NEAR Protocol has seen remarkable bullish momentum over the past two weeks, with its price surging by more than 50%. Despite facing resistance at a key price level, the altcoin remains well-positioned for further gains.

Thus, it is ideal to keep a close watch on NEAR as it approaches a potential breakout that could result in a 45% rally.

NEAR Is Nearing a Multi-Month High

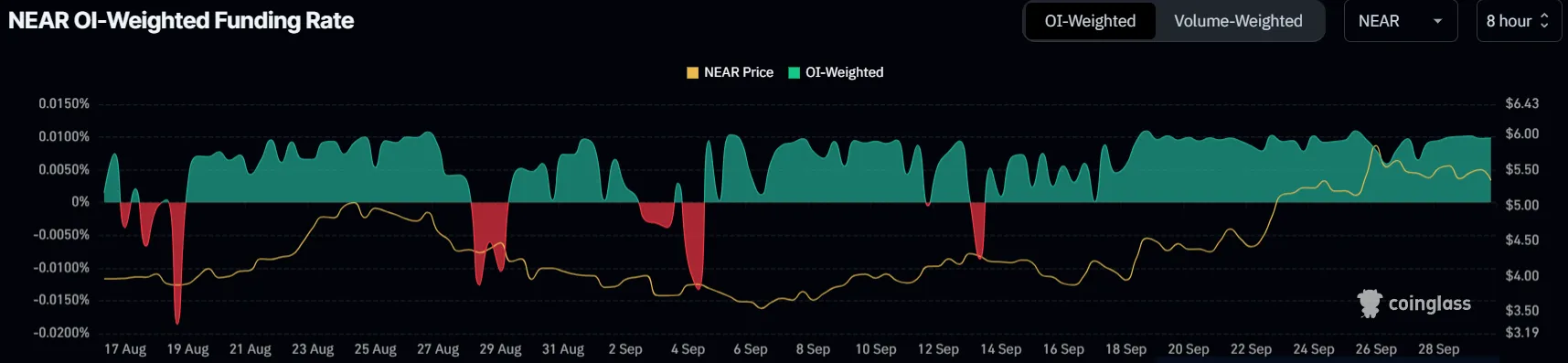

The recent price drawdown has not dampened investor sentiment around the NEAR Protocol. The funding rate remains positive, indicating that traders are still optimistic about the asset’s future price movement. This continued optimism suggests that investors are anticipating a further surge in NEAR’s price.

The positive funding rate shows that long positions are more dominant, a bullish signal for the market. As long as the funding rate remains favorable, NEAR traders will likely continue to support the price, creating a solid foundation for the cryptocurrency’s next potential rally.

Read More: What Is NEAR Protocol (NEAR)?

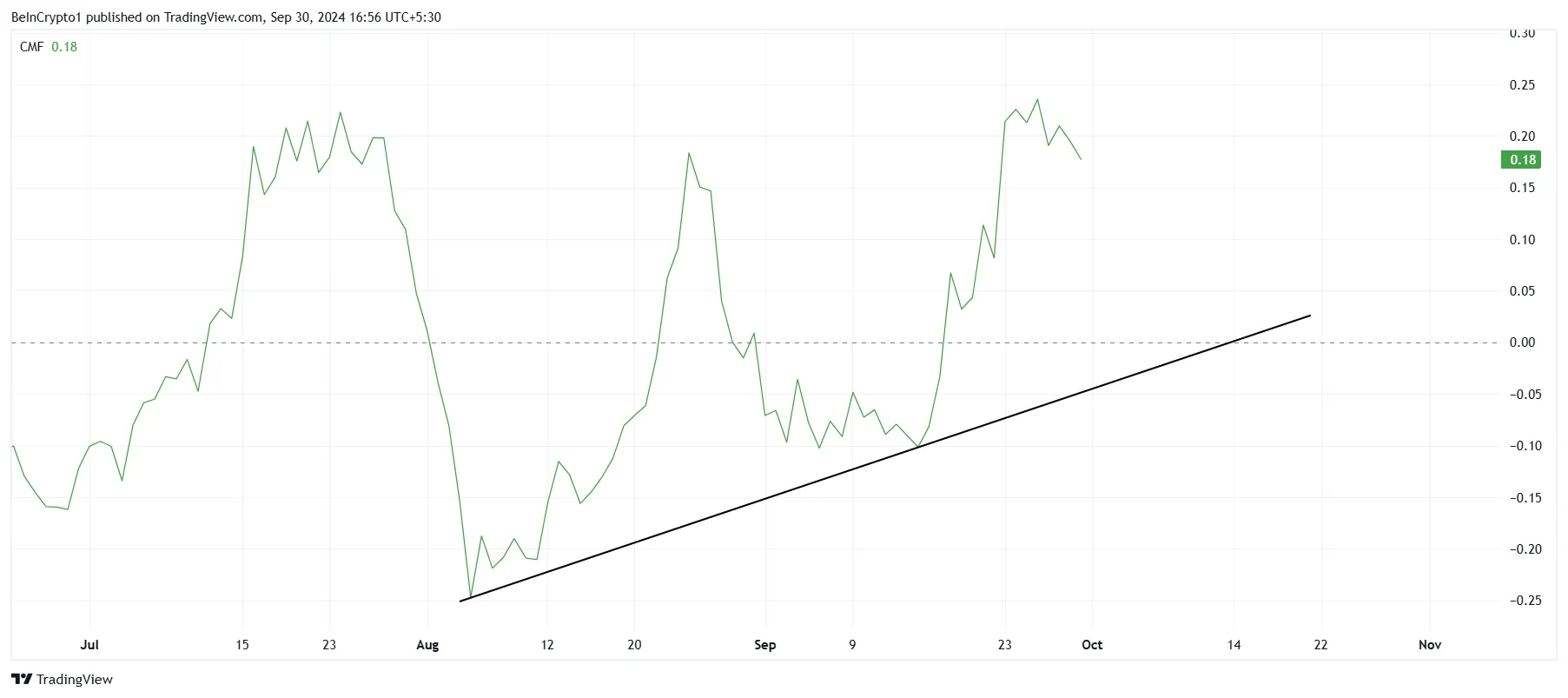

NEAR’s macro momentum also remains strong, supported by key technical indicators. One such indicator is the Chaikin Money Flow (CMF), which measures the inflow and outflow of capital into the asset. Since the beginning of August, the CMF has been on an upward trend, suggesting increasing buying pressure.

Currently, the CMF is above the neutral line, indicating strong inflows into NEAR. This upward momentum is a strong indicator that the bullish trend could persist, helping the cryptocurrency push through critical resistance levels and continue its upward trajectory.

NEAR Price Prediction: Finding a Way

NEAR is currently trading at $5.31 after a failed attempt to break the crucial resistance at $5.74. This level has served as both a barrier and a support floor in the past, making it a significant price point for NEAR. Successfully breaching this resistance could set the stage for a larger rally.

Technical analysis suggests that if NEAR manages to overcome this hurdle, the altcoin could follow the trajectory indicated by its double-bottom pattern. This pattern hints at a 45% rally, which would place NEAR’s target price at $7.47.

Read More: Near Protocol (NEAR) Price Prediction for 2024

For this rally to materialize, NEAR will also need to flip $6.37 into a strong support level. Failure to do so could result in the cryptocurrency consolidating above $5.13, effectively invalidating the current bullish outlook and delaying any upward movement.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/near-protocol-on-track-for-a-rally/

2024-09-30 12:08:45