Layer 1 blockchain protocol Sui (SUI) has made headlines recently, recording an impressive 120% increase over the past 30 days, allowing the protocol’s native token SUI to outperform the top 10 largest cryptocurrencies on the market, culminating in a new all-time high of $2.35 on October 13.

However, since this peak, the token has retreated by nearly 5%, largely due to growing concerns over allegations of insider selling among the project’s stakeholders.

Can SUI Match Solana’s Success?

Market expert LightCrypto took to social media platform X (formerly Twitter) on Sunday to express his skepticism about the sustainability of SUI’s recent gains. In a lengthy post, he noted SUI’s substantial rise, which has quintupled from its previous lows of $0.5 on August 5, amid the broader market crash that occurred that day.

While the market appears to be eager for new winners, with macroeconomic conditions pointing to further price gains, LightCrypto raised two critical points that could undermine SUI’s upward trajectory.

Related Reading

Firstly, the expert questioned the rationale behind SUI’s current $23 billion fully diluted valuation (FDV), particularly when compared to Solana’s $73 billion according to Coingecko data.

LightCrypto argued that it no longer makes sense to assume SUI can replicate Solana’s success, especially given that it currently trades at just a quarter of Solana’s market valuation.

The expert further challenged the community to articulate a compelling risk-reward scenario that justifies such a disparity, asking whether SUI has demonstrated even a fraction of Solana’s potential.

Potential Market Correction Looms

Secondly, LightCrypto alleged the worrying trend of insider selling, indicating that insiders, including what is believed to be a large endowment fund, have dumped around $400 million in tokens during the recent rally.

The expert noted that this selling trend has not only occurred at higher price levels, but has also been ongoing since much lower valuations.

Ultimately, LightCrypto believes that the acceleration of these sales may create a disconcerting atmosphere for retail investors, who may be buying tokens from those best informed about their true value.

Related Reading

The implication is stark: as these supposed insiders cash out while retail investors chase momentum, the potential for a market correction looms large, potentially threatening the token’s current rally.

Despite these allegations, SUI, currently trading at $2.24, continues to see significant investor interest in the token, with trading volume up 36% in Sunday’s session, valued at approximately $1.7 billion.

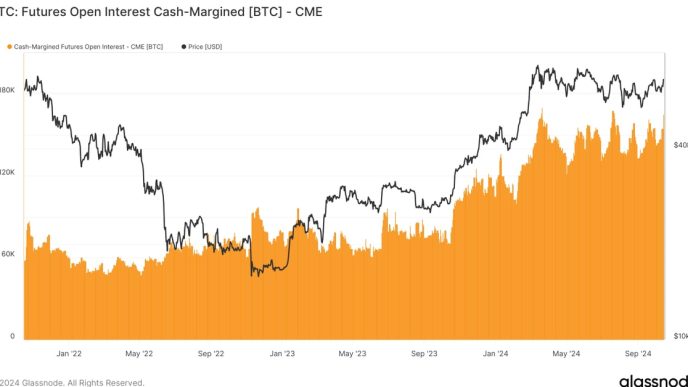

Furthermore, regardless of LightCrypto’s troubling findings, corrections are normal after a token hits a new record high, with the clear example of Bitcoin (BTC), which has been unable to come close to that level since hitting a new record high of $73,7000.

What is certain is that if the expert’s claims prove to be true, it could further exacerbate a potential correction in the SUI price, with the first major support level for bulls being the $2.046 area.

Featured image from DALL-E, chart from TradingView.com

Source link

Ronaldo Marquez

https://www.newsbtc.com/sui/sui-records-substantial-120-price-surge-but-insider-selling-claims-raise-red-flags/

2024-10-15 11:00:34