PEPE price is currently noting bearishness owing to the broader market cues, but this could turn around.

Considering the macro price action, the famed meme coin could be poised for a massive rally.

Potential PEPE Profits Incoming

PEPE price’s decline led to millions of dollars worth of supply becoming loss-bearing. Investors across the globe felt the same impact, as the overall profit supply fell to 72%.

The last time profits were this low was earlier in the month of August, and the last time before this was February 2024. The six-month low profits suggest the investors are losing largely and quickly.

Read more: Pepe: A Comprehensive Guide to What It Is and How It Works

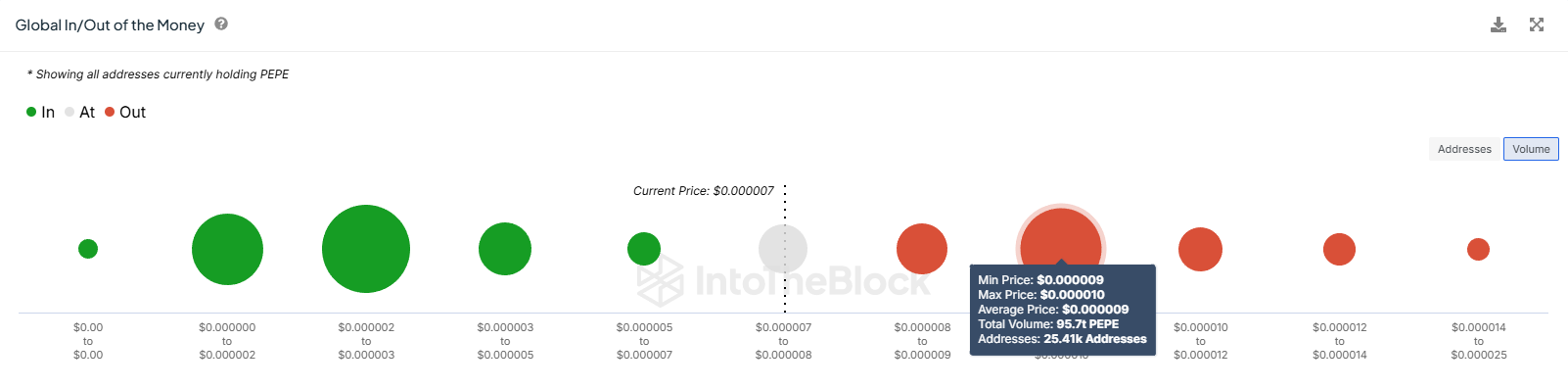

One of the largest bouts of losses occurred in the last two weeks, as the PEPE price fell from $0.00001000 to $0.00000718 at the time of writing. According to the Global In/Out of the Money (GIOM) indicator, about 123 trillion PEPE lost profits in this duration.

At the current price, this supply is worth close to $880 million. Between $0.00000900 and $0.00001000, investors bought the largest amount of supply, crossing over 95.7 trillion PEPE. However, there is a shot that all of this supply could become profitable again.

PEPE Price Prediction: Breaking Out

PEPE’s price is stuck in a descending wedge after failing to break through in the latter half of July. Testing the lower trend line of the pattern, the meme coin is trading at $0.00000718.

Given that the descending wedge is a bullish pattern, a breakout above the upper trend line suggests a nearly 80% rally ahead. This uptrend places the potential target at $0.00001725, which is the current year-to-date high.

Read more: Pepe (PEPE) Price Prediction 2024/2025/2030

However, profits would increase if the pattern fails and the PEPE price falls through the lower trend line. As a result, the meme coin could drop through the support of $0.00000633, falling to $0.00000474. This would invalidate the bullish thesis entirely.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/pepe-price-could-rally-after-validating-this-pattern/

2024-08-17 14:00:00