TL;DR

- Cardano’s price soared to as high as $1.17, with market cap surpassing $40 billion amid bullish network indicators.

- 73% of ADA investors are now in profit, a sharp recovery from August’s lows when the majority of the token’s holders were underwater.

ADA Heads North

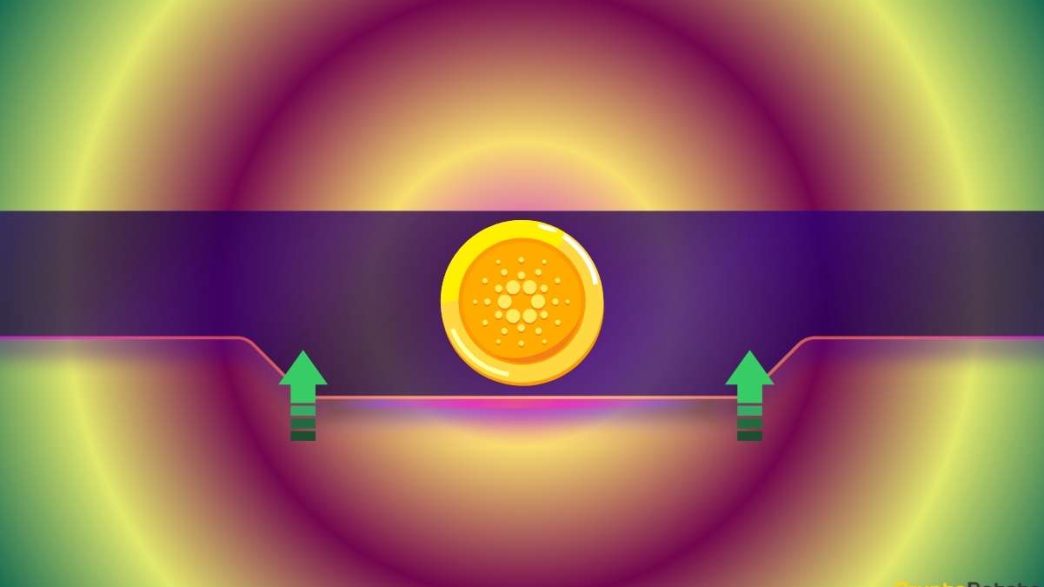

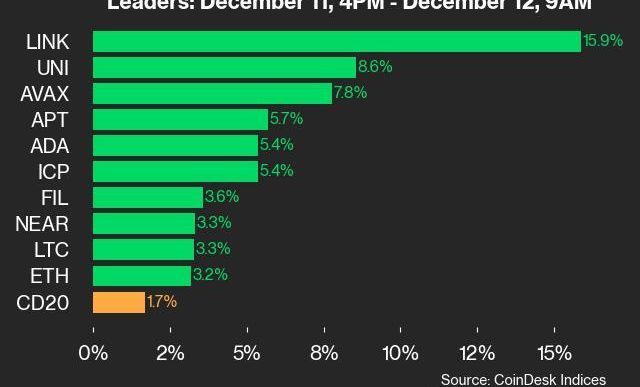

The cryptocurrency market experienced a notable recovery in the past 24 hours, with multiple leading digital assets charting impressive gains. Bitcoin (BTC), for instance, jumped above $100,000 again, while Ethereum (ETH) is inching toward the $4K level.

Cardano’s ADA is also one of the best performers, with its price pumping by almost 15% on a daily scale. At one point, the valuation reached $1.17 before stabilizing at its current $1.14 (per CoinGecko’s data). Meanwhile, ADA’s market capitalization surged above $40 billion, solidifying the asset’s presence among the top 10 biggest cryptocurrencies.

Its most recent resurgence aligns with three bullish indicators. The first one is “Net Network Growth,” which, according to IntoTheBlock, has risen by 0.26% daily. The platform explains that the metric is a momentum signal “that gives a pulse of the true growth of the token’s underlying network.”

Next on the list is “Concentration” (an indicator that measures daily changes in the positions of whales holding over 1% of the circulating supply and investors owning between 0.1% and 1%). The metric has climbed by 0.26%, entering the bullish zone.

Last but not least, we will discuss “Large Transactions” (a technical tool showing the number of transactions greater than $100,000). The figure has risen by 0.52%, suggesting increased network activity.

We recently released a video with some of the major developments surrounding Cardano. Check it out here:

ADA Investors in the Green

Contrary to the aforementioned bullish elements, one is in bearish territory. This is the “InTheMoney” indicator, which displays the change in the number of ADA investors currently sitting on paper profits.

As of writing these lines, 73% of all people exposed to the asset are in the green, 16% are underwater, and 11% are break-even. Despite the slight retreat, the percentage of profitable investors remains much higher than what was observed at the start of August this year.

Back then, almost nobody holding ADA was sitting on paper profits due to the token’s crash below $0.30. At that point, a whopping 87.6% were in the red, while approximately 12% were break-even.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Source link

Dimitar Dzhondzhorov

https://cryptopotato.com/cardano-ada-jumps-by-15-daily-these-3-bullish-factors-suggest-a-further-rally/

2024-12-12 14:24:11