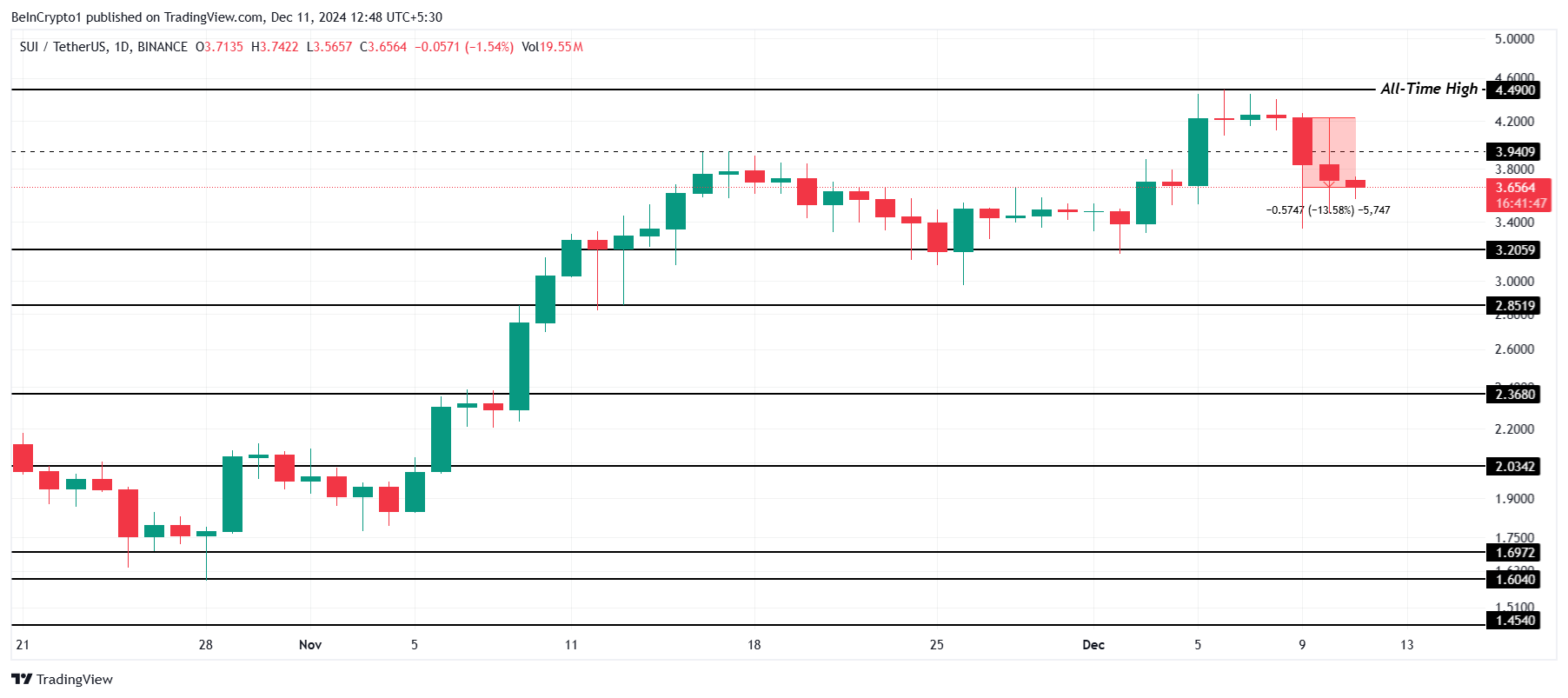

SUI has recently experienced a 13% price drop, which followed a failed attempt to form a new all-time high (ATH).

Despite an initial surge that created some optimism among traders, the altcoin’s correction has led to uncertainty in the market, causing traders to withdraw their support. This shift in sentiment is contributing to volatile price action.

SUI Faces Challenges

The market sentiment around SUI has significantly weakened, as evidenced by a dramatic decline in Open Interest. The value of open positions on SUI futures has dropped by $248 million, falling from $923 million to $675 million.

This sharp decrease indicates that many investors are pulling their money out, reflecting the rising uncertainty surrounding SUI’s price trajectory. As traders lose confidence, the potential for further declines increases.

Technical factors also suggest that a period of consolidation is imminent. Investors appear hesitant to commit to their positions, with uncertainty clouding SUI’s potential for a strong recovery. The lack of fresh capital influxes further exacerbates the situation, reinforcing a cautious market outlook.

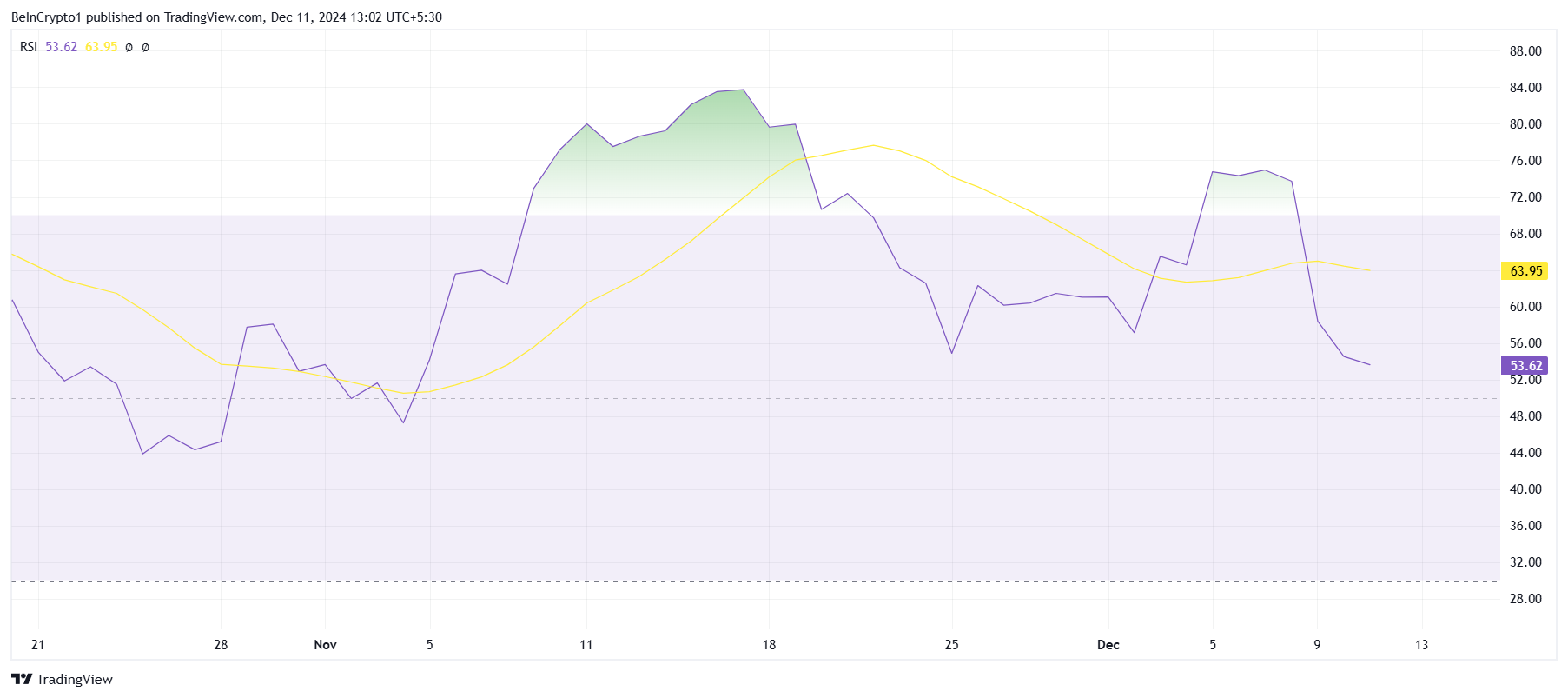

Despite the bearish price action, some indicators suggest that the bullish momentum for SUI hasn’t completely dissipated. The Relative Strength Index (RSI) is currently holding above the neutral line, indicating that the asset isn’t entirely oversold. While this may signal that there is still some underlying buying interest, it also reflects the mixed market sentiment, which is hindering a decisive direction.

At this stage, the RSI presents conflicting signals. On the one hand, it suggests the possibility of a rebound if buying pressure returns. On the other hand, the inability to break key resistance levels could continue to weigh on SUI’s price, contributing to sideways movement or additional corrections.

SUI’s price is currently facing uncertainty, with a potential for sideways momentum as key indicators reflect mixed signals. Despite recent volatility, the cryptocurrency remains constrained by support and resistance levels. Investors are closely watching for a breakout, as a clearer trend could emerge once price action stabilizes.

SUI has dropped by 13.5% over the last 48 hours, now trading at $3.65, not far from its all-time high of $4.49. The cryptocurrency appears poised to remain consolidated above the key support at $3.20. This consolidation could persist as traders await clearer market signals before making larger commitments.

Should SUI manage to reclaim $3.94 as a support level, a rebound toward the ATH of $4.49 becomes likely. This would invalidate the bearish-neutral thesis and provide a fresh, bullish outlook. Investors should monitor this level closely, as a successful bounce could signal a renewed upward momentum.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/sui-open-interest-drops-after-price-fall/

2024-12-11 09:00:00