Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The Bitcoin price could be headed for more pain, as a crypto analyst has identified a new bear market indicator that suggests a crash to $40,000 is imminent. The analyst has predicted when this deep price decline is set to occur, warning investors to remain cautious or risk selling at a loss.

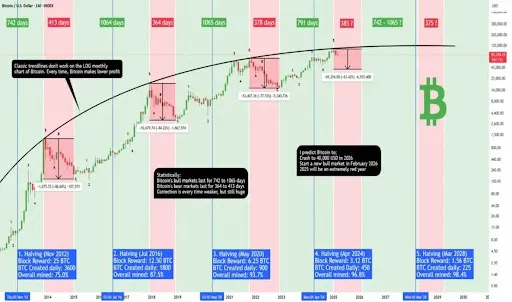

Xanrox, a crypto analyst on TradingView, shared a detailed price analysis of Bitcoin on March 17, predicting that the pioneer cryptocurrency is set to crash to $40,000 by 2026. The analyst revealed that Bitcoin follows a predictable cycle pattern tied to its halving events, which occur every four years. During these years, the market alternates between bull markets, where prices skyrocket, and bear markets, marked by severe corrections.

Bear Market Indicator Predicts Next Bitcoin Price Crash

Related Reading

In every cycle, Bitcoin’s price crashes after a bull market, ultimately experiencing a decline between 77% to 86%. Reflecting on this recurring trend, Xanrox forecasts a major Bitcoin price correction, albeit a weaker one than those of previous cycles. The analyst believes that the cryptocurrency will crash 65% to $40,000, citing its significantly larger market capitalization and rapidly growing institutional adoption.

He shared a price chart that highlights the various halving cycles and the magnitude of each bull market rally and bear market crash since Bitcoin’s inception. He pointed out that statistically, predicting Bitcoin’s movements with a simple chart has always been accurate, suggesting that his 65% crash prediction was inevitable.

Currently, Bitcoin’s considerable market capitalization of $1.63 trillion makes it unrealistic to achieve the extreme growth needed to reach a target of $300,000, $500,000, or even $1 million, as some moon analysts predict. Xanrox suggests that 2025 may be a bearish year, with the next Bitcoin bull run set to begin in 2026, after the bear market.

CryptoQuant Says BTC Bull Cycle Is Over

Sharing a similar bearish sentiment about the current market, CryptoQuant’s founder and Chief Executive Officer (CEO), Ki Young Ju, has announced the unfortunate end of the Bitcoin bull cycle. Ju revealed that the market should expect 6 – 12 months of choppy price action, indicating the start of the bear market.

Related Reading

He also highlights that every on-chain metric for Bitcoin is signaling a bear market, with fresh liquidity depleting while new whales are selling BTC at a significantly lower price. Moreover, Bitcoin is trading at $82,549, marking an over 20% price crash since its all-time high of more than $109,000 this year.

Featured image from Unsplash, chart from Tradingview.com

Source link

Scott Matherson

https://www.newsbtc.com/news/bitcoin/bitcoin-price-crash-to-40000-2/

2025-03-18 21:00:58

#Bloomberg dropped BOMBSHELL

#Bloomberg dropped BOMBSHELL