This week marks an exciting period for the crypto market, with key events expected to drive market sentiment. At the forefront are the highly anticipated remarks from Federal Reserve Chair Jerome Powell and a significant $100 million token unlock by SUI.

These developments and updates from the decentralized finance (DeFi) and blockchain spaces are poised to impact investor behavior and market performance.

EigenLayer Prepares for EIGEN Token Transferability This Week

Restaking protocol EigenLayer will remove transfer restrictions on its EIGEN tokens on September 30. This new feature aims to allow EIGEN holders to trade and transfer their staked rewards.

“Please note that if your EIGEN is currently staked, there is a 7-day withdrawal period for unstaking EIGEN,” the team added.

This marks a critical moment for EigenLayer. According to DefiLlama, EigenLayer holds over $12 billion in total value locked (TVL) at the time of writing. This figure makes it the second-largest DeFi platform by TVL.

Read more: What Is EigenLayer?

On Monday, Jerome Powell, the Federal Reserve Chair, will participate in a moderated discussion at an economic conference. This event marks his first appearance since the Fed’s 50-basis-point interest rate cut on September 18.

Powell is expected to provide insights on the central bank’s future policy direction. This insight will have implications for both traditional financial markets and the cryptocurrency space.

BeInCrypto reported that the Federal Reserve’s decision to cut rates for the first time since 2020 has already stirred investor interest. Since the decision, Bitcoin (BTC) has been trading near key resistance levels around $64,000.

Mithil Thakore, CEO and co-founder of Velar, noted that a break above $64,000 could lead Bitcoin to a smoother ascent toward its previous highs of around $74,000. Thakore remarked that major macro factors, including global conflict risks and the US presidential election, could also affect the market.

“Markets don’t like uncertainty. For this reason, shrewd traders will seek to hedge exposure to BTC going into Q4. Given the likelihood of high volatility in the short term, traders who are bullish on BTC would do well to look to the options market and take out calls rather than playing with perpetuals,” he told BeInCrypto.

DeFi Kingdoms Partners with Metis L2 for PvP Game Colosseum Launch

On October 2, DeFi Kingdoms will introduce its Colosseum game on the Metis Layer-2 (L2) network. This major development includes player-versus-player (PvP) private battles, an influence system, and an NFT marketplace. These features are designed to enhance user engagement and promote competitive gameplay.

“Players will be able to stake their Heroes to gain ‘Influence,’ granting them passive rewards and XP! Additionally, players can use their Influence to predict the winners of Bouts and be rewarded!” The DeFi Kingdoms team said.

The partnership with Metis allows DeFi Kingdoms to accelerate the development of PvP features while bringing added rewards in the form of METIS tokens. The team highlighted the long-term advantages, noting that the partnership with Metis would enable them to speed up certain timelines. This includes the timeline for PvP, which they now expect to deliver to their players earlier and with more features than initially planned.

Avalanche to Launch Major Network Upgrade: Avalanche9000

In October, Avalanche will undergo its most significant network upgrade yet, known as Avalanche9000. This upgrade aims to enhance the scalability, security, and performance of the Avalanche blockchain, particularly for developers building Layer-1 (L1) chains.

On its official website, the Avalanche team explained that the upcoming changes will make it easier for developers to customize their blockchain infrastructure. This reduction in technical complexity and economic barriers will enable more projects to launch L1 chains on the blockchain.

Avalanche9000 will also introduce enhanced regulatory compliance options. These options include built-in geo-restrictions and custom permissions, helping projects align with global regulatory standards. The new upgrade will include better support for open and permissionless validator sets, which contributes to increased decentralization and security across the network.

As part of this upgrade, Avalanche is looking to attract more builders to its ecosystem by offering developer incentives and rewards. The upgrade includes access to a testnet environment, where developers can experiment with new ideas and innovations before deploying them on the mainnet.

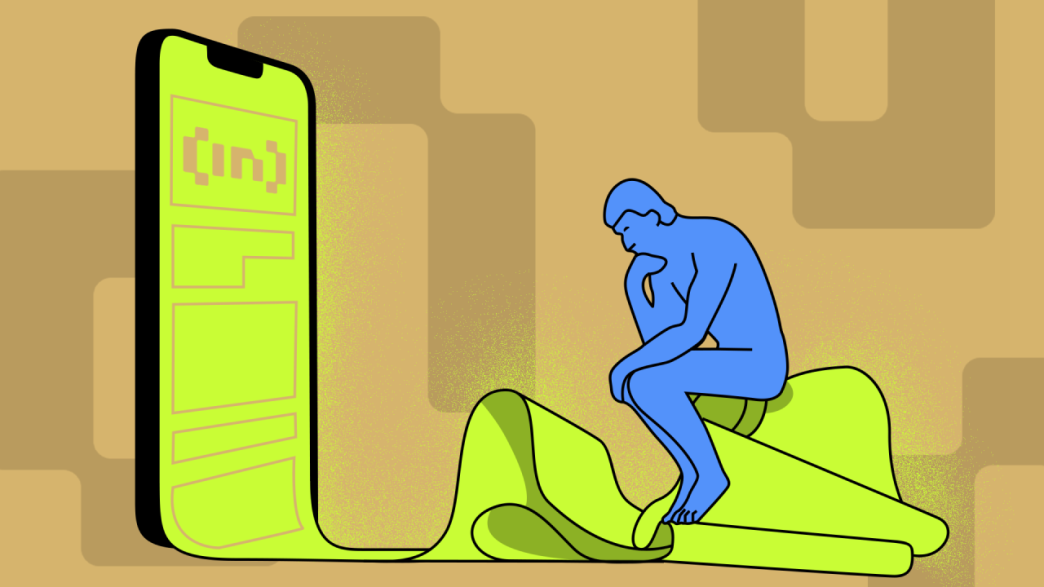

SUI and Other Major Token Unlocks This Week

One of the most significant events this week is SUI’s $100 million token unlock. SUI will release 64.19 million tokens to early contributors and investors, as well as its treasury. This amount represents 2.4% of its circulating supply.

Other notable token unlocks include DYDX, which will release $8.9 million worth of tokens. Similarly, MAV will also unlock $8.47 million in tokens.

Read more: Everything You Need to Know About the Sui Blockchain

Token unlocks often present both opportunities and risks for investors, as the sudden influx of liquidity can trigger volatility. As the week progresses, traders will be closely watching how the market reacts to these token releases. Market participants are advised to stay cautious, as these unlocks could significantly impact short-term prices.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lynn Wang

https://beincrypto.com/top-crypto-market-news-september-30-october-6/

2024-09-30 06:39:05