Popular meme coin Pepe (PEPE) experienced a 12% price surge on Tuesday following Elon Musk’s move on X. He changed his display name to “Kekius Maximus” and adopted the Pepe the Frog avatar, referencing the online game Path of Exile.

However, this initial excitement has turned out to be short-lived. As the hype surrounding Musk’s actions begins to subside, PEPE has already started to shed some of its recent gains.

PEPE’s Short-Lived Rally: No Thanks to Elon Musk

On Tuesday, tech billionaire Elon Musk gave his X profile a new makeover, adopting the moniker “Kekius Maximus.” Musk replaced his profile picture with the ‘Pepe the Frog’ meme along with the new name, reimagining the character as a warrior clad in armor and wielding a video game joystick.

This move led to a surge in optimism around the PEPE meme coin, which drove its value by 12% during the trading period. However, this initial excitement appears short-lived, as the meme coin has initiated a decline. Over the past 24 hours, its value has decreased by 4%.

During that period, PEPE’s trading volume has rocketed by 31%. When an asset’s price declines while its trading volume surges, it may indicate increased selling pressure as more participants look to exit their positions. It signals that the price growth is driven by mere market speculation and not by actual demand for the asset and, therefore, not sustainable.

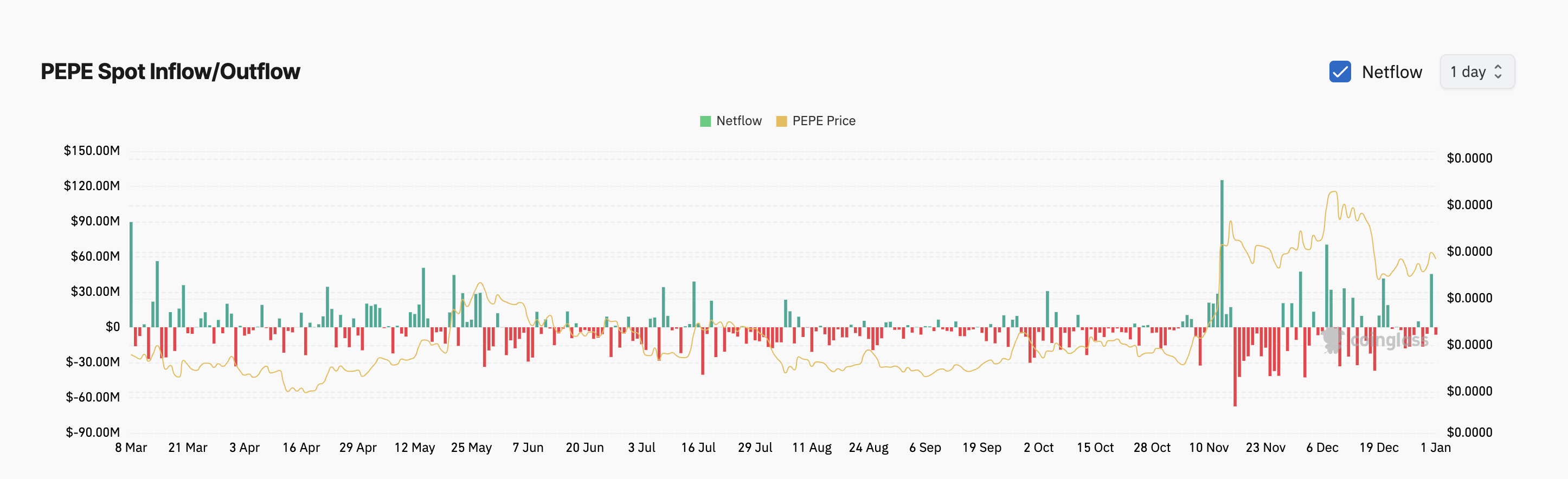

Moreover, the surge in PEPE’s spot outflows further reinforces this bearish outlook. According to Coinglass, over the past 24 hours, $6.34 million has been withdrawn from the spot market. This stands in stark contrast to the $45 million in PEPE inflows recorded on Tuesday.

When an asset experiences spot outflows, it means more of the asset is being sold or withdrawn from the market than bought. This signals a decrease in demand as investors or traders are moving their holdings away from the asset.

PEPE Price Prediction: Meme Coin Price May Fall to $0.0000017

On a daily chart, PEPE’s Super Trend Indicator rests above its price, confirming the decline in demand. This indicator tracks the direction and strength of an asset’s price trend. It is displayed as a line on the price chart, changing color to signify the trend: green for an uptrend and red for a downtrend.

When an asset’s price falls below the Super Trend line, it indicates bearish momentum in the market. This line acts as a resistance level, making it challenging for the price to break above.

For PEPE, this resistance is at $0.000024. If the downtrend continues, the PEPE meme coin price could drop to $0.0000017.

On the other hand, PEPE’s price may attempt to breach the $0.000024 resistance level. If successful, it could reclaim its all-time high of $0.000028.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/pepe-hits-roadblock-musk-effect-diminishes/

2025-01-01 13:00:00