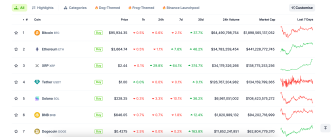

Cardano (ADA) has surged by double digits over the past week, reaching $1.15 — a price last seen in April 2022. This rally is fueled by reduced selloffs from long-term holders and increased accumulation by large investors.

With growing bullish momentum, ADA could see further gains in the near term. Here’s why.

Cardano Long-Term Holders and Whales Join Forces

November’s 217% surge in Cardano’s price sparked the movement of previously dormant tokens, as reflected in its declining Mean Coin Age over the 30-day period.

This metric measures the average “age” of all coins in an asset, weighted by their holding duration. When it declines, it suggests increased on-chain activity, as previously idle coins are being spent or transferred, mostly for profit.

However, over the past week, this trend has shifted. Per Santiment, ADA’s Mean Coin Age has been in an upward trend, indicating network accumulation. This reduced selloff from ADA long-term holders has led to a 10% rise in value in the past seven days.

Additionally, ADA whales or large investors have increased their holdings during the period in review. On-chain data shows that ADA addresses holding between 100 million and 1 billion coins have collectively acquired $276 million worth of ADA over the past seven days.

When whales increase their holdings, it signals confidence in the asset’s future price movement, potentially driving further market demand. This accumulation can lead to price appreciation due to reduced circulating supply, as whales hold a larger portion of the total supply.

ADA Price Prediction: New Highs Remain Within Reach

On a daily chart, Cardano’s Elder-Ray Index confirms the bullish bias toward the altcoin. At press time, the indicator’s value is 0.31.

This measures the strength of a trend by comparing the buying and selling pressure in the market. When it is positive, it indicates that buying pressure outweighs selling pressure, suggesting a bullish market trend. If this trend continues, ADA will extend its gains and climb toward $1.30, a price it last traded at in January 2022.

On the other hand, an uptick in coin distribution will cause a decline to $1.09. Should the bulls fail to defend this price level, the Cardano coin price value will slip under $1 to trade at $0.92.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/cardano-price-multi-month-high/

2024-12-02 08:30:00