A few days ago, Cardano’s (ADA) price slipped to $0.32, bringing the altcoin’s year-to-date performance lower. However, as of this writing, an approximate 5% increase has helped ADA revisit $0.35.

Despite the recent price increase, Cardano remains in 11th place in terms of market capitalization. This on-chain analysis explains what must happen for the project to have a shot at regaining its previous position.

Cardano Needs This to Bounce Tron Off

On August 20, BeInCrypto reported that Cardano had fallen out of the top 10 cryptocurrencies due to a notable price surge in Tron (TRX) and rising demand for its native token. ADA, on the other hand, hadn’t seen such growth until the recent broader market uptick.

Market capitalization is determined by price and circulating supply, so for Cardano to regain its position above Tron, its value would need to increase. However, according to the In/Out of Money Around Price (IOMAP) indicator, this may not be straightforward. The IOMAP tracks the average on-chain cost of acquiring tokens compared to the current price.

This tool can identify the number of addresses at break-even, in profit, or holding at a loss. It also uses this data to detect key support and resistance levels. Essentially, the more addresses clustered around a certain price range, the stronger the support or resistance at that level.

As seen above, the number of addresses that purchased ADA between $0.33 and $0.35 is not up to the 155,800 addresses that accumulated 2.24 billion tokens at $0.38. These tokens, which are out of the money, are worth about $850 million.

Therefore, for ADA to have a shot at taking back the number 10 spot, its price has to reach $0.38 or break this resistance. At press time, Cardano’s market cap is $12.90 billion, while Tron’s is $13.84 billion.

If ADA’s price hits $0.38, its market capitalization will be worth $14.11 billion, and Tron might be pegged back if the latter’s market price stalls.

Token Overvalued Ahead of Upcoming Upgrade

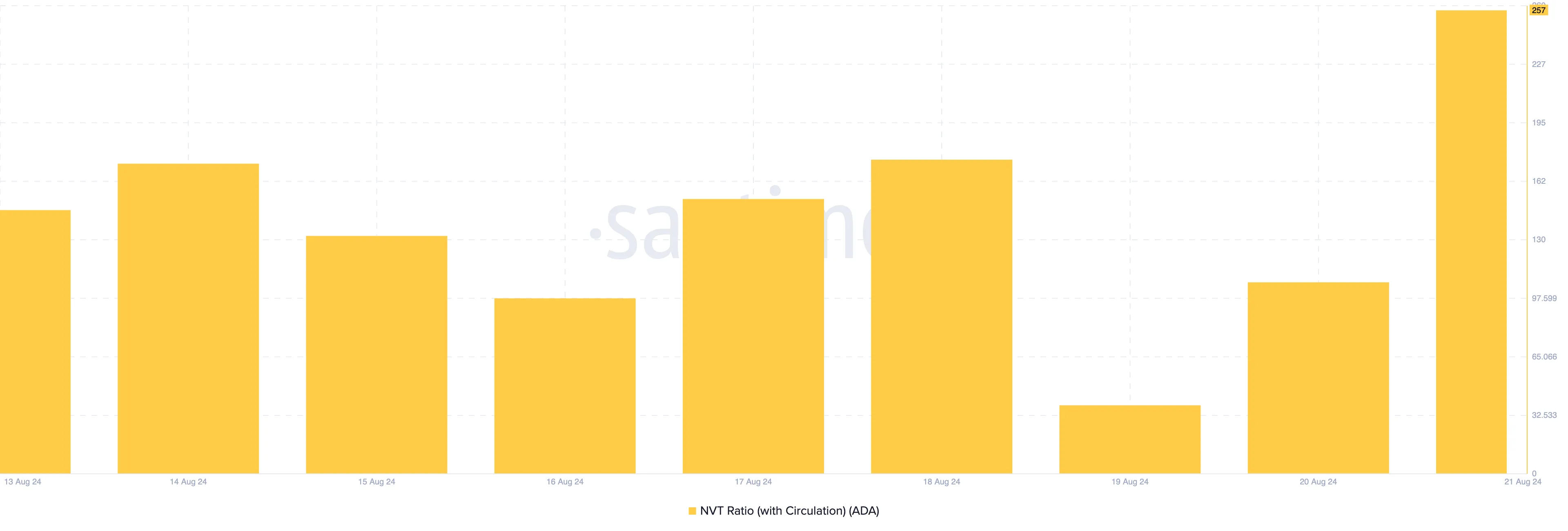

Despite the current ADA’s price, on-chain data reveals that it might be unjustifiably inflated. This is due to the indications from the Network Value to Transaction (NVT) ratio, which shows whether a cryptocurrency’s market cap is outpacing the transaction volume.

When the NVT ratio is high, it means that the market cap outweighs transaction growth. If this is the case, the token is termed overvalued, as the price is in an unsustainable bubble.

Conversely, a low NVT ratio means transactions on the network are growing at a faster rate than the market cap. When this happens, it implies demand for the token is visible and undervalued. For Cardano, it is the former, as the image below shows a notable spike in the NVT ratio.

Read more: How To Stake Cardano (ADA)

This reinforces the notion that ADA is overvalued relative to the current market condition. If this ratio remains extremely high, it could be challenging for the price to reach $0.38 in the short term.

However, DiscoverCrypto, a YouTube Channel dedicated to analyzing several altcoins, opined that the Chang hard fork may drive a notable rally for ADA. The upgrade, which is aimed at advancing decentralization on the Cardano blockchain, is expected to take place before the end of August.

“The bottom is pretty much, and I think we are about to have another peak for 2024 and 2025,” the channel host said.

ADA Price Prediction: a Move to $0.36 Likely

From a technical point of view, ADA still trades within a symmetrical triangle. This pattern connects a series of highs and lows and is characterized by two converging trendlines. While it is neither bullish nor bearish, the price’s next movement depends on other indicators.

For instance, the Cumulative Volume Delta (CVD), which measures buying and selling pressure in the spot market, is positive. This positive value implies that market participants are buying more ADA than the volume sold. Assuming the CVD is negative, it would have indicated higher selling than buying

If sustained, ADA’s price could soon reach $0.36. This outlook is also supported by the Moving Average Convergence Divergence (MACD) indicator, which tracks momentum. Currently, the MACD reading is positive, indicating that ADA is experiencing bullish momentum.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

In a highly bullish case, the price can reach $0.39, possibly taking Cardano back to the 10th market cap spot. However, rejection at $0.36 could drive the price back to $0.33.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/cardano-attempts-to-claim-top-10/

2024-08-21 09:00:00