World Liberty Financial (WLFI) is partnering with Sui, adding the token to its “Strategic Reserve.” The two companies plan to work on development opportunities, and Sui’s price has risen 15%.

WLFI is a Trump-affiliated project, but it is completely distinct from the federal government. Its token stockpile may bear a similar name to Trump’s US Crypto Reserve, but investors should be aware that there is no direct connection.

World Liberty Financial to Add SUI In Its Portfolio

Sui, a proof-of-stake network, is currently the 9th largest blockchain in terms of total value locked (TVL). After a successful period at the end of 2024, its token value began sinking in January.

SUI reached an all-time high in early January but has dropped over 50% since then. However, today’s partnership with Donald Trump-affiliated World Liberty Financial has brought back bullish momentum for the altcoin.

“World Liberty Financial has chosen to partner with Sui as their preferred American blockchain. WLFI recognizes what we’ve been building, a blockchain designed for the future of finance that’s fast, secure, and accessible. That’s why our teams are in advanced talks for deeper integration,” claimed Christian Thompson, Sui’s Managing Director.

This partnership will include a few important components. First, WLFI is adding SUI tokens to its treasury as part of the firm’s “Macro Strategy” token reserve.

This is the first step in a broader plan of integration, exploring new development applications. Already, this news has been bullish for Sui, causing a 15% price spike.

Meanwhile, there has been some confusion in the crypto community about what is going on. WLFI is a Trump-affiliated project, and Sui used the phrase “Strategic Reserve” in the headline for its press release and social media.

To be clear, this partnership is completely distinct from Trump’s US Crypto Reserve, which he announced recently.

However, future cooperation here is not completely implausible. Trump wishes to use “Made in USA” crypto projects to fill the Reserve, and Sui certainly qualifies.

If the President ever expands the list of assets in the Reserve, Sui’s cooperation with WLFI may help it make the cut.

At the moment, however, a Sui deal like that is not within WLFI’s power to execute. If the two companies form a solid working relationship, Sui may build its reputation in Trump’s circle, increasing its chances.

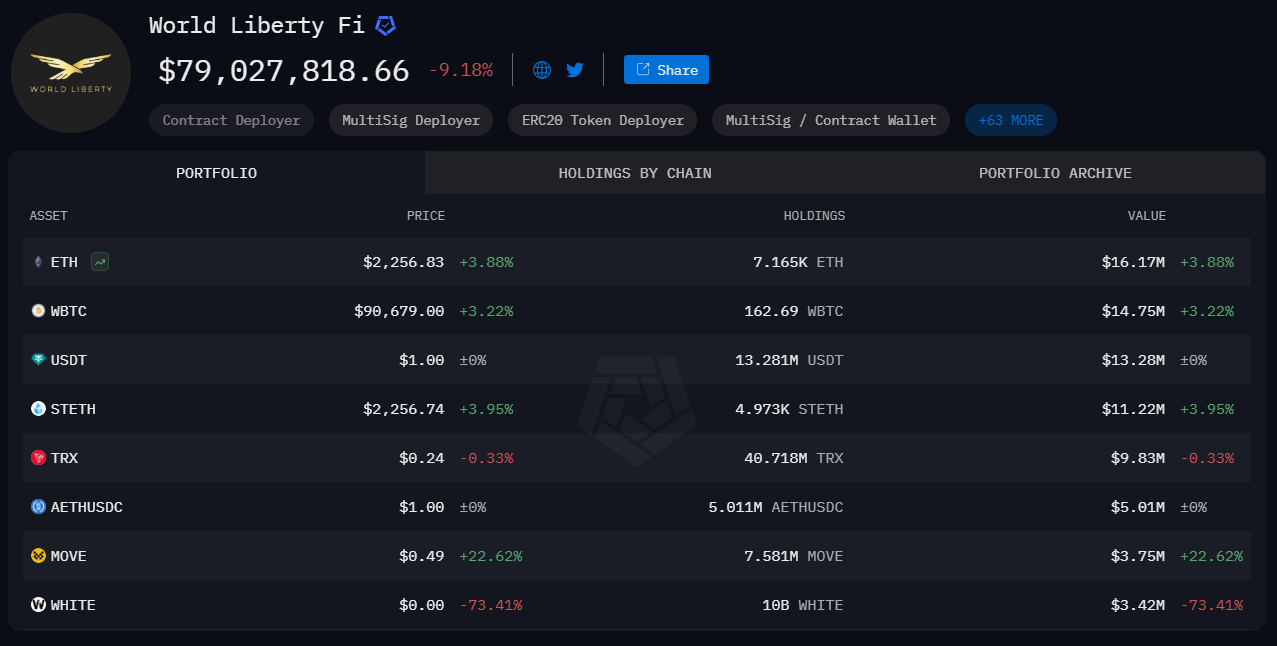

Nonetheless, WLFI’s “Strategic Reserve” has nothing to do with the federal government, and investors should be aware. As of today, WLFI’s portfolio includes over 20 different cryptocurrencies. The majority of the holdings are in Ethereum, Wrapped Bitcoin, USDT, Tron’s TRX, and MOVE.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Landon Manning

https://beincrypto.com/sui-partners-with-world-liberty-financial/

2025-03-06 15:54:06