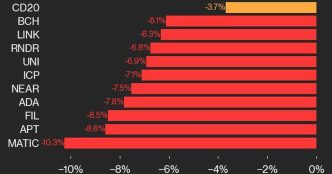

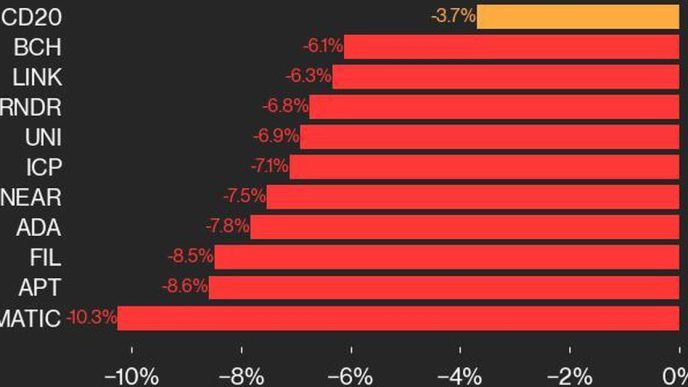

Cardano (ADA) price has struggled to recover its losses from the end of July, with the altcoin failing to breach the $0.39 resistance level.

While this ongoing price action presents a bullish opportunity for some short-term investors, it could lead to a bearish scenario for the broader market. Without a clear breakout, Cardano’s price remains under pressure, increasing the likelihood of further declines.

Cardano Holders Can Yield Gains

Cardano’s Market Value to Realized Value (MVRV) Long/Short Difference is flashing bearish signs, currently sitting at -20%. This indicator is used to gauge the profit possibility for either long-term or short-term holders.

Highly negative values point to profits for short-term holders. On the other hand, positive values suggest long-term holders are profitable. In the case of Cardano, this indicator suggests that short-term investors are more likely to realize profits than long-term holders.

While this may initially seem bullish, it is, in fact, a negative signal for the market. Short-term holders are more prone to selling. As short-term investors look to capitalize on their gains, Cardano’s price could face further declines.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

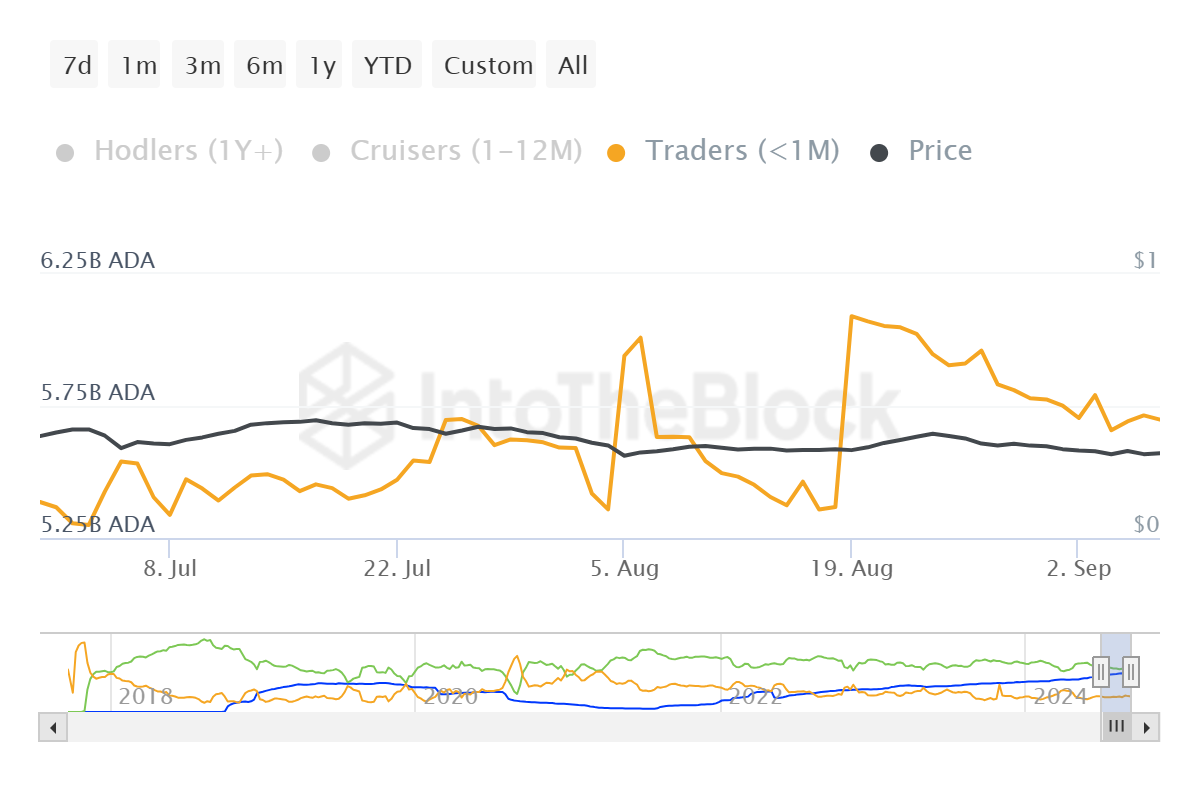

Short-term investors currently hold around 5.7 billion ADA, valued at over $1.9 billion. These addresses tend to hold for less than a month, making them more likely to sell quickly. If a significant portion of this supply is sold, it could trigger a substantial price drop for Cardano, amplifying the already bearish momentum.

The large concentration of ADA held by short-term investors adds to the risk of a rapid sell-off. Thus, the macro momentum, driven by short-term market participants, continues to weigh heavily on ADA’s outlook.

ADA Price Prediction: Consolidation Ahead

Cardano is currently trading at $0.33, consolidating between $0.31 and $0.39. This range has kept the altcoin from breaking out, and the consolidation suggests ADA is unlikely to see significant upward movement in the short term.

Broader market conditions are not favorable, leaving short-term holders profitable and poised to sell. ADA could lose support at $0.31 if selling begins, leading to a considerable decline.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

However, if short-term investors choose to hold rather than sell, Cardano could still have a chance at a bullish outcome. This scenario would be confirmed if the $0.39 resistance is breached and flipped into support, invalidating the current bearish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/cardano-investors-realize-2-billion-profit/

2024-09-16 13:00:00