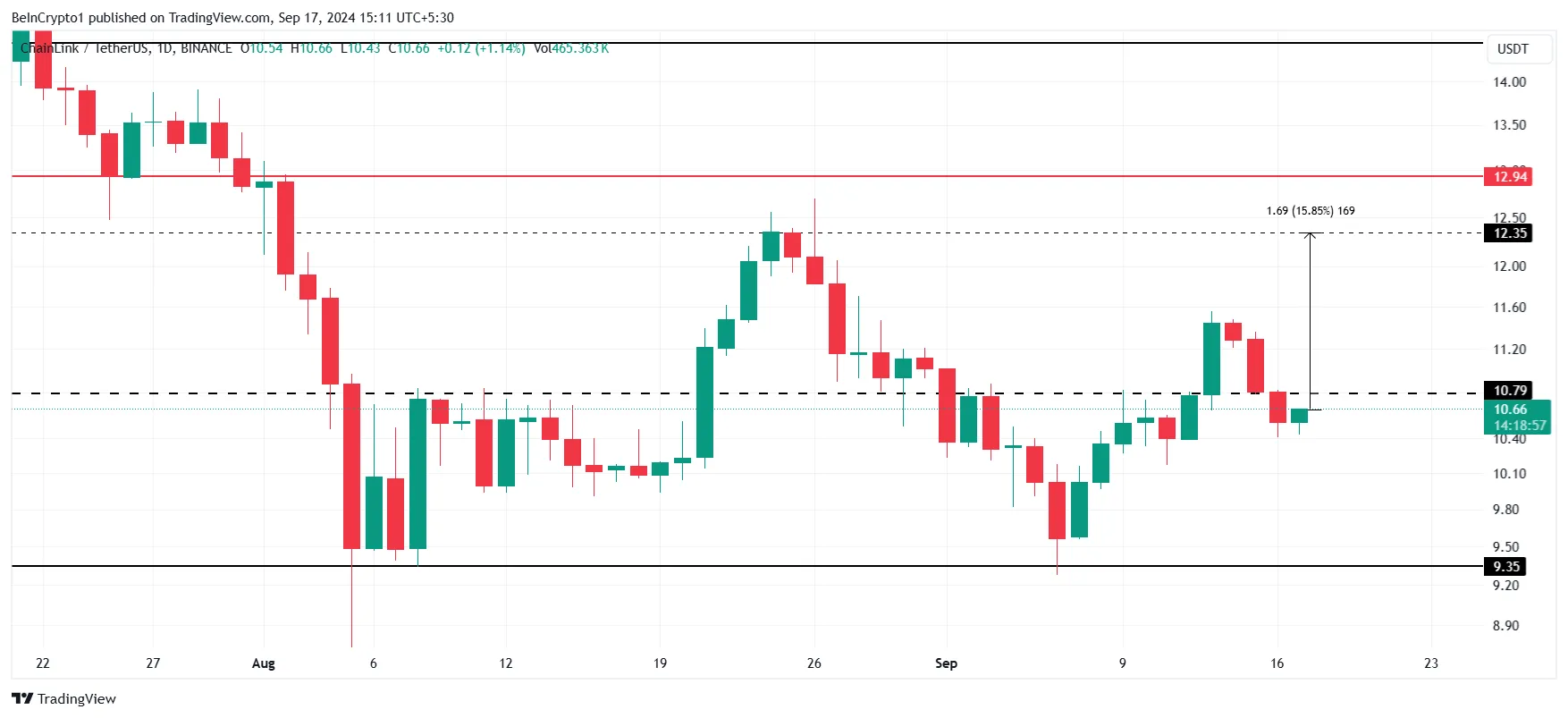

Chainlink (LINK) price is currently trading under the $12.35 resistance level, which has been a key barrier in preventing the cryptocurrency from flipping $13.00 into a support floor.

While LINK has faced selling pressure in recent weeks, the current low volume of profit-taking suggests that a breakout could occur soon. If Chainlink can sustain its momentum and overcome this resistance, it could be poised for a significant rally.

Chainlink Is Looking at a Rise

The macro momentum for LINK price suggests a potentially sharp move on the horizon, with Bollinger Bands nearing a squeeze. Bollinger Band squeezes along with low transaction volume, typically precede a significant price movement, either upward or downward.

For LINK, this could translate into a price rally if the base line of the indicator remains below the candlesticks, signaling bullish momentum. If Chainlink can maintain its current position within the Bollinger Bands and avoid a downward break, the potential for an upward surge increases.

Read More: How To Buy Chainlink (LINK) and Everything You Need To Know

This bullish outlook is backed by the Chainlink’s short-term holders currently holding less than 2.9% of the total circulating supply, a 16-month low last seen in May 2023. These investors, who typically hold for less than a month, are prone to selling during price rallies. However, their reduced supply minimizes the risk of a significant sell-off that could negatively impact LINK’s price.

With such a small percentage of the total supply in the hands of short-term holders, their potential for market disruption is limited. This reduced influence offers a stronger foundation for Chainlink’s price to rally without the threat of sudden sell-offs driving it downward.

LINK Price Prediction: Ready for a Breach

Chainlink is currently trading at $10.66, just below the local resistance of $10.79. Flipping this resistance into support is crucial for LINK to attempt a breach of the $12.35 barrier. This could set the stage for a potential rally.

If Chainlink’s momentum continues, the price could rise to $12.94. Breaching this level would mark a six-month high for the altcoin as it targets $13.00, resulting in a 15% rise. A successful break above this point could fuel further bullish sentiment in the market.

Read More: Chainlink (LINK) Price Prediction 2024/2025/2030

However, failure to breach $12.35 could result in the continued rangebound movement for LINK. The altcoin may remain trapped under this resistance while hovering above $9.35, as it has been for the past six weeks, invalidating the bullish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/chainlink-secure-21-price-rally/

2024-09-17 10:21:16