SUI, the native token of the Sui Network, has seen a 13% pullback in the past seven days, halting its bullish rally. The cryptocurrency broke from a 1-month structure, fueling a bearish sentiment among market watchers, who foresee further downside for the token.

Related Reading

SUI Loses Key Support Zone

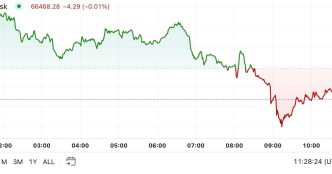

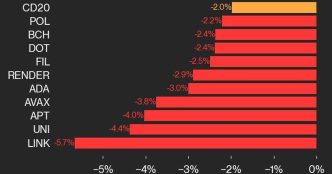

SUI has been on a downtrend this week, losing the recently gained levels alongside most of the market. The cryptocurrency saw a 5.3% drop in the last 24 hours, which has worried some investors and crypto analysts.

The token registered one of the best performances during Q3, leading the market as one of the few altcoins registering green numbers in most timeframes. SUI started the month by recording a 15% weekly surge, which fueled its rally toward its new all-time high (ATH).

Additionally, the token jumped 25% from its monthly opening, shooting past the $2 barrier to reach a new ETH of $2.35. However, its bullish rally was overshadowed by insider selling allegations on October 13.

Market expert LightCrypto alleged that SUI’s performance would be affected by insiders’ continuous selling, who had unloaded $400 million in SUI tokens.

Following the allegations, the cryptocurrency faced a 15% daily correction but remained above the crucial $2 support level. Since then, the cryptocurrency has moved sideways, hovering between the $2-$2.15 price range until today.

On Tuesday morning, SUI lost the $2 support, plunging 6.5% toward the $1.87 mark before recovering the $1.90 zone. The token’s dip represented a 13% decline from its price seven days ago and an 18.4% drop from its ATH.

Is A 30% Pullback Looming?

Following SUI’s recent price action, some crypto analysts revealed that another pullback seems to be looming. Crypto analyst Altcoin Sherpa weighed in on the markets’ current performance, as it slowed down after Bitcoin’s surge to $69,000 on Sunday.

Sherpa considers the market’s rally momentarily paused, highlighting that “most alts are either pulling back or consolidating.” To him, the tokens that recorded a strong run in September, including Bittensor (TAO) and SUI, have “a bit more pullback to go” before resuming their rally.

The analyst forecasted a 25% to 30% correction toward the $1.4 support zone or lower, detailing that there will probably be “plenty of bounces” along the way. Similarly, crypto investor Doji noted that the cryptocurrency broke “a massive 1-month stricture to the downside.”

Related Reading

The investor revealed that the token dropped below the lower trendline of a broadening wedge pattern on its 1-month chart. Doji suggested that SUI will retest the pattern before dropping lower toward the lower liquidity spot at $1.4. Nonetheless, he expects “to see the middle of the macro range at some point.”

Despite the drop, SUI registers a 30.7% surge in the monthly timeframe, trading at $1.92 at the time of writing.

Featured Image from Unsplash.com, Chart from TradingView.com

Source link

Rubmar Garcia

https://www.newsbtc.com/news/sui-to-face-another-pullback-following-5-3-dip-analysts-forecast-30-correction/

2024-10-23 12:00:47