Bitcoin’s price has surged by 19% in the last few days, pushing it to $64,342. Despite this significant rise, the cryptocurrency is facing resistance at $65,000.

A key group of investors, known for profit-taking at this point, poses a potential threat to the continued bullish momentum. Bitcoin’s rally could reverse if selling pressure escalates, leading to a decline.

Bitcoin Investors Might Book Profits

Bitcoin’s price is facing the threat of a correction, largely due to the potential of selling. Signs of the same can be noted in the Market Value to Realized Value (MVRV) Ratio.

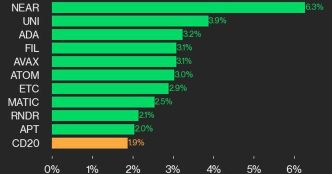

A key indicator of profitability, this metric has reentered the danger zone after nearly a month. Bitcoin’s 30-day MVRV currently stands at 6.3%, signaling that investors are in profit.

Historically, when the MVRV Ratio ranges between 2% and 12%, it often triggers selling pressure, leading to corrections. Investors tend to lock in profits when this threshold is reached, which could lead to a decline in Bitcoin’s price.

Read more: Bitcoin Halving History: Everything You Need To Know

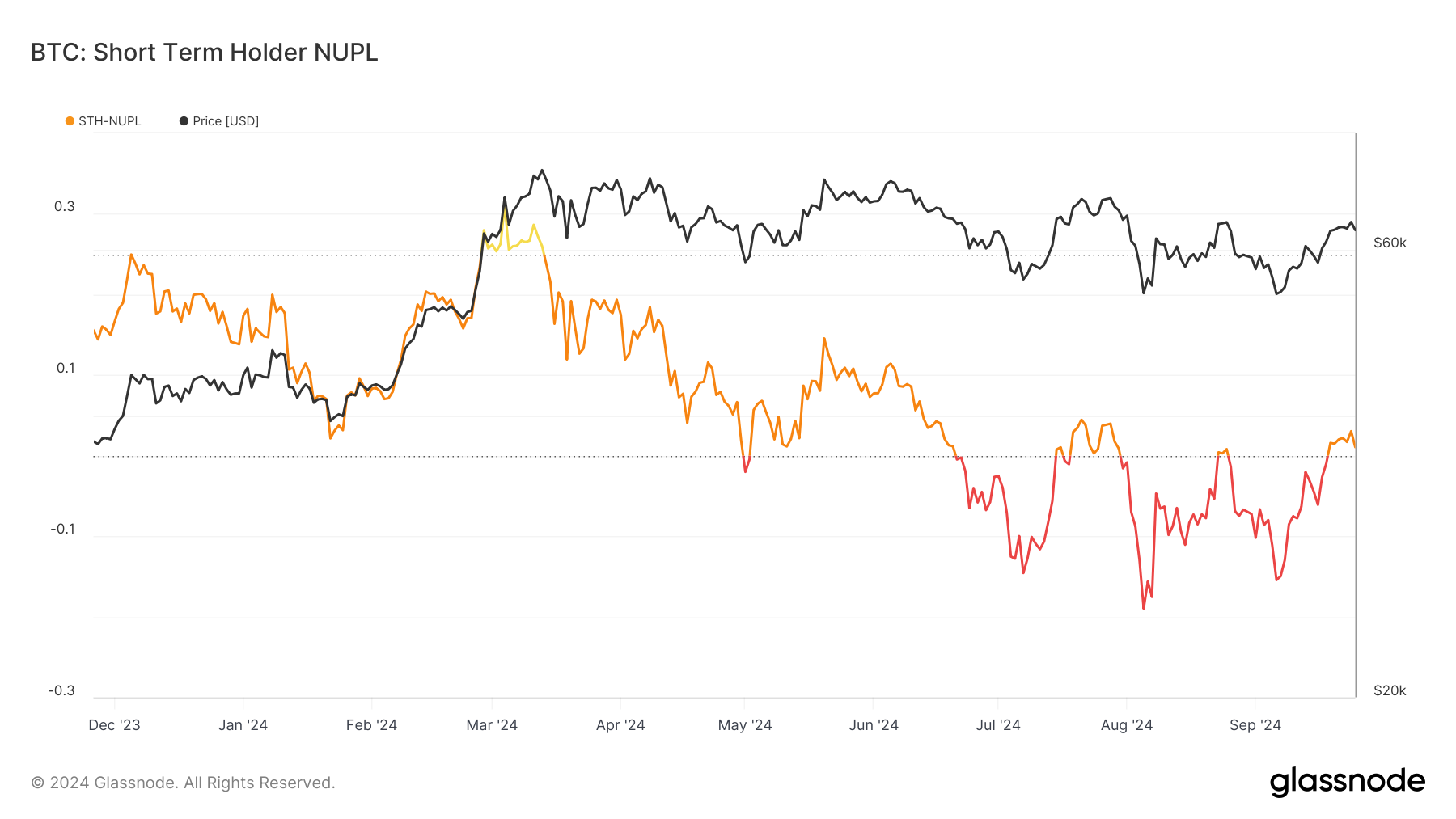

Another critical indicator, the short-term Net Unrealized Profit/Loss (NUPL), suggests that short-term holders are experiencing massive unrealized profits. This group of investors, known for holding assets for less than a month, is typically quick to sell once profits accumulate. The NUPL shows that the bullish momentum has reached a level where short-term holders are likely to start selling, increasing the risk of a price drop.

Short-term holders (STH) are expected to begin liquidating their positions as the bullish sentiment fades above the current threshold. Historically, when STH are in profit and above the threshold, they sell off their assets, putting downward pressure on Bitcoin’s price. This makes a potential decline in price highly likely if this trend continues.

BTC Price Prediction: Fall Ahead

Bitcoin’s recent rise of 19% has brought its price to $64,342, with $63,068 now acting as crucial support. This level has established itself as a key area where Bitcoin could find stability if selling pressure increases. However, despite the recent gains, a breach of the $65,000 resistance level seems unlikely in the near term.

If profit-taking intensifies, Bitcoin could drop below the $63,068 support, potentially falling to $59,666, the next critical support level. This price floor may serve as a point for Bitcoin to bounce back if selling pressure weakens. However, failure to hold this support could lead to further declines.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Conversely, if market optimism surrounding October continues, Bitcoin may have a chance to breach the $65,000 resistance. A sustained rise above this level would invalidate the current bearish outlook, potentially leading to further price increases and a continuation of the bullish trend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bitcoin-price-may-drop-due-to-selling/

2024-09-26 13:29:26