eyes are on WIF to see if it can capitalize on this moment and rally to new heights.

DogWifHat Turning Point

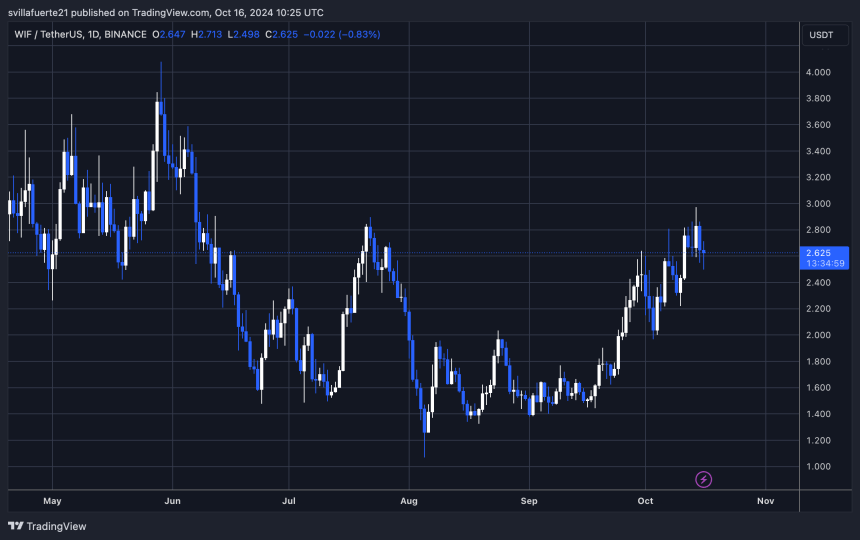

DogWifHat (WIF) is at a critical turning point, with its price hovering just above the $2.5 mark, a crucial psychological level for confirming an ongoing uptrend. Investors and traders are closely watching this level, as its ability to hold will determine whether WIF pushes to new highs or retraces to lower demand zones.

Top analyst Ali Martinez recently shared a technical analysis on X, revealing that a buy signal has appeared for WIF on a key indicator, the TD Sequential.

The TD Sequential, known for accurately predicting trend reversals in the crypto market, has previously been spot-on for DogWifHat. According to Martinez, this new buy signal could be the catalyst that sends WIF into a bullish phase, fueling optimism among investors.

The overall sentiment in the market is also leaning toward a potential surge as volatility continues to rise and other major cryptocurrencies show signs of life. Martinez’s analysis supports the growing belief that WIF could be on the verge of a breakout, especially if it holds the $2.5 level.

Related Reading

However, if the price fails to maintain this support, investors expect a drop to lower demand levels. In the coming weeks, WIF’s price movement will be pivotal in determining whether the meme coin continues its upward trajectory or faces further corrections.

WIF Technical Analysis

WIF is currently trading at $2.62 after experiencing a few days of volatile price action within a sustained uptrend. On Monday, the price set a new high at $2.97 but has since retraced slightly and is now testing crucial demand at a previous resistance level of around $2.5.

This level is key for bulls, as holding above $2.5 would maintain the upward momentum and set WIF up to target the $3 mark, in line with the broader market’s continued push upward.

However, should WIF fail to hold the $2.5 level and close below it, this could indicate a shift in the price structure and signal the start of a correction.

Related Reading

Traders are keeping a close eye on these levels, as a drop below $2.5 would suggest weakening bullish momentum and the potential for a pullback to lower support areas. The next few days will determine whether WIF continues its uptrend or faces a short-term retracement.

Featured image from Dall-E, chart from TradingView

Source link

Sebastian Villafuerte

https://www.newsbtc.com/meme-coins/strong-buy-signal-for-dogwifhat-wif-key-indicator-hints-at-rally-to-4/

2024-10-17 05:00:21