SUI price has just reached a new all-time high, climbing more than 69% in the last seven days. The recent surge is backed by strong technical indicators, including bullish EMA lines and a recovering BBTrend.

With Total Value Locked (TVL) also hitting new records, SUI shows signs of solid investor interest and usage growth.

SUI TVL Reached A New All-Time High

SUI’s Total Value Locked (TVL) has just reached an all-time high of $1.36 billion, showing a significant increase in investor confidence and usage of the chain.

Total Value Locked (TVL) represents the total amount of assets staked or locked in a blockchain’s smart contracts. It is a crucial metric that measures a platform’s health and adoption, as higher TVL indicates more user engagement and confidence in the platform’s security and potential.

SUI first reached $1 billion in TVL on September 30, and since then, its growth has stabilized. After a period of consolidation, it appears to be ready to reach new highs, as it has been doing in the last few days.

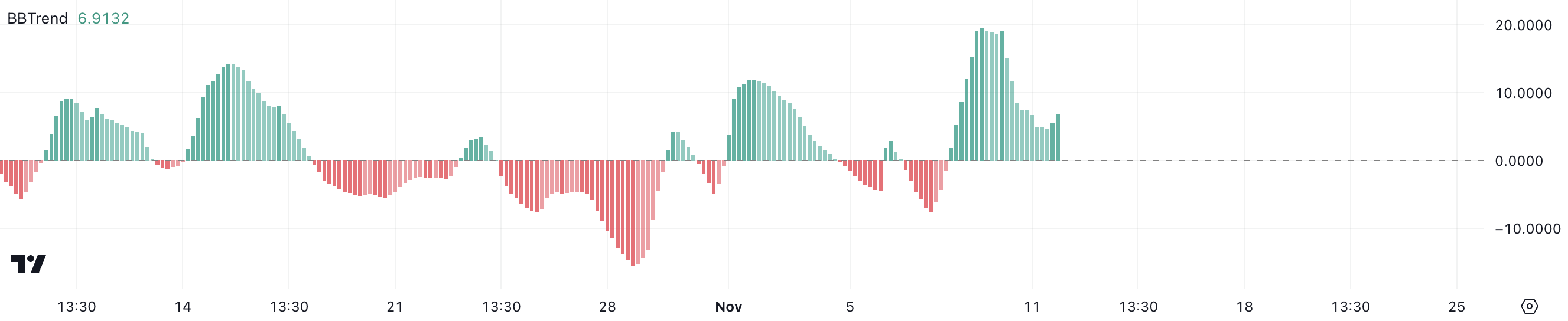

SUI BBTrend Is Recovering

SUI’s BBTrend has remained positive for three consecutive days, during which its price has surged by 37%. This consistent positive trend indicates that bullish momentum has been building up steadily, supporting the recent price growth.

The BBTrend’s ability to stay positive during this period suggests that strong buying interest is driving SUI’s upward movement.

BBTrend, or Bollinger Band Trend, is a momentum indicator used to assess the direction and strength of an asset’s price movement relative to its Bollinger Bands. A positive BBTrend value indicates that the price is gaining upward strength, while a negative value suggests a downtrend.

On November 10, SUI’s BBTrend peaked at 19.17 before experiencing some hours of decline. However, the indicator appears to be gaining traction again, currently standing at 6.95, which implies renewed bullish momentum as buyers return to support the price.

SUI Price Prediction: A New All-Time High Soon?

SUI recently hit a new all-time high of $3.27, fueled by strong bullish momentum reflected in its EMA lines. The alignment of these exponential moving averages suggests that the uptrend could continue, potentially driving SUI to even higher levels.

If the BBTrend continues its recent recovery and the TVL also reaches new peaks, these factors could collectively push SUI to set new all-time highs.

However, if the current uptrend weakens, SUI price could face a significant reversal. The nearest strong support zone is at $2.21, which could act as a safety net if the price begins to decline.

Should this support fail to hold, SUI may face a deeper correction to $1.96, representing a potential 37.9% drop from current levels.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/sui-price-new-all-time-high/

2024-11-12 05:00:00