The stablecoin industry will have to weather significant losses in interest income following the Federal Reserve’s latest rate cut, a new report from CCData shows.

In its latest report on stablecoins and central bank digital currencies (CBDCs), the digital asset data and index provider notes that the vast majority of the top five stablecoin issuers’ reserves are in US Treasury Bills, making interest rates a critical aspect of their business model.

With lower interest rates and thus lower yielding T-Bills, the firm estimates a loss of about $632 million for the big stablecoin issuers.

“With the top five centralized stablecoins holding combined US Treasury Bills of nearly $125bn, accounting for nearly 80.2% of their reserves, the recent Federal Reserve decision to cut interest rates for the first time since March 2020 is set to result in $625mn in lost annual interest income for each 50 bps (basis points) cut.

Based on their latest attestation reports, Tether holds nearly $93.2bn in US Treasury bills and repurchase agreements, which contributed to the majority of $5.2bn net profit in H1 2024. The second largest stablecoin, USDC holds $28.7bn worth of US Treasury bills via their Circle Reserve Fund, while FDUSD, PYUSD and TUSD hold US Treasury assets worth $1.83bn, $634mn, $502mn respectively.”

Tether (USDT), the leading stablecoin issuer, has invested more than $112 million into an agroindustrial company that started in Argentina in an apparent move to diversify its investments. In Q4 of 2023, much of Tether’s record-breaking profit was due to yield on its US government bond holdings.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

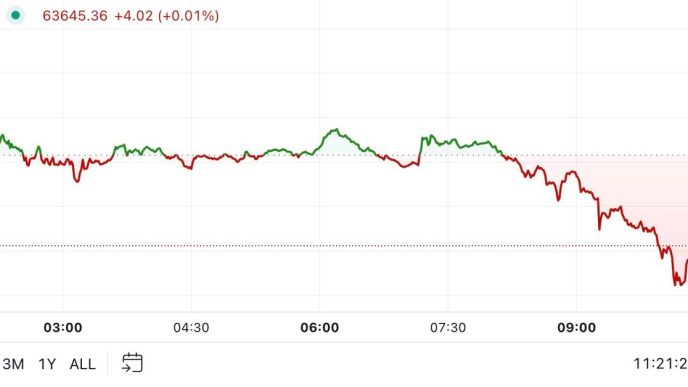

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shuterstock/Terablete/Skorzewiak

Source link

Alex Richardson

https://dailyhodl.com/2024/09/30/tether-and-four-other-stablecoins-set-to-lose-625000000-in-interest-income-following-fed-pivot-ccdata/

2024-09-30 11:45:57