Binance’s native token BNB’s price continues to attempt and fail to flip its crucial resistance block into support.

Weakening the altcoin are its own traders who withdrew their money just as the market showed slightly bearish signs.

BNB Suffers From Rising Fear

BNB’s price is impacted by both its traders’ actions and the broader market cues. Between August 23 and the time of writing, Open Interest in BNB’s Futures market saw a significant decline. Dropping 20% from $614 million to $497 million, this drop in OI directly contributed to the recent price drop of Binance’s native token.

Broader market conditions largely influence the fading bullish momentum in BNB. The weakening sentiment is evident in various indicators that now suggest potential challenges ahead for the altcoin.

Read More: How To Trade Crypto on Binance Futures: Everything You Need To Know

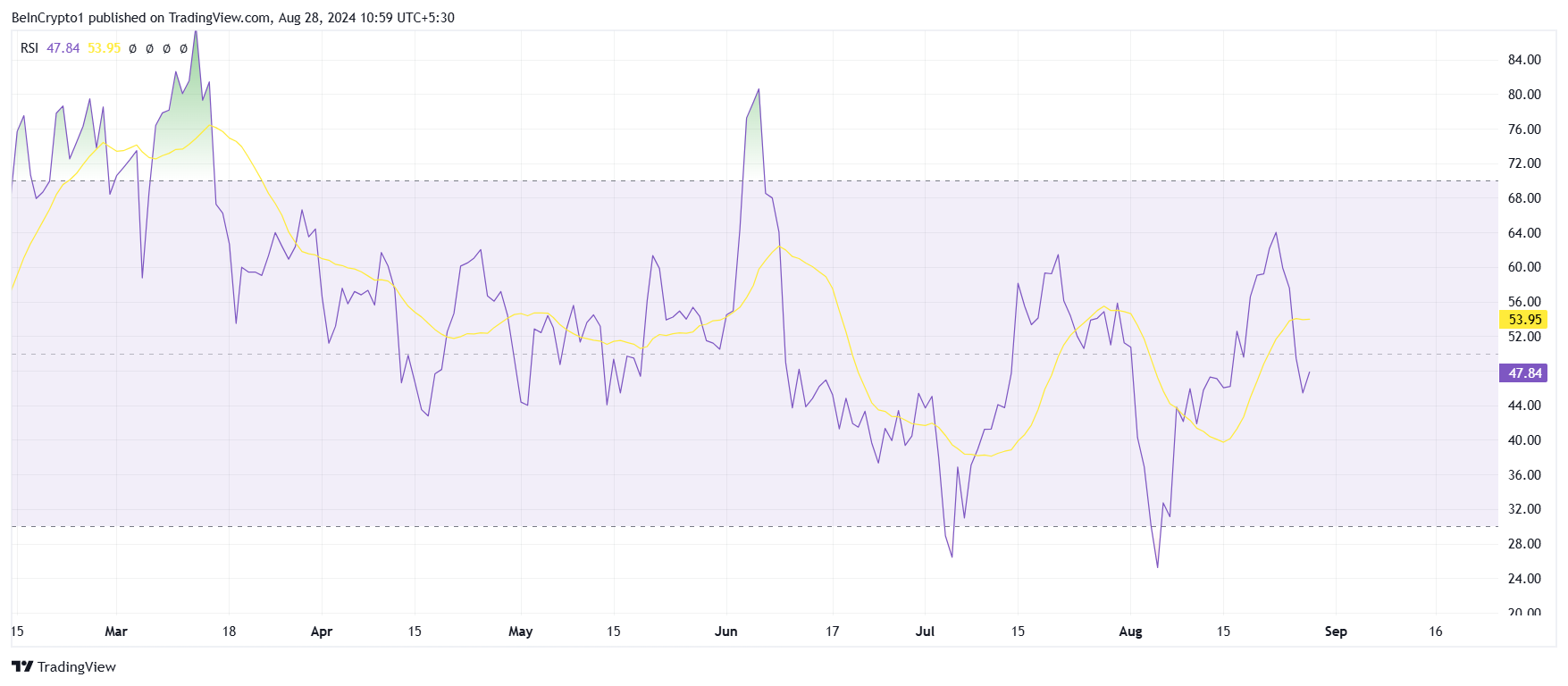

One such indicator is the Relative Strength Index (RSI), which has slipped into a bearish zone. The RSI’s movement into this territory indicates a shift in market sentiment, suggesting that investors may be more cautious about BNB’s short-term prospects.

While the RSI’s current position points to a potential struggle, it’s important to note that this does not guarantee a prolonged stay in the bearish zone. Market conditions can change, and a rebound could occur if broader factors align favorably.

However, for now, BNB price may face difficulties in reinitiating a recovery.

BNB Price Prediction: Here We Go Again

The BNB price, trading at $540 at the time of writing, has been down by 9.8% over the last four days. This drawdown came after the Binance native token entered the five-month-old resistance block from $575 to $619.

Since early March, BNB has made nine attempts to enter and break this barrier but has succeeded only twice. One of these resulted in the altcoin charting a new all-time high of $721 in early June.

Falling below $550 support, the Binance native token seems to need stronger bullish cues to rally again. However, it is uncertain if BNB can break out of the resistance block.

Read more: Binance Coin (BNB) Price Prediction 2024/2025/2030

However, a drop below $520 could prove detrimental to investors’ gains. BNB’s price could then fall to test the support of $495. But if $550 is flipped into support and the altcoin bounces back, it could reenter the resistance block and invalidate the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bnb-price-echoes-past-struggles/

2024-08-28 08:00:00