Solana (SOL) has recently experienced a notable price surge, reaching a new all-time high (ATH) and showcasing increased demand for its ecosystem.

This growth has been partly fueled by the popularity of the OFFICIAL TRUMP (TRUMP) token, which has heightened activity on the Solana blockchain. These developments position SOL as a strong contender to overcome historical bearish trends and sustain its rally.

Solana Overtakes Ethereum

The growing adoption of the Solana blockchain is evident, with active addresses per hour currently 26 times higher than Ethereum. This surge in activity highlights the network’s scalability and efficiency, making it a preferred choice for developers and investors alike.

The launch and rising demand for the TRUMP token have further bolstered Solana’s ecosystem. The increased activity from TRUMP transactions has underscored Solana’s ability to handle high transaction volumes, indirectly boosting its reputation and demand. This rising popularity is a positive indicator of SOL’s price trajectory as the network’s utility continues to expand.

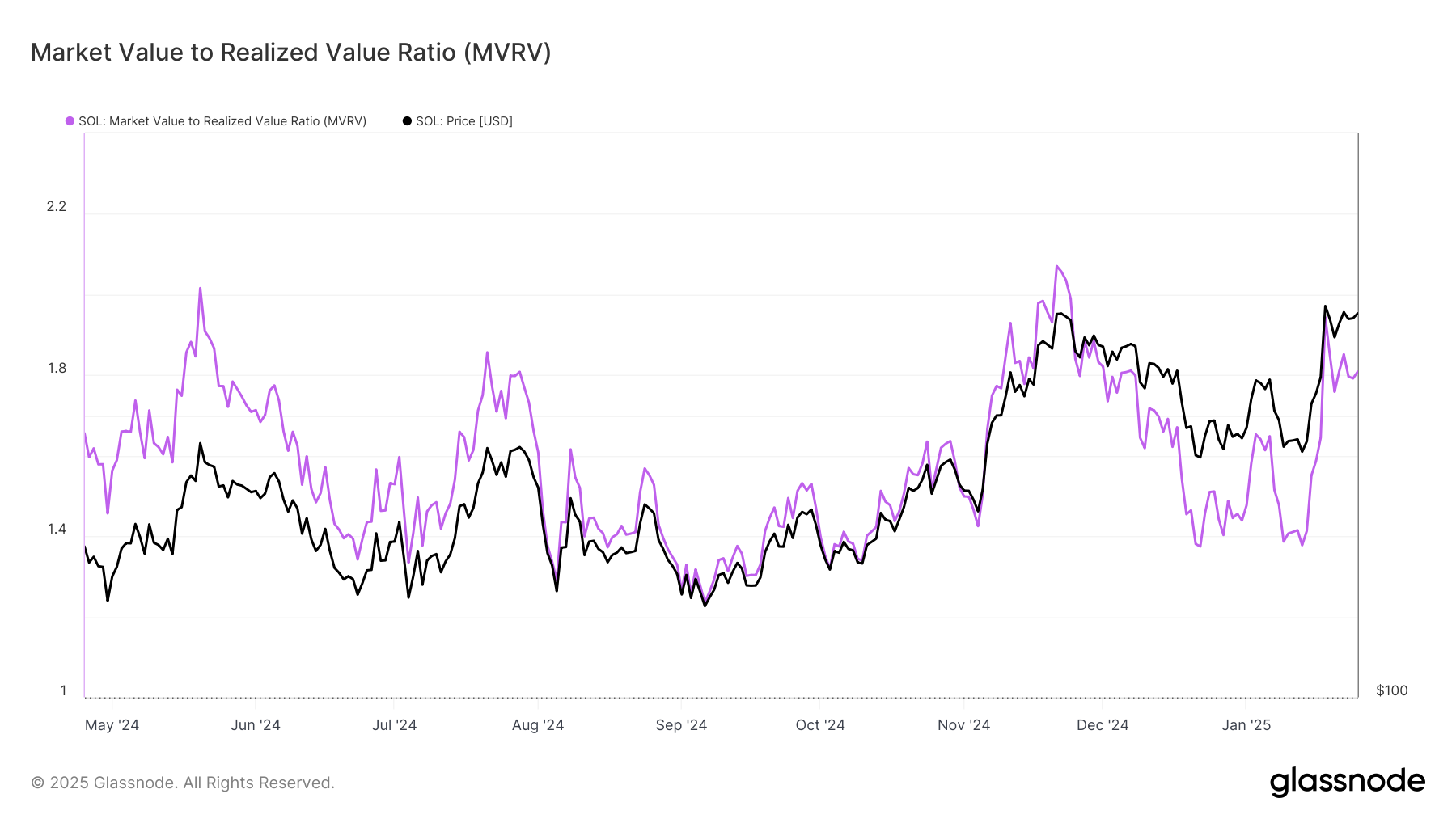

Solana’s overall momentum is reflected in its Market Value to Realized Value (MVRV) Ratio, currently hovering around 1.80. Historically, surpassing this threshold has led to corrections for the altcoin. However, despite crossing this mark, SOL has avoided significant retracements, with its uptrend merely pausing.

This stabilization is a promising sign, as it provides the altcoin with an opportunity to cool off before potentially resuming its rally. While some may view this as a bearish signal, it ultimately supports a healthier and more sustainable price rise in the long term.

SOL Price Prediction: Aiming Beyond The ATH

At the time of writing, Solana is trading at $253, maintaining a strong support level at $241. The primary hurdle for SOL is flipping the $270 resistance level into a support floor, a move that has eluded the altcoin so far.

If Solana manages to secure $270 as support, it could pave the way for the token to surpass its previous ATH of $295 and aim for the $300 mark. Achieving this would require a 17% price increase, a feasible goal given the current bullish momentum and network growth.

On the flip side, a failed attempt to breach the $270 resistance could lead to a pullback. In this scenario, Solana’s price might fall to $241 or even lower to $221, effectively invalidating the bullish outlook. Such a drop would reflect broader market uncertainties, highlighting the importance of sustained buying pressure to maintain upward momentum.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/solana-user-activity-higher-than-ethereum/

2025-01-26 20:00:00