Ethereum co-founder Vitalik Buterin revealed plans to donate all proceeds from Layer 2 (L2) and related project tokens that he holds. His interest lies in supporting public goods within the Ethereum ecosystem or charitable activities.

Buterin’s recent transactions have come under scrutiny with varied opinions between sales and donations.

Vitalik Buterin Supports Growth

The Ethereum executive’s remarks stemmed from discussions about founders’ interactions with their projects’ tokens. More precisely, his Ethereum transactions over the past weeks raised concerns about whether he was selling ETH.

Buterin denied keeping proceeds from any sales over the past six years. He said all profits go toward supporting value-adding projects within Ethereum’s ecosystem and beyond.

“BTW the above also applies to L2 tokens or other project tokens I hold (incl not-yet-liquid): all proceeds will be donated, again either to support public goods within the Ethereum ecosystem or broader charity (e.g. biomedical R&D),” Buterin explained.

Further, Buterin does not intend to invest in L2s or other projects any time soon, committing to supporting undervalued projects. His chosen approach to empower these projects is through donations.

Indeed, Buterin has made multiple donations recently. BeInCrypto reported that some of them were sent through Multisig wallets, as traced on Etherscan.

Read More: How To Donate Crypto Using The Giving Block

Among Buterin’s most outspoken donations include 100 ETH (valued at $300,000 at the time) in support of the 2077 Collective, a group dedicated to promoting Ethereum adoption. The Russo-Canadian innovator also donated 30 ETH to the legal defense of Tornado Cash developers Alexey Pertsev and Roman Storm in May.

Meanwhile, Buterin’s move to sidestep L2 investments should not be considered an action against the increasingly popular scaling solutions. He challenged attacks against Ethereum’s L2s barely a week ago amid allegations from cyber security experts that the network’s Layer-2 solutions can unilaterally seize users’ funds.

“A major nuance: the rules for stage 1 require that only a security council with >= 75% vote threshold can overrule the code, and a quorum blocking (ie. >= 26%) subset needs to be outside the company. OP and ARB both comply with this. So the orgs cannot unilaterally steal funds,” Buterin wrote.

Layer 2 Chains Are Important

L2s solve challenges concerning network congestion, particularly during peak periods. They aim to solve high transaction fees, increase speed, and poor user experience, weaknesses associated with Layer 1 (L1) blockchains. L2s also improve scalability, effectively enhancing the network’s capacity to handle more transactions per second while maintaining security.

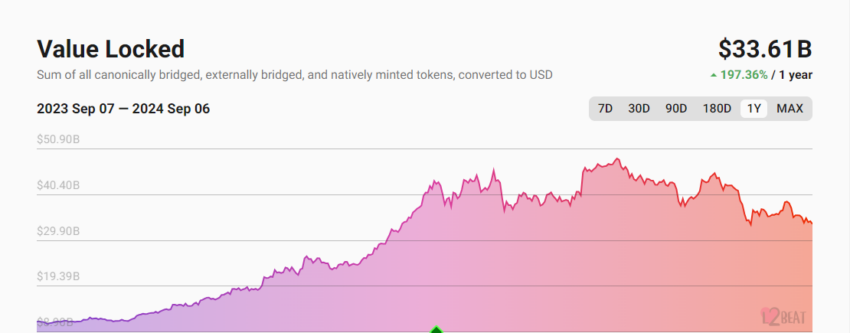

Data on L2Beat shows that the total value locked in Ethereum L2 networks exceeded $33 billion as of September 6. This marks a 197% increase due to key adjustments over the years.

Read more: Layer 1 vs. Layer 2: What Is the Difference?

This growth reflects the impact of these scaling solutions in driving adoption. Coin98 Analytics reported that Base L2, an Ethereum scaling solution, recorded the highest total unique addresses among popular blockchain platforms. It added a stark 15.97 million users between August and September.

The surge in unique addresses mirrors the increasing acceptance and recognition of L2 solutions as viable alternatives to traditional blockchain platforms.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lockridge Okoth

https://beincrypto.com/altcoins-vitalik-buterin-will-donate/

2024-09-06 10:49:46