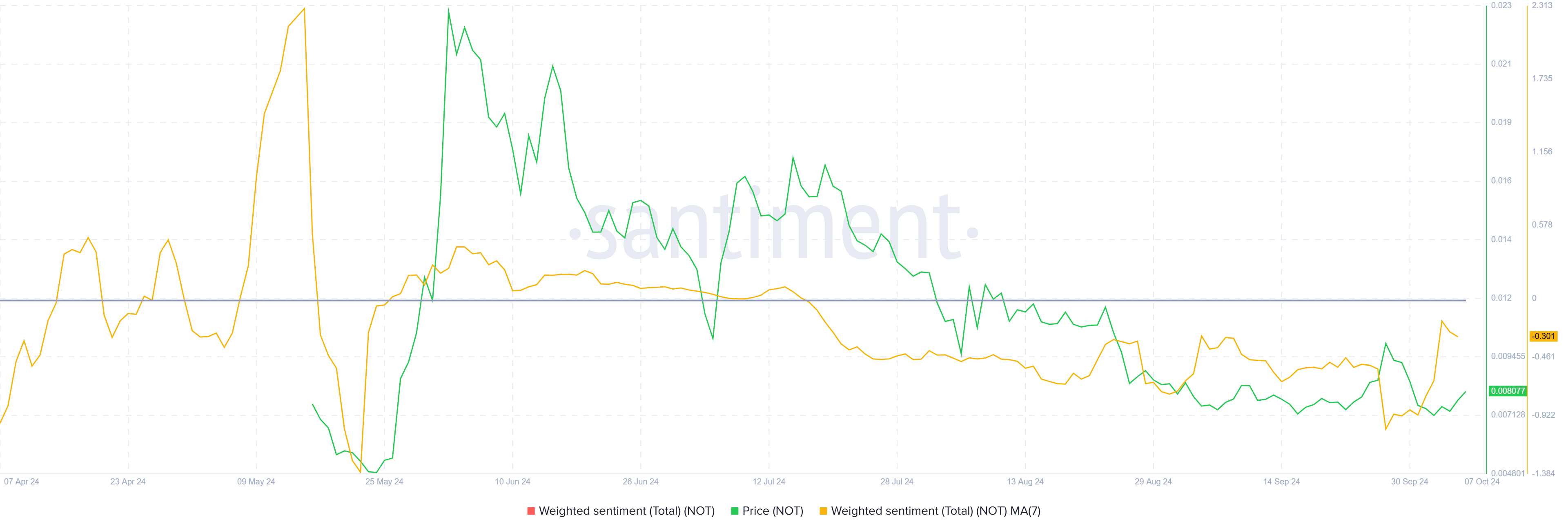

Notcoin’s (NOT) price has experienced a period of consolidation throughout most of September. While the Telegram coin briefly broke above the crucial resistance level of $0.0083, it quickly fell back into consolidation.

Despite this, there is optimism that a rally may be on the horizon if certain market conditions align.

Notcoin Investors Await Gains

According to the Global In/Out of the Money (GIOM) indicator, approximately 17.97 billion NOT, valued nearly at $145 million, was purchased by investors between the price range of $0.0081 and $0.0072. These tokens represents a significant portion of the market supply, and the demand to turn these investments profitable could push the price higher. Investors who bought within this range are likely hoping for a breakout above the $0.0083 barrier to start seeing returns on their investments.

This large volume of purchased tokens is likely to drive up buying pressure, increasing the chances of breaching the resistance. Once this happens, Notcoin could experience an upswing, possibly bringing it closer to a more profitable trading range for these investors.

Read More: What is Notcoin (NOT)? A Guide to the Telegram-Based GameFi Token

Despite this potential bullish scenario, the overall market sentiment for Notcoin remains bearish. The extended period of consolidation has led to growing pessimism among some investors, which could counter the upward pressure caused by the accumulation of 17.97 billion NOT. The lack of significant price movement has caused hesitation, as traders are wary of the token’s future prospects, and this could result in continued subdued price action.

If the bearish sentiment continues to dominate, it could keep Notcoin’s price trapped under the $0.0083 resistance level. The prolonged consolidation may discourage new buyers from entering the market, limiting the potential for upward momentum in the near term.

NOT Price Prediction: Attempting a Breach

At the time of writing, Notcoin is trading at $0.0080, stuck in a tight range between $0.0083 and $0.0070. A breakout above the $0.0083 resistance level could signal the start of a rally, potentially pushing the price toward $0.0094.

However, the mixed signals from both bullish and bearish factors suggest that consolidation may continue for the foreseeable future. The previously mentioned 17.97 billion NOT supply could still generate profits as long as the price stays above $0.0081, the upper limit of the accumulated range.

Read More: How To Buy Notcoin (NOT) and Everything You Need To Know

If Notcoin successfully breaks through the resistance, a rally could lead to a 17% price increase, sending the token to $0.0094. Such a move would invalidate the bearish-neutral outlook and potentially open the door for further gains.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/notcoin-not-price-17-billion-profit/

2024-10-07 06:47:37